The ancient Egyptians could be considered the forebears of a trend that is now emerging on the technology horizon.

Tracking the movements of the sun, the Egyptians used sundials to measure the length of the sun’s shadow to help to calculate the time of the day. This sensor communicated to Egyptian builders, farmers and tradesmen the length of each day, helping each one to then plan accordingly. These first world sensors helped to transform Egyptian civilization.

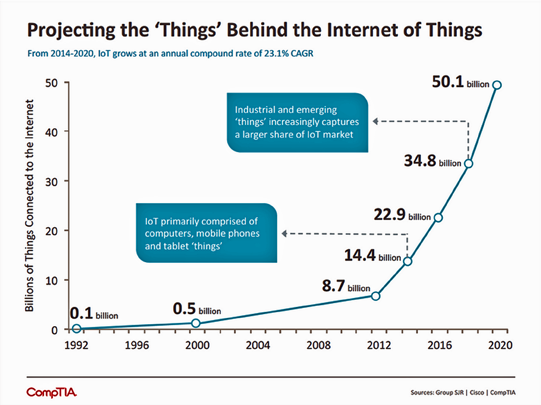

Once again, civilization looks to the skies for technological innovation. The Internet of Things (IoT) has become part of the nation’s vernacular. According to CompTIA’s Sizing Up the Internet of Things (IoT) report, the highly touted IoT (objects that are embedded with sensors which have the ability to communicate) will be composed of 50.1 billion connected devices by the year 2020 and $1.9 trillion in global economic value-add.

The information being generated by IoT devices has the ability to connect everything to everything else. Not just communication between the different devices, but across industries. The future has arrived—but only with the help of satellites.

At the center of the IoT satellite universe is the Global Positioning System (GPS). GPS is the underlining satellite backbone to the IoT ecosystem. Offering Positioning, Navigation, and Timing services to industries, such as banking, transportation, agriculture, public safety and disaster relief as well as health inspired wearables, GPS is the conduit between different sensors. GPS enables these sensors to be more precise, allowing for real time feedback. GPS makes these sensors “smart.”

In the not-so-distant past, satellite communications (SATCOM) systems were large, complex and costly. These systems were used primarily by government agencies and large corporations that had operations in

remote places.

Satellites simply made it possible for these organizations to extend their reach. With the advent of direct-to-home (DTH) satellite television services, the model started to shift from being mainly enterprise-based to a technology that consumers could actually access at a reasonable price.

The huge uptake in DTH satellite services effectively commoditized Ku-band components (antennas, feeds, frequency converters, receivers), which opened an opportunity for the satellite services market to shift from broadcast television to IP data—just in time for IoT to explode onto

the scene.

The role of satellites in IoT is expanding just as fast as the IoT phenomenon itself. More recently, this trend has been fueled by three

primary developments:

• The emergence of bandwidth efficient, affordable Time Division Multiple Access (TDMA) services over Fixed Satellite Systems (FSS), making it possible to buy FSS capacity by the megabyte, as opposed to full-time

• The evolution of satellite systems originally designed to carry primarily voice services to carry IP data using small, low power user terminals

• The availability of higher powered satellites with large antenna arrays and spot beams, making it possible to reduce the power and aperture required on the ground to achieve acceptable IP data rates across the satellite

Each of these developments has enabled IoT in slightly different ways.

The first development area—the emergence of bandwidth-efficient TDMA services over FSS (Fixed Satellite Services)—is not necessarily new, as TDMA satellite services have been around for decades. However, the rapid adoption of new TDMA services based on advanced technologies that have been developed by iDirect, Hughes, Newtec, and others, has allowed FSS providers to offer IP-based satellite data services that allow customers to purchase capacity using various usage-based models, as opposed to purchasing spectrum on a full-time basis.

These systems typically operate at higher frequencies (i.e. C-, Ku-, Ka-band) and require antennas with larger apertures. These services operate primarily on geostationary satellites, due to the delicate nature of the timing required to keep all of the network elements synchronized.

With recent advances in efficient modulation and coding technologies (i.e., DVB-S2X), these TDMA networks are able to squeeze more usable bandwidth out of every megahertz of spectrum with every new release. These advances drive down the cost of the services to the consumers, and more importantly, increase profitability for the satellite operators.

The second development area is rapidly engaging customers with narrowband IP data requirements on a global basis. This area generally involves the repurposing of Mobile Satellite Systems (MSS) previously designed to carry voice traffic. These systems include INMARSAT, Iridium, Thuraya, and recent start-up Omnispace, which is developing assets originally fielded by ICO Global. All of these satellite systems are repurposing channelized satellite payloads that were originally designed to carry voice traffic, and have been re-engineered to carry IP data.

Another attractive characteristic of these MSS platforms is that they all operate in the L- or S-band. Most of the MSS platforms also use spot beams, which further enhance their ability to deliver high data rates using very small user terminals, many of which can be held in one’s hand.

These platforms operate in three different orbits. INMARSAT and Thuraya operate in geostationary orbit, Omnispace operates in Medium Earth Orbit (MEO), and Iridium operates in Low Earth Orbit (LEO). Of these systems, only Iridium and Omnispace offer true global coverage, with Iridium offering modest data rates of up to about 20 Kbps, and Omnispace offering data rates up to 600 Kbps today. The emergence of low / medium speed IP data services over MSS platforms has made it possible to support telemetry and remote access to devices and locations that were previously unreachable by any means.

The final area of development that will fuel the explosion of IoT over satellite is the emergence of High Throughput Satellites (HTS). Nearly every major satellite operator has announced HTS systems.

These satellites will be primarily geostationary constellations that will use large, high powered spacecraft which will allocate power and spectrum in narrow footprints (spot beams). High frequency (mainly Ku- and Ka-band) geostationary satellite systems will be able to operate at an efficiency similar to their L-band counterparts in terms of the delivery of higher data rates for a given aperture size and power requirement.

As these systems will spread their allocation across multiple spot beams, frequency re-use will be relatively straightforward, effectively multiplying the capacity of these satellites. The result will be satellites that can support aggregate IP data throughputs measured in multiple gigabits per second, able to support tens of thousands of simultaneous users. Examples of these next generation HTS systems include Intelsat’s EPIC™ and Telesat’s Vantage™.

As federal and state governments move forward with IoT policies and regulations, decision makers must keep the satellite industry in mind. Congress has called for a national IoT strategy. State governments are certain to follow suit. Let us all make certain that the satellite industry has a well-deserved seat at this table.

Intelligent Designs LLC is a small business based in the Chicago, Illinois area. The firm specializes in design, systems integration, and implementation of high-performance communications systems that utilize satellites and line-of-sight communications components. Much of the firm’s work involves IOT, with recent projects focusing on delivering IP data connectivity to airborne, shipboard, and land mobile users via satellite.

Intelligent Designs is led by David R. Beering, a satellite professional who has held key roles in the development and implementation of more than 80 satellite communications projects. Follow him on Twitter @drbeering.

David Logsdon is the senior director of public advocacy for CompTIA as well as the Executive Director of CompTIA’s Space Enterprise Council. In this role, he runs the association’s New and Emerging Technologies Committee (focused on the policy surrounding social, mobile, big data/data analytics, cloud, Internet of Things and smart cities).

He was also the staff lead for CompTIA’s federally focused technology convergence commission, which examined the impact on the public sector when social, mobile, analytics and cloud converge. Follow him on Twitter @DJLSmartData.