In February of 2023, Professor Tim Farrar (of TMF Assoc.) cautioned his clients “Don’t play poker with Charlie Ergen.” The advice was not only sensible (for Ergen is a renowned poker player) but timely, in that Ergen was, at the time, rumored to be interested in buying Globalstar (it didn’t happen) but it also heralded what has been a hugely busy year for Ergen and his main assets Dish Network and EchoStar. Indeed, it has been a year when the Colorado satellite genius has rarely been out of the headlines, and Professor Farra’s advice still remains as sound as ever.

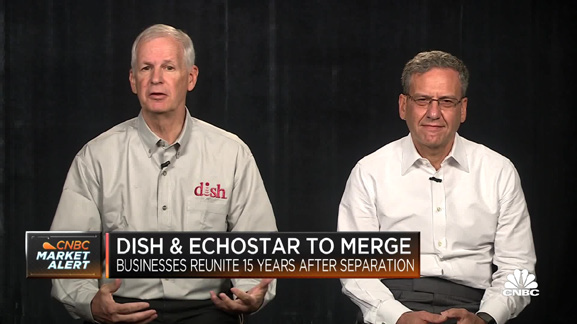

The year has seen Dish announcing its merger with EchoStar as Charlie Ergen attempts to tap into EchoStar’s war-chest of $2 billion in unleveraged cash to help fund the $3.5 billion cost of T-Mobile’s 800 MHz of 5G spectrum for Ergen’s Boost cellular expansion (which has to be done by April 1st of 2024).

Charlie Ergen

But will the Dish & Co expansion end in tears? Analysts at Moffett Nathanson (MN) believe bankruptcy for the combination is inevitable. MN, in a blunt note to clients in November, stated that there was an “overwhelming probability” that Dish & Co will enter bankruptcy sometime in the next few years.

However, analysts at New Street Research (NSR) in their note on November 22nd states that if Dish & Co can fund the T-Mobile spectrum purchase, then the company’s overall spectrum could be worth — conservatively — $57 billion and as high as $91 billion if sold after 2026. NSR has compared and contrasted the sums paid by various spectrum buyers over the past year or so. NSR reports that the core book value of Dish’s spectrum portfolio is worth about $29 billion, but adds that almost every slice of spectrum acquired by telcos has increased in value since its acquisition.

“If we revalue just the portion of AWS-4 that is part of Band 66, the 600 MHz and 3.45 GHz based on appropriate precedents, we arrive at a market value of $57 bn. If we revalue all bands, we get to $90 billion plus,” said NSR analyst, Jonathan Chaplin.

The report adds that different locations naturally affect the potential value of Dish & Co’s spectrum assets. A chunk of bandwidth in the middle of nowhere clearly is worth significantly less than bandwidth serving Manhattan.

Another commentator summed up Ergen’s asset rich portfolio as comprising “$100 billion of spectrum rights which equates to $300 a share.” Then there’s its — albeit dwindling — DBS assets as well as Hughes Network, Boost cellular/5G in the U.S., and miscellaneous overseas investments (S-band, etc).

Charlie Ergen is a savvy master of wholly leveraging and exploiting company assets. Few doubt he has his eyes on a longer-term positive outcome from his Dish plus EchoStar merger, and that vision certainly does not include bankruptcy.

Artistic rendition of a OneWeb satellite on-orbit.

There’s another pair of satellite operators for whom the year has seen genuine progress, but also a legal quagmire that’s starting to resemble Jarndyce & Jarndyce (the Charles Dickens fictional, never-ending lawsuit in Bleak House). Intelsat and SES in October both received their FCC billions in compensation for freeing up certain C-band satellite assets. So far, so good. However, SES is suing Intelsat for a claimed extra $400 million from that company, which would then represent a 50% share of the FCC’s total payout.

Intelsat’s bankruptcy court ruled in its favor that SES had no claim for the $400 million. However, an appeal subsequently found that SES’s claim was valid and referred the action back to the bankruptcy court to amend its decision. SES filed a renewed claim on September 28th, asking that the bankruptcy court’s “role now is to render a decision that is consistent with ‘both the letter and the spirit’ of the [Appeal] Court’s decision.”

‘Not so fast’ stated Intelsat’s lawyers on November 13th. The Intelsat motion to the Court was explicit. “SES’s typically bombastic brief disrespects the role of this Court as the sole fact finder, turning a blind eye to the 7-day trial in which this Court visually saw SES’s witnesses make one outlandish, credibility- destroying statement after another, and repeating the same tired rhetoric this Court heard and rejected after considering the parties’ contract and every piece of extrinsic evidence. And SES blatantly misrepresents what the district court did, and did not, do. The District Court did not preordain anything about this Court’s fact finding — that would be legal error.”

Intelsat’s lawyers put the responsibility for determining how this claim ends back into the hands of Intelsat’s bankruptcy court. “The Court should now do explicitly what it already did implicitly: reject SES’s narrative and deny SES’s claims again.”

Intelsat’s 55-page argument seems, therefore, to turn what many observers thought was a done and dusted verdict in SES’s favor into yet another legal chapter that might run and run for some time to come. Remember, in Jarndyce & Jarndyce, the only winners were the lawyers!

