AST SpaceMobile is being rebranded to AST Networks. That was one positive slice of news to emerge from the company’s end-of-year results on April 1st.

The company’s overall news didn’t help confidence with investors and the firm’s share price crashed 13.6% on April 1st and another 24% on April 2nd. The price recovered on April 3rd by a — perhaps — promising 15.42%.

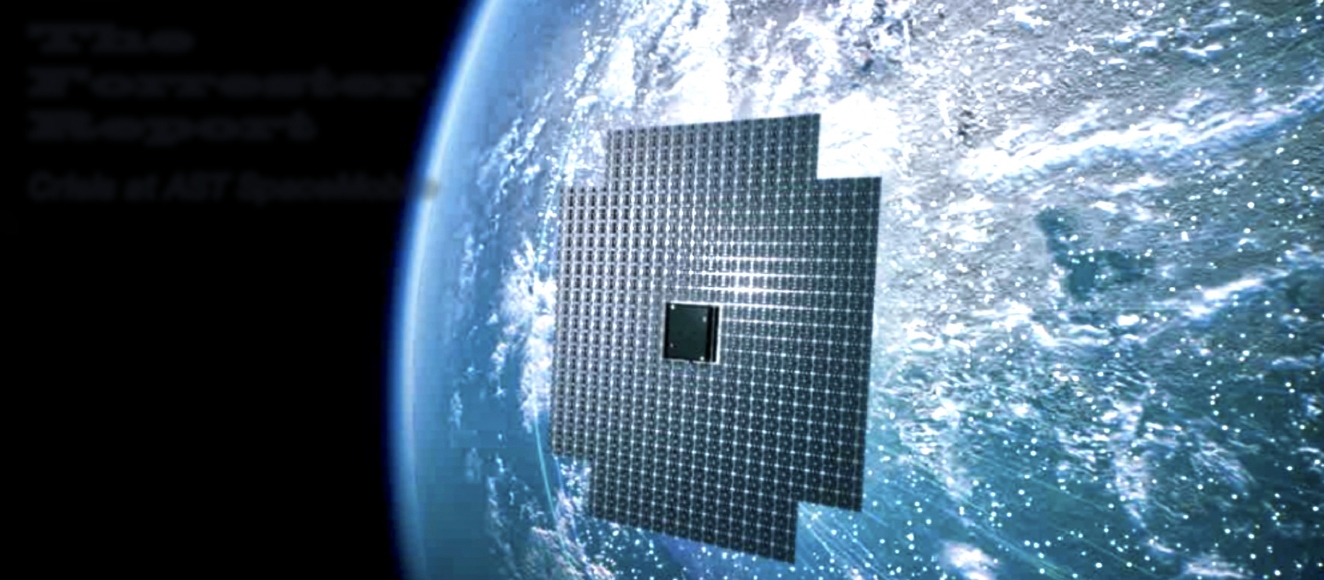

AST undoubtedly has a great idea, and already has a massive prototype satellite on-orbit that offers the “only space-based cellular broadband network accessible directly by everyday smart-phones.” The company has some major telcos as partners, not the least of which are Vodafone, AT&T and Google.

Nevertheless, the banks have mixed views. For example, Deutsche Bank (DB) holds onto its ‘BUY’ rating, but has trimmed expectations as to AST’s share price target. DB suggests $19 per share, which is down from the bank’s previous $23.

A smaller boutique bank, Scotiabank, has lowered their AST share price expectations by a few cents (from $7.50 to $7.40). Scotiabank say they see AST’s current position as “moderately negative.”. Zacks Equity Research recently upgraded AST to ‘BUY.’

On April 3rd., the Federal Communications Commission (FCC) approved an experimental licence to AST covering test uplinks from mobile handsets to the company’s BlueWalker-3 satellite.

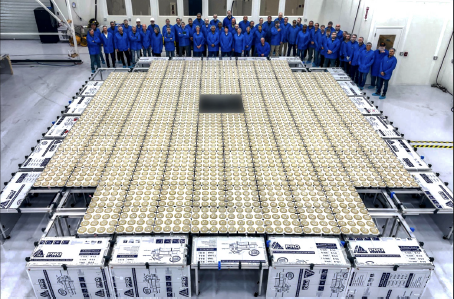

Its existing orbiting satellite, BlueWalker-3 (BW3), was launched on a SpaceX rocket in September of 2022 many months late in being launched. The satellite has 64 sq meters of phased array antenna. BW3 was initially supposed to be launched by a Russian Soyuz rocket, but the Russian embargo hit and negated that plan.

Obviously, AST needs far more than a single satellite in LEO. The company is in production of its next five BlueBird Block 1 satellites (each of 700 sq ft/64 sq m in area) and SpaceX is contracted to launch them, but they are “[available to launch] between July and August 2024,” which, unfortunately, is the third delay for the five craft batch.

Abel Avellan

AST Network’s CEO Abel Avellan told analysts: “Unfortunately, production was negatively impacted primarily by two suppliers, leading to delays in integration and testing,” Avellan said.

