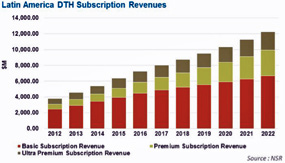

The Latin American DTH market has, in recent years, seen excellent growth in both household and revenue numbers. With just under 22 million Direct-to-Home (DTH) subscribers as of 2012, Latin America (LATAM) as a whole represents almost 20 percent of global DTH subscribers.

During the next three to five years, LATAM will be the fastest growing region in the world in terms of subscriber and revenue growth, especially among Basic subscribers. Long-term, Premium (HD) subscribers will see growth accelerate, as the middle-class grows throughout the region.

With current Latin American DTH penetration rates at around 14 percent, NSR expects an increase in uptake of DTH services among existing TV households, moving forward. Taking data from NSR’s Direct-to-Home (DTH) Markets, 6th Edition, the number of DTH subscribers in Latin America, as a whole, is expected to more than double, from around 22 million in 2012 to 46 million by 2022. More importantly, however, will be the timing of this growth.

Of the total growth occurring from 2012-2022, nearly two-thirds will occur from 2012-2017. DTH subscribers will increase by nearly 16M from 2012-2017, and then will increase by “only” another 9M or so, despite a higher base year total, from 2017-2022.

While overall subscriber growth will be driven by “Basic” subscribers, which will just under double from 18M to 34M, “Premium” subscribers will see a far more impressive CAGR, with the number more than tripling from just over 2M to nearly 8M by 2022.

Premium subscriber growth, however, will, in fact, come in the later years of the forecast. Such reflects the fast growth in the short-term of Basic subscribers, and more long-term Premium subscriber growth. This trend indicates a shift in Latin America to HD programming, and other higher-ARPU services, and the fact that it will be a long-term shift.

The regional shift to HD services is best exemplified by looking at subscription revenue growth. Total regional subscriber revenues are expected to increase by around $8.5B to 2022. While “basic” revenues will continue to reign supreme long past 2022, “Premium” revenues will increase their share of the overall revenue pie from 16 percent in 2012 to 27 percent in 2022, increasing from $626M to $3.25B in the process, indicating a strengthening regional middle-class with an appetite for higher-quality television content.

A recent example of the shift to HD occurred in June 2013, with SES launching their new satellite SES-6. SES-6’s anchor customer, Oi!, is a Brazilian DTH provider, which has publically stated that their goal in securing capacity on SES-6 is to increase their HDTV offerings to the Brazilian DTH market.

Further regional trends moving forward will include market deregulation, particularly in countries such as Mexico, which has a history of governmental monopolization. As deregulation brings about increased competition, it should also breed new opportunities for operators to cash in on markets that are being made more efficient, potentially increasing their bottom line in the long run.

Revenues and subscribers in Latin America will continue to show strong growth moving forward. While the bulk of new subscribers will continue to be “Basic,” especially in Central America, there is an undeniable shift towards HD programming, “Premium” revenues, and subsequently higher ARPUs from these newly-minted middle-class customers.

The launch of the SES-6 satellite aboard a Proton-M rocket from the Baikonur Cosmodrome in Kazakhstan.

Further, growth, particularly among Basic subscribers, will accelerate remarkably quickly in the short-term, with total subscribers increasing by nearly 75 percent from 2012-2017, for a CAGR of more than 11 percent. Long-term growth will be slower overall, but faster among Premium subscribers, reflecting a shift towards a larger middle-class.

With sports programming being a key differentiator, and with regional competition intensifying due to governmental deregulation, specifically in Mexico, these new subscribers will be hotly contested among operators. However, with the overall revenue pie growing by over $8B, there should be more than enough to go around, provided operators are able to cater to the needs of a new class of Latin American customers.

Information for this article was extracted from NSR’s report: Global Direct-to-Home Markets, 6th Edition. For further information, please access the report’s infopage at:

http://www.nsr.com/research-reports/broadcast-digital-media/direct-to-home-dth-markets-6th-edition/

About the author

Mr. Curcio joined NSR in 2012, following a position as a project manager in Shenzhen, China. His prior industry experience includes a role at SES (Den Haag Office) as a strategic marketing intern during the summer of 2010, where he helped develop a strategy to increase their share-of-wallet with key Europe-based customers. His consulting experience also includes having conducted a market-entry strategy project for SGS International, aiding their entry into Mainland China. Blaine speaks English, Italian, Chinese and Spanish. He obtained a Bachelor’s Degree in International Business from Illinois State University.

About NSR’s Direct-to-Home (DTH) Markets, 6th Edition

This report provides an industry-leading assessment of key trends, drivers, and restraints facing the Direct-to-Home (DTH) satellite TV market. The study focuses in on the DTH and payTV satellite TV market, emphasizing country-level research being incorporated into regional-level analyses. This study addresses some of the most pressing questions in the DTH industry today, including:

How many DTH & Satellite payTV subscribers will there be per region from 2012-2022? How much in subscription revenues will they bring to DTH and satellite payTV providers?

In which regions do Digital Terrestrial Technology (DTT) and Over-the-top (OTT) services present the greatest threat to DTH, and in which regions are they a lesser factor?

Can DTH providers in emerging markets successfully transition from a focus on subscriber acquisition to increasing existing subscriber ARPUs? What factors continue to drive subscriber growth for the leading platforms in key countries?

Which key countries have the greatest opportunities for DTH growth, and which countries are signaling higher barriers to entry?

In the face of economic, political, and terrestrial threats to satellite

TV services, which DTH markets still present niche opportunities for market growth?

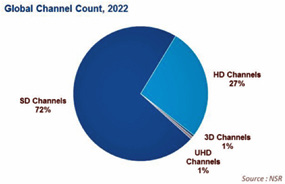

How big of a role will future technologies like UltraHD play, and in which regions will it be a factor? What is the outlook for SD, HD,

or 3D channels?

Direct-to-Home (DTH) Markets, 6th Edition provides in-depth assessment and forecasting using both primary and secondary research, and includes figures for:

– TV Households & DTH Subscriber figures from 2012 - 2022

– SAC, ARPU, and Subscription Revenues for DTH and satellite payTV Platforms through 2022

– SD, HD, 3D, and Ultra HD Channels & Transponder Demand Trends & Forecasts to 2022

As market conditions continue to change, DTH platforms face challenges from higher programming fees, online providers, and economic stagnation. In many developing regions, political turmoil can also hinder DTH providers’ efforts for expansion. However, for regions such as South Asia, driven by the continued growth in India, DTH subscription revenue continues to increase, reaching almost $3.5 Billion by 2022. Furthermore, premium and above package tiers will account for more than half of these subscription revenues.

Despite these challenges, there remain more than 20,000 SD, HD, and 3D channels and over 100 DTH platforms worldwide, and their competitive edge continues to be maintained through new technologies, increased subscriber numbers, and increasing ARPUs in many regions.

Channel growth will continue to be robust, with over 35,000 channels by 2022, including dedicated capacity. While HD channels will roughly double, from just over 5,000 to just over 10,000 by 2022, SD will also post considerable gains, particularly in the developing world, increasing by nearly 10,000 during the period. Even by 2022, SD will still have the lion’s share of the channel count.

Considering all these factors, NSR’s Direct to Home (DTH) Markets, 6th Edition provides a comprehensive picture of the global DTH market, with detailed analysis on a regional level comprising much of the research.