Though commercial Earth Observation (EO) represents a small part of the satellite industry, this sector has grown at a CAGR of 8.3 percent since the year 2008.

Thirst for data-driven decision making in various sectors like oil & gas, infrastructure, agriculture, forestry and wildlife, and emergency response is expanding the reach of the EO industry beyond the traditional government customer. These are the areas where the traditional satellite-based EO industry will compete directly with other platforms such as Unmanned Aircraft Systems (UAS) and smallsat constellations providing high temporal resolution.

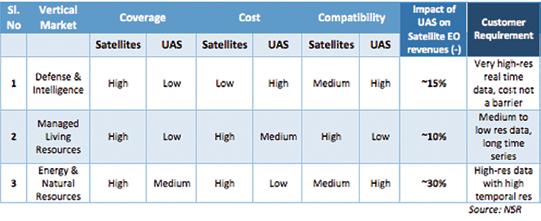

NSR’s recently released report, Satellite-Based Earth Observation, 7th Edition (www.nsr.com/research-reports/commercial-space/satellite-based-earth-observation-eo-7th-edition/), found the decision making that goes into acquiring data and data products usually depends on the 4C’s—Cost of acquisition, Coverage of the platform, and Compatibility of data to meet Customer requirements. All these factors are intertwined, as higher coverage implies higher cost, which in turn means large datasets (in both medium or high resolution) and, thereby, a set of boundary conditions for the customers to select, as per their requirement.

An example of the 4C’s is illustrated in the table below, which compares the utility of satellites and UAS in different vertical markets on a relative basis. A classic example would be the Defense and Intelligence market, which is well established for both satellite and UAS-based EO.

Though satellites cost lower than UAS in the long run for ISR purposes, primarily due to the operational expenditure associated with flights, they are still used only for strategic planning purposes—the on-demand, real-time UAS imagery and video are the areas that provide the key battlefield inputs and where this platform offers advantages over satellite.

This is, however, not the case in the Energy and Natural Resources vertical market, as satellite imagery requires substantial post processing and integration with other data sets (seismic, geological, etc.). This leads to a preference for lower-cost, sub-50 cm imagery provided by small UAS. The energy market is actually one of the biggest promoters of UAS applications in monitoring off-shore pipelines, change detection in the nearby environment, and live-video feed relay of plant operations.

On the other hand, small satellites and their constellations deliver a different value proposition, which is strongly reliant on powerful algorithms based on machine learning, pattern recognition, and other image analytics methods. Most small satellite platforms under 50 kg launch mass are unable to produce the same image characteristics as that derived from a sophisticated satellite such as Digital Globe’s WorldView-3.

However, large constellations of these smallsats will provide high revisit rates, leading to useful time-series data generation. Such data products are useful in vertical markets like Managed Living Resources (agriculture, forestry) and Industry (Construction, Transportation) due to the correct match between cost, coverage, and compatibility of datasets with the customer’s requirements.

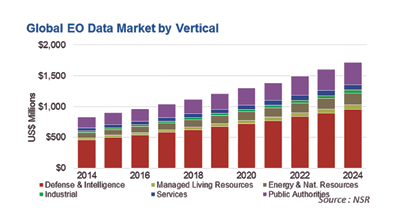

NSR’s Satellite-Based Earth Observation, 7th Edition report took into account the impact of smallsats and UAS, among many other factors, on the global commercial satellite EO industry and modeled the market across six industry verticals to find that the satellite EO data market will grow from $833 million in 2014 to $1.72 billion by 2024.

Rapid progress in the commercial UAS sector (more so during 2014 to 2015), especially in the computing and image processing software part, is adding to the competitive environment for satellite-based EO. This is especially occurring as entry barriers to the industry are lowered due to technological innovation and ‘trickle-down effect’ from other sectors such as consumer electronics, cloud computing, and powerful analytics.

The traditional satellite-EO industry is, therefore, at the cusp of major shifts in business models for adapting to threats from smallsats and UAS, which now seem more real than ever before.

Based in Bangalore, the silicon-valley as well as the space city of India, Mr. Basu joined NSR as an analyst in 2014. He has authored the first edition of NSR’s Unmanned Aircraft Systems study and has been a co-author of the fifth edition of Satellite Manufacturing and Launch Services report. His area of expertise and interest include launcher and satellite manufacturing, UAVs, Earth Observation, and Fixed Satellite Services markets.

Mr. Basu comes to NSR after completing a ‘Masters in Science’ from the International Space University, Strasbourg, in the area of ‘Space Studies’. Prior to attending ISU, Mr. Basu had a two year term with the Indian Space Research Organization (ISRO) as an engineer at the spaceport of Sriharikota, where he worked on six launch missions of the PSLV, and as a system engineer for the GLSV MK-III project. He has also worked closely with ISRO as an intern in the areas of launch vehicle engineering and business development at various centers across India, like the Vikram Sarabhai Space Centre (VSSC), Liquid Propulsion System Centre (LPSC), and the commercial wing of ISRO, Antrix, while pursuing his ‘Bachelors in Technology’ in the field of ‘Aerospace engineering’ from the Indian Institute of Space Science and Technology (IIST), Trivandrum.

Mr. Basu has collaborated with research labs in India and abroad in varying capacity, and has published his works in international journals and at conferences on subjects ranging from computational fluid mechanics to space policy and climate change. He holds international certifications in the field of Supply chain management and project management, and has been a speaker at various industry organized user meets.

For information regarding this report, please visit:

www.nsr.com/research-reports/commercial-space/satellite-based-earth-observation-eo-7th-edition/