There are also concerns about AST’s frequencies. Although initially using frequency filings from Papua New Guinea (PNG), AST says it has updated its U.S. registration and commensurate frequency filings for a 243 (plus 5) constellation of satellites (called USASAT-NGSO-20). The PNG filing to the ITU called for 368 satellites (Micronsat-2).

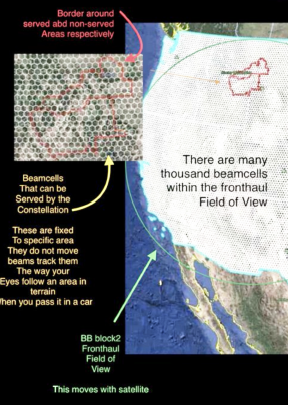

The company’s follow-on satellites — BlueBird Block 2 — craft are much larger, with 2,400 sq. ft. (223 sq. meters) of phased array antennas. AST says these will start launching in the December 2024 to March 2025 timeframe.

These ‘Block 2’ craft will — said the company — allow a “ten-fold” improvement in processing bandwidth over the Block 1 satellites.

AST’s financials state tha, as of December 31, 2023, the company had cash, cash equivalents and restricted cash on hand of $88.1 million. The firm ended the first quarter of 2024 with cash and cash equivalents and restricted cash of approximately $210.8 million. AST had additional liquidity of $51.5 million in gross proceeds available to draw upon, under its Senior Secured Credit Facility.

To date AST has raised more than $1 billion and has in place agreements and understandings with 40 mobile network operators including the aforementioned companies and others.

Total operating expenses increased by $69.5 million to $222.4 million for the year ended December 31, 2023, as compared to $152.9 million for the year ended December 31, 2022.

Critics suggest that these delays and cost-overruns are damaging the company, and that AST losses are greater than anticipated (-$75 million versus expectations of -$57 million). Analysts are concerned that, only a few weeks ago, the company was anticipating an earlier launch of its Block 1 craft.

AST cites changes in their core supplier and that estimated further required funding has increased to $350 million to $400 million to build and get the satellites aloft, including the design, assembly and launch of the follow-on 20 Block 2 satellites.

There are also inevitable complaints that AST has been over-promising on their launch dates and under-delivering. One shareholder talked of the company having known that recent launch announcements could never have been accurate, given the company’s component problems.

If the launches now happen as promised, then AST will cover “the most commercially attractive markets.” However, first AST has to overcome the threatened cash shortfall in both Operating Expenses as well as Capital Expenses.

In the company’s SEC filing, highlighted was AST’s business progress that included...

• Milestone strategic financing is a vote of confidence in AST’s tech and business model

• Fixed-firm-price contract award announced with the United States Government through a prime contractor, expected to produce initial revenue in Q1 2024

• Necessary funding on-hand to execute near-term strategic plan for the launch of five 700 sq. . Block 1 BlueBird satellites and first next genera on 2,400 sq. ft. Block 2 BlueBird satellite, which will surpass Block 1 BlueBird satellites as the largest commercial phased array in Low Earth Orbit (LEO)

• “Continue to advance discussions with additional strategic partners, following the blueprint of strategic investments alongside commercial payments”

Meanwhile, there are other ‘direct-to-phone’ threats emerging from companies such as SpaceX, Globalstar/Apple and Lynk, plus others — all seeking space-based connectivity. None are slow in trying to corner a segment of the potential market.

Indeed, SpaceX is moving forward with plans to expand their current broadband satellite service to include text and voice mobile services. The Device-to-Device (D2D) application is approved by the FCC for use in certain U.S. cities and states. SpaceX submitted its request to the FCC on March 25th. and it was approved on March 28th.

You pays your money and...

• “AST couldn’t make and launch 5 satellites in more than a year. And you really believe they are going to make 4-5 satellites per month? This company is toast!

• “SpaceX is turning out around 8 satellites per day.”

• Supplemental Coverage from Space, or SCS, will be a game- changing framework for expanding coverage in the U.S. With premium low-band spectrum in the mix, like the kind ASTSpaceMobile plans to use, it’s clear: The era of satellite direct-to-device has officially arrived.”

Nothing proposed by competitors comes close to this level of technology. And AST holds the patents.

SpaceX concluded its application letter, stating, “SpaceX is excited to launch its commercial direct-to-cellular service later this year, with its partner T-Mobile. With this enclosed additional technical information in hand, the Commission can expeditiously grant SpaceX’s applications.”

In other words, the clocks are running and AST’s competitors are far from being idle in addressing the D2D market segments.

Chris Forrester

Author Chris Forrester is a well-known broadcasting journalist, industry consultant and Senior Columnist for SatNews Publishers. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996. He also files for Advanced-Television.com. In November of 1998, Chris was appointed an Associate (professor) of the prestigious Adhamn Center for Television Journalism, part of the American University in Cairo (AUC), in recognition of his extensive coverage of the Arab media.