Staying with satellite operators, it has also been a mixed year for Eutelsat. On the one hand, the company wrapped its merger with mega-constellation OneWeb, but in the process has seen its share price collapse as worries deepen as to whether that move was a wise move. November 23rd saw Fitch Ratings issue a double downgrade on Eutelsat’s debt, and thus into ‘junk bond’ territory.

While saying that Eutelsat’s outlook was “stable,” the Fitch report added the lower rating reflects Eutelsat’s significantly increased execution and free cash flow risks with reduced revenue visibility at OneWeb, while its key profitable segments remain under pressure. It added that competition in the LEO market “may be intense,” which is probably an extreme understatement. The Fitch downgrade is likely to make Eutelsat’s fresh borrowings more expensive.

Goldman Sachs, in a similar move, downgraded Eutelsat from ‘Buy’ to ‘Neutral’ in late November. Eutelsat’s (non-dividend paying) shares took an immediate hit and fell to an ‘all time low’ of just 3.77 euros. The fall during the week was of 7% (and down 51% over the past year). Eutelsat’s market capitalization, including OneWeb, is now just 1.86 billion euros.

Eutelsat is working with Bharti of India on distribution of OneWeb in India, which could well be a White Knight rescuer over time. The only challenge is that risk of competition: from an SES and Jio Reliance partnership as well as — waiting in the wings for its operating license — is Musk’s Starlink — not to mention Amazon’s Project Kuiper.

Mark Dankberg

Viasat has also experienced an eventful year. Indeed, full marks must go to Starlink antenna.

Mark Dankberg and his team for managing to stay calm when everything around them was seemingly collapsing. Viasat wrapped the firm’s acquisition of London-based Inmarsat in March (that move was announced in November of 2021) and then promptly lost two, major satellites.

Its much-needed ViaSat-3 (Americas) launched on April 30th, but suffered a fundamental problem with its giant antenna — this will eventually be a near-total, insurance claim. While trying to resolve — or mitigate — the problem, news emerged that Inmarsat’s latest craft (Inmarsat-6 F2) had also suffered an “unprecedented anomaly.” This will also be subject to a full insurance claim.

However, the losses might actually be a blessing in disguise. Dankberg admits that there are work arounds for the company’s clients and Inmarsat’s significant assets will help, as well as the upcoming launches of the two other ViaSat-3 craft (Europe/Africa, and Asia) that will now be adjusted to new roles. However, Inmarsat was (and apparently still is) firmly backing a LEO system called ‘Orchestra’ (“The Communications Network of the Future”) and designed to operate with Inmarsat’s existing GEO satellites in a “dynamic mesh” of connectivity.

The 150 to 175 satellite constellation would benefit from a near $1 billion insurance pay-out and — in today’s LEO climate — be a perfect fit for Viasat and Inmarsat’s growing aeronautical and maritime services, as well the company’s government and consumer obligations.

Indeed, the year has seen huge progress in aircraft In-Flight broadband and entertainment services. Barely a day goes by without some airline announcing its latest affiliation with the likes of Viasat, Intelsat, Panasonic, Thales, Hughes, Gogo, Starlink or SES for in-flight services.

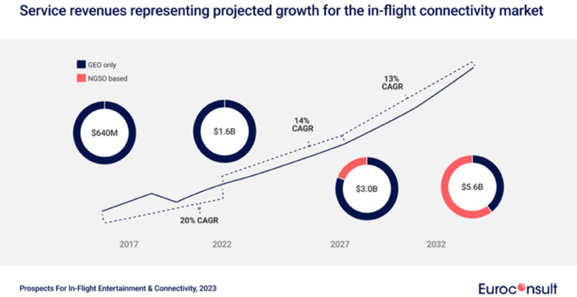

The month of November alone saw news from Delta Airlines (dumping Intelsat for Hughes Network on 400 aircraft), EgyptAir selecting Panasonic Aviation, and Intelsat winning Aerolineas Argentinas. The prospects, according to analysts from Euroconsult, are extremely positive. 2023 has been a second consecutive year of strong growth, with more than 36,000 commercial and business aviation aircraft now equipped with onboard, internet access.

Euroconsult notes that a particularly interesting question that often arises in relation to the provision of onboard broadband access is around cost or, more specifically, the potential for airlines to move toward offering the service as a free of charge benefit for all passengers. Although there is a general belief from the industry that the market will develop in such a way in time, it is not certain when the free provision of this service will occur as standard across the majority of airlines.

Finally, we could not let 2023 go without a word about Elon Musk. Setting aside his contentious challenges with Twitter/X, and even the Tesla Cybertruck neither of which are the focus of this summary, he, nevertheless, has to be celebrated and praised for all of his SpaceX work. Test launch Number 2 of Starship was spectacular, and the prospects of Test Flight 3 is exciting and highly-anticipated.

Starlink went from strength to strength during 2023. By year’s-end SpaceX might well have announced subscription numbers of 2.5 million or more. There are more than 5,000 Starlinks on-orbit (and 4,500 operational) and that sets an extremely high benchmark for other LEO challengers.

In summary, the satellite industry is in great shape for 2024. DBS/DTH might be under pressure and — at best — be in decline in most markets. However, the good news is that revenues are growing (even if margins are tightening).

I wish one and all a highly enjoyable and profitable 2024.

Chris Forrester

Author Chris Forrester is the Senior Columnist and Contributor for SatNews Publishers and is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications.