Satellite Ground Network Infrastructure is on the cusp of a fundamental change. Largely driven by massive, recent investments in space hardware, satellite communications (SATCOM) and Sat-to-Ground (EO, TT&C) sectors have witnessed a number of technological disruptions that have the potential to drastically alter the dynamics of a matured, five-decade old industry.

Small cubesats, software-defined payloads1, new multi-orbit and multi-band satellite architectures, advancements in electronically steered antenna technology, and other developments such as cloud-based analytics are making space an exciting, but increasingly complex and dynamic marketplace. The interworking of SATCOM with Earth Observation (EO) technology and telecoms, as well as use of commercial platforms for government and defense programs are also being modulated by such transformational forces.

The ground infrastructure is — naturally — a key element to support the full potential of these investments and innovations in space. However, despite a constant evolutionary track record at component levels, satellite ground networks -both at the core and at the edge- lack the scale and agility necessary to avoid the palpable risk of becoming bottlenecks.

Increasingly, it is not about throughput or efficiency, but about the need of a more active, collaborative, and coordinated approach by ground network stakeholders. Players must promptly embrace speed and change. Adopt open standards and best practices. Embrace technologies from the larger telecom marketplace. Combined, these are the new requirements to unleash the full potential of space-based investments and innovations.

Dramatic change brings new opportunity for satellite technologies to become mainstream in a 5G future. In order to achieve a seamless integration of satellite technology into the global telecom and IT ecosystem, as well as strategic government programs, ground network technology must shift from purpose-built, proprietary hardware architectures to software-defined, flexible, and extensible virtual platforms.

The Transformation of Space

The satellite industry is in the midst of the largest transformation since the inception of satellite communications over five decades ago. In this new era that can be referred to as “the 21st-century Space Race” (see Appendix “How the New Space Race is Driving Ground Evolution”), innovations in space technology have converged to pave the way for a truly disruptable environment.

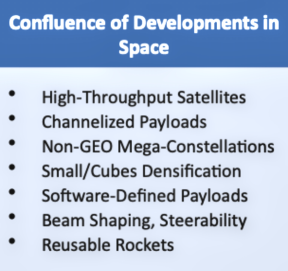

The Space-based technology innovations fostering this new massive wave of change started years ago, with the global proliferation of high-throughput satellite (HTS) architectures targeting a variety of applications. Following HTS, the densification of mission-focused smallsats, multi-orbit and multi-band network architectures, software-defined satellite payloads, electric propulsion, and other technologies all entered the picture. All told, innovations in space are creating complexity on the ground.

These innovations, in turn are meeting simultaneous advancements in the launch business. Improved economics via reusable rockets, heavier payloads, and an increasing number of satellites per launch are changing access to space. Concurrent advancements in spacecraft and launch technology have the combined effect of lowering entry barriers and the “cost per byte from orbit.” Expanding satellites’ flexibility and reach challenge established, matured industry sectors and their supply-chain structures, some of which have remained unchanged for decades.

Disruptions in satellite technology are affecting the entire industry, but three areas are experiencing the most change: Satellite Communications (SATCOM), Government & Military (Gov/Mil) and Earth Observation (EO), with the main implications being:

SATCOM: Emergence of multi-orbit, multi-band high-throughput satellite (HTS) architectures. These GEO3/MEO4/LEO5global constellations have multi-spotbeam, frequency-reuse technology and bring massive amounts of capacity to market. This drives down bandwidth costs and fosters new demand for fixed and mobility applications.

Gov/Mil: The enormous amount of capacity deployed by satellite operators -some with bandwidth-steering flexibility- encourages increasing use of commercial networks by government and defense end users. This trend is prompting new, “Ownership vs. Trust” tradeoff analysis by Government & Military planners.

EO: A proliferation of low-cost, high-revisit smallsats capable of capturing high-resolution images of the planet has democratized space. Recent use of Ka band platforms for high data-rate missions, and developments in advanced data-processing analytics have brought the need to scale operations. This in turn requires space platforms to interact dynamically with the ground network in more collaborative, usage-based and cloud-empowered ways.

Innovation in Space Requires New Thinking on the Ground

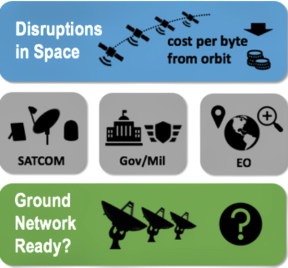

The Space segment today is exhibiting an accelerated confluence of technology innovations and risk-taking. This contrasts sharply with constant, but more conservative developments on the ground. While ground systems have certainly improved consistently, technology has transited a rather silo-focused evolutionary pattern of successive innovations, often driven by the need to achieve increasing performance levels on dedicated and purpose-built proprietary hardware.

Successive developments in satellite coding and modulation6, as an example, have gradually taken spectral efficiency closer to the maximum theoretical limits; and the move to IP as the default means of transport for a variety of applications has opened opportunities to serve niche markets and interface with users in a variety of ways.

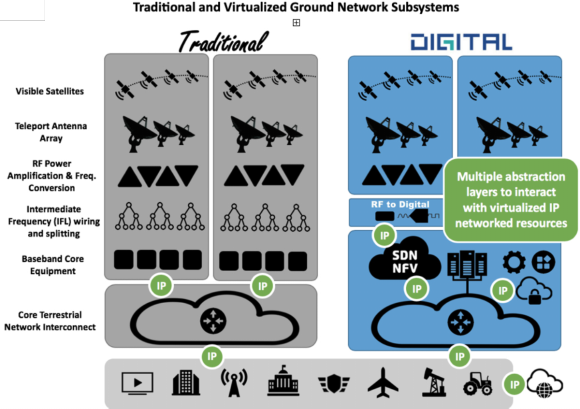

However, in light of the mentioned extensive set of innovations in space, performance-focused developments on the ground are necessary, but not sufficient to deal with the challenges and opportunities foreseen in the coming intersection of space assets with 5G telecom, enterprise, EO and government networks. The complexity of the satellite network being built today will require accelerated efforts towards the “fully virtualized ground network.” It will require multiple abstraction layers managed and orchestrated by common service definitions that meet new needs in terms of capacity, flexibility, cost, service creation, and resiliency.

Toward the Virtual Satellite Network

The need to quickly move toward a scalable and flexible virtualized ground network environment is clear because, despite developments, the traditional ground network will soon hit flexibility and scalability barriers and hold the industry back, limiting returns on space innovation.

Ground infrastructure stakeholders, including teleport or gateway players, satellite operators, service providers, and — particularly — ground system vendors must promptly embrace best practices from the IT and larger telecom worlds. The space industry has been slow to jump onto the open network architecture bandwagon.

This means many of the problems to be faced by the satellite industry have already been solved and adopted terrestrially with software-defined network (SDN) and cloud-based architectures. A fully digital ground is also necessary to better integrate with telecom to enable 5G. Therefore, simply embracing proven principles and best practices from the larger scale telecom and IT worlds, and adapting those to specific needs, can accelerate availability and adoption7.

NSR identified the following technological developments as key building blocks for ground network virtualization:

Virtual Network Functions (VNF)8 Functions that have been carried in the analog domain and/or performed on proprietary hardware will need to be virtualized to reduce hardware costs and augment flexibility. Certain functions could be exposed to provide access to services via containerization technology9.

Infrastructure-as-a-Service10 (IaaS) IaaS is key to the future of managed services and integration with telecoms. Leading satellite and teleport operators have introduced an array of managed services solutions but need to drive further efficiencies in teleport facilities and core compute centers.

Cloud Platform The adoption of cloud computing has quickly become a key driving force for businesses today, as applications are moved out of on-premise data centers in a bid to innovate, cut costs and increase agility.

Electronically Steered Antennas (ESA) While use of parabolic antennas will remain vital in the teleport / gateway infrastructure, development in new ESAs with the right performance and price points will be key to unlock the full potential of Non-GEO constellations and accelerate adoption in mobility markets.

Digitization of the RF Chain Digitization of the connection between the antenna and teleport hardware (IF signal flow) will bring physical-layer flexibility and cost reduction by decoupling traditional RF-chain conversion and amplification functions from the actual location where signals are digitally processed.

Solutions for the “Integrated Enterprise” 77 percent of enterprises have at least one application or a portion of their enterprise computing infrastructure in the cloud11. Thus, seamless, cloud-enabled interworking with satellite technology is key. Industry Standards: Ultimately, for the industry to transition from niche to mainstream, the adoption of open standards is a must as all major industries have been built around standards.

Big Data Analytics The ability to extract actionable insights from large quantities of a variety of digitized information carried across the network will provide platforms with an informational advantage for natural evolution.

Next-gen ground networks will provide scalability, flexibility and resiliency – and challenge traditional teleport and gateway design concepts. Yet, such a new mindset around how ground networks are conceived and designed is inevitable if the industry is to overcome obvious bottlenecks and unleash the full potential from space assets.

Framework for Ground Network Virtualization

NSR believes in the opportunity to explore new ways to architect and deliver advanced satellite services if the industry rethinks value creation in the context of a fully virtualized architecture.

Proliferation of software-defined satellites, HTS constellations and EO assets in space commoditize satellite connectivity driving the need to further commoditize ground hardware components to reach scale. The mentioned technological constraints on the ground can be solved if leading satellite players were to ambitiously embrace the potential of virtualization via collaborative digital platforms, adopting and adapting best practices from IT and telecom networks.

Moving to a virtualized infrastructure environment allows for leveraging economies and scale in generic computing power and storage. Integration into core cloud ecosystems -both private and public- brings built-in benefits such as high security and access to new services via well-defined demarcation points, integrating with broader ecosystems and providing one common harmonized look and feel for orchestrating assets’ functions and onboarding new missions more easily.

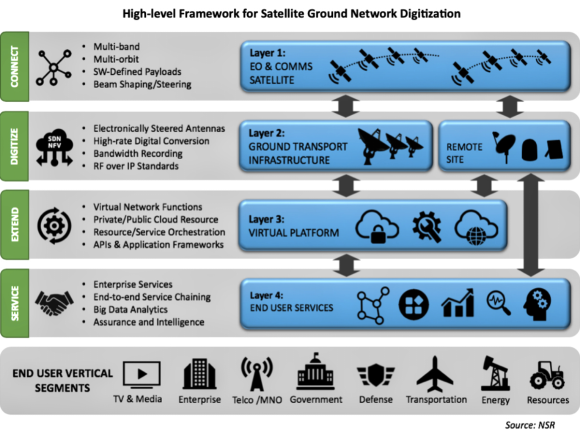

Based on these overarching concepts, the described challenge and solution building blocks, NSR produced one possible, high-level framework for architecting a fully virtual satellite ground network infrastructure. The framework may not be perfect but may be used as reference to picture high-level purposes as well as specific virtual network functions required to achieve scale, flexibility, and positive network effects13.

The framework is divided into the following layered purposes and virtual functions:

“CONNECT” Involves the primary use of satellites to connect two or more points on Earth in the case of SATCOM and to downlink valuable information for subsequent ground-processing in the case of EO and Sat-to-Ground missions. Satellites’ software-defined capabilities need to be managed and orchestrated from a ground-based control plane to best leverage satellites’ capabilities in synchronization with ground’s data transport and processing capabilities.

“DIGITIZE” It can be argued that satellite links are digitized by default both at baseband (IP as common transport protocol) and RF levels (digital modulation and coding), but ground-based digitization may involve multiple digital abstraction layers to maximize flexibility and drive core/remote network scale. These include:

Digital IF: As a guiding principle, NSR believes in the value of digitizing the RF signal as early as possible in the IF-to-RF chain. “Digital IF” can be valuable for the virtual processing of individual satellite carriers (independently from antenna location), both for the transport of data across the core terrestrial network and for quality monitoring or management purposes and extraction of insight from such data.

Kratos’ SpectralNet14 product is a good example of RF to IP conversion for limitless distance transport over private or public IP networks.

Terrestrial Interconnect and Peering: Already implemented in hybrid managed services offerings, terrestrial core links allows the transport of baseband IP packets across wide area terrestrial networks either in an IP switched environment (Gigabit Ethernet, VLANs and MPLS) or in an IP routed environment.

“EXTEND” NSR views this layer as very important for satellite players to leverage the value of the digital ground network, not just to integrate and connect, but also as a springboard for further development and cooperation. The extensibility and scalability of the virtual ground infrastructure will become increasingly important to foster cooperative ecosystem-focused environments that can speed integration and drive innovation. Key functions at this layer include:

Compute and Storage: Commodity compute and storage resources are the necessary underlying infrastructure for the digital ground. Where computing resources are physically located can vary (teleport, gateways, centralized data centers) based on several conditions such as terrestrial connectivity costs, applications’ delay sensitivity, etc., but the aggregated power of such resource is key for VNFs.

___________________________________________

___________________________________________

Sample List of Existing and In-Development

Virtualized Solutions

• Kratos’ dynamic digital ground products

• Atlas Space Operations’ The Freedom Ground

Network with software-centric and cloud-based

approach.

• AWS ground station-as-a-service

• Bridgecomm: Developing a network of optical

ground stations

• Intelsat & SES “Azure Express Route”

partnerships with Microsoft

• Kongsberg Satellite Services (KSAT) K-lite

solutions for smallsat players

• RBC Signals & Infostellar: Ground station

aggregators. Cloud-basaed solution for optimizing

ground segment asset utilization and virtualization

(especially for EO)

Virtual Network Functions (VNF)15: To reach the necessarily scale, economies and flexibility in the ground network it is vital for SATCOM hardware to shift from purpose-built hardware elements to SDN architectures and standards. VNFs can run on commodity computing resources virtualized across teleport and data-center type of facilities. Remote SATCOM terminals may also leverage the SDN concept when counting with standardized compute and storage. The philosophy of the SD-RAN being applied in the telecom space could also be applied to the design of future remote-site satellite equipment.

Network Management & Asset Orchestration: In the context of the required dynamics and array of network resources that can be dynamically assigned, both in space and on the ground, a comprehensive platform for real-time, policy-driven orchestration and automation of physical and virtual network functions becomes of prime importance. This includes the ability to unify management data across RF and IP delivery legs for enhanced service management.

As an example, in 2019 SES16 announced plans to leverage the open-source ONAP framework for asset orchestration.

Private & Public Cloud: Digital ground networks can establish private cloud environments to extend capabilities and connect with functions and services available in major public cloud environments. The leading cloud players, namely Amazon (AWS), Microsoft (Azure) and Google (Cloud) have been gravitating towards enabling platforms hooks into A.I.17, machine learning, automation, and block chain18 technologies, allowing ecosystem participants to benefit from these technologies.

Examples include the announced “Azure Express-Route” Microsoft partnerships with Intelsat19 and SES, as well as Amazon’s extension of its AWS platform to ground20 stations.

API’s, Development Tools & Plug-Ins22: Extending the digital ground capabilities requires the ability to expose functions for third-party integration via well-defined software interfaces. A concept already applied in MSS23 and EO systems, ground system vendors can also extend the capabilities of specific hardware elements via open APIs as an intermediate step towards gravitating to VNFs. Infrastructure operators can also put specific development tools in the hands of external developers and integrators to extend and expand network capabilities. The Plug-in concept can also be valuable for specific functions developed by third parties hat could become part of the core network capabilities.

Development Framework: The landscape is shifting from a service-provider-centric view of value creation towards a more open and cooperative environment to address a wide range of uses and needs. With the “virtual ground+satellite” infrastructure, new ways to enable service personalization at the network level becomes possible. Major ecosystem players could attempt to fully plaformize their infrastructure for 3rd-party ready development environment to become a springboard for the development and delivery of future integrated applications.

“SERVICE” This layer represents the “front end” for partners and users to interface with and leverage the digital ground platform. Users can have their own, personalized network view and have access to performance, analytics and monitoring information. Additionally, third-party applications residing at partner or end-user premises can interface and interact with the digital network and its cloud extensions to deliver specific functionality. While the “EXTEND” layer facilitates a range of wholesale delivery and cloud compute resources, the “SERVICE” layer is where network-based personalization occurs driving value-added services.

By adopting an encompassing service delivery framework as illustrated in this article, ecosystem players can interact collaboratively with the network at various abstraction layers, enabling a wide range of possible uses and interactions, as well as encouraging network-centered innovation.

Business Benefits

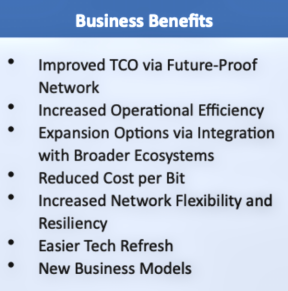

A strategic alignment of the new digital ground network with developments in space and telecom/IT can substantially improve TCO24and “future-proof” the network. Adopting the necessary building blocks can drive operational efficiency, improve innovation cycles, increase speed of network deployment, maximize flexibility, and solve the current scalability constraints. All these issues are difficult to achieve with the traditional ground network architecture.

Conducting a comprehensive virtualization process on the ground - whether on-prem, off-prem cloud or hybrid environments - can simultaneously leverage the “supply-side” economies of scale of space-based developments and unleash “demand-side” economies of scale characterizing use of broader cloud-based systems. Benefits will ultimately lead to more efficient supply chains, better user experience and innovative products and services, leading to new revenue streams and improvements in ARPU and client stickiness.

Bottom Line

A fully digital and virtualized ground infrastructure can best leverage dynamically configured space resources and achieve seamless integration of satellite technology with the broader telecom and cloud ecosystems. Ground network scalability, resiliency and flexibility are easier to achieve when designing the ground network to operate in a standardized digital environment, a process that requires ground infrastructure to change emphasis from purpose-built, proprietary hardware components to a software-defined, flexible and extensible virtual architecture.

Key will be to shift digital-processing functions to scalable and commodity hardware while investing in modern software capabilities. The exposure of distinct abstraction layers via standardized demarcation points can speed integration with third-party systems and bring new ways to enable service personalization and value-add at the network level.

While some players — including ground system vendors — may be responsible for driving digitization at component or sub-system levels, others, such as major satellite operators and service providers, may attempt to fully virtualize their systems and become a springboard for the development, and delivery of future applications in verticals spanning from commercial SATCOM to Government, to EO.

From software-defined satellites to software-defined networks, there will be an increasing relevance on smart software in future managed services. Over time, this shift could impact the value chain as virtualization fosters modified roles and responsibilities among value chain players.

Despite challenges, virtuous cycles for the industry could be driven by increasing levels of infrastructure sharing and network-based, cooperative value creation.

APPENDIX

How the New Space Race is Driving Ground Evolution.

The satellite industry is in the midst of the largest transformation since the inception of satellite communications over five decades ago. One could look back and draw an interesting parallel between today’s drive for change and that of the so-called “Space Race” era that unfolded in the late 50’s between the United States and the Soviet Union. Starting with the successful launch of Sputnik-1, first artificial satellite put into orbit in 1957, and peaking in 1969 with the landing of a Man on the Moon, this period gave birth to the satellite industry.

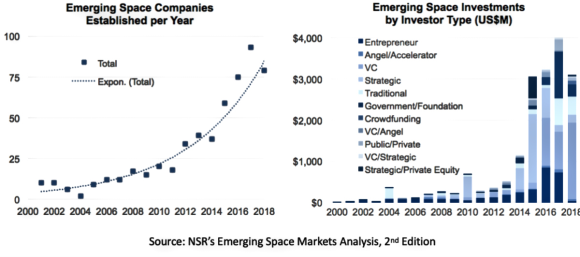

Today, we are transiting a new space race era, a “21st-Century Space Race” that has common goals with the old race around space exploration, and launch of artificial satellites, but taken to a much higher level. This modern Space Race involves the launch of thousands of satellites across different types of orbits, deep space exploration, space travel, asteroid mining, and — ultimately — Mars colonization and a multi-planet civilization.

Aside from the magnitude of today’s projects and ambitions, a key difference is the 21st-century space race is largely driven and funded by the private sector, attracting an enormous inflow of capital, fueling innovation.

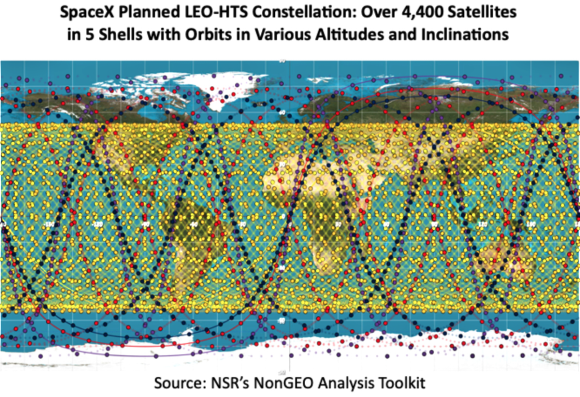

The ongoing, unprecedented launch cadence of thousands of satellites placed into non-geostationary (LEO/MEO) orbits is a prime example that must be observed in the context of this new space race. The commercial sector is in the driver’s seat of innovation, and the push for new paradigms in network economics with implications across all users of space-based applications or programs – public or private, civil or military.

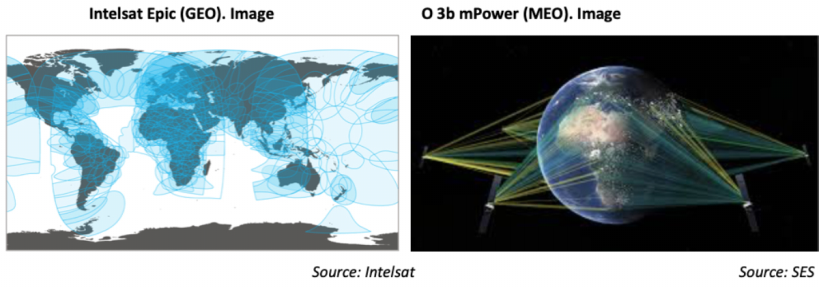

HTS has undoubtedly been the growth story for SATCOM, with established satellite operators pioneering adoption of enhancing technologies and driving distinct service models. A partial list of HTS developments and milestones include:

• In the early 2000’s, Thaicom, Hughes and ViaSat (then Wildblue) introduced vertically-integrated Ka-band HTS architectures focused on driving down the cost per bit for residential broadband and enterprise users.

• In 2013, Intelsat announced its Epic-series HTS satellite program, which pioneered the open-model Ku-HTS architecture for transitioning B2B applications from widebeam capacity. Epic sats were first to incorporate commercial use of RF channelizing technology.

• In late 2013, Inmarsat began deploying its Global Xpress Ka-band GEO-HTS constellation targeting global government and mobility users.

• In late 2014, Eutelsat was first to announce venturing into software-defined payloads for its Quantum-series satellites.

• With the acquisition of O3B completed in 2016, SES became the first wholesale FSS operator to decisively enter the Non-GEO HTS era with satellites using mechanically steered beams.

• With the Telesat LEO initiative, the Canadian operator could soon become the second wholesale operator to enter the Non-GEO race, with B2B focus.

SES’ transition plans from O3B to next-gen “mPower” MEO satellites is a good example that highlights drastic need for change on the ground infrastructure: O3B will shift from the 12 mechanically-steered beams per satellite in O3B’s first-generation system -currently operational with 16 satellites- to 5,00025 electronically-steered beams per satellite in the next-gen system.

While each first-generation satellite has an aggregate capacity of 20 Gbps, mPower satellites will have 10 times the capacity, delivering a terabit-level constellation that can scale as more satellites are added, according to SES. In addition to established players driving successive iterations of HTS architectures, the accelerating number of “Emerging Space"26 startups being established, fueled by exponentially-growing amounts of investment capital, paints the picture of motivations for change on the ground to scale operations and more flexibly interact with increasingly heterogeneous and powerful space assets.

The potential game-changing capabilities of the so-called “mega-constellations” cannot be under-stated. Launch of thousands of satellites within only two to three years by SpaceX’s Starlink, OneWeb -and potentially Amazon Kuiper and other LEO initiatives in a future- not only promise to intensify competition in satellite HTS, but also the possibility of new business paradigms shaped around the integration of spacecraft manufacturing, launch, and network operation.

References

1A software-defined satellite payload allows dynamic reconfigurations on the satellite of one or more of: Power levels, frequency bands and beam footprints.

2https://www.azquotes.com/quote/261632

3Geosynchronous Equatorial Orbit (GEO), is a circular geosynchronous orbit 35,786 kilometers (22,236 miles) above Earth's equator and following the direction of Earth's rotation.

4Medium Earth Orbit is the region of space around Earth above LEO and below GEO

5Low Earth Orbit (LEO) is an Earth-centered orbit with an altitude of 2,000 km (1,200 mi) or less above sea level.

6Successive developments in satellite coding and modulation technology include introduction of Adaptive Coding and Modulation (ACM), automatic uplink power control (AUPC), higher-order 16, 32 and 64-ary code modulation schemes, and use of proprietary and standards-based advanced FEC coding such as Flexible LDPC and DVB-S2X; in addition to bandwidth access schemes (SCPC, MF-TDMA, dynamic SCPC) and carrier cancelling on loopback transponders.

7https://www.businesswire.com/news/home/20191127005522/en/Intelsat-Recognized-SD-WAN-over-Satellite-“Service-Implementation-Year”-Awards

8In a Network Functions Virtualization architecture, a virtualized network function, or VNF, is responsible for handling specific compute functions that run in one or more virtual machines on top of commodity networked hardware.

9Containerization is the encapsulation of an application and its required environment: Packaging an application along with its required libraries, frameworks, and configuration files together so that it can be run in various computing environments efficiently.

10IaaS is a model where a third-party provider hosts and maintains core infrastructure, including hardware, software, servers and storage on behalf of a customer. This typically includes the hosting of applications in a highly scalable environment, where customers are only charged for the infrastructure they use.

11Source: 2018 IDG Cloud Computing Study:

12https://www.cnbc.com/video/2019/06/18/how-satellites-can-play-a-role-in-the-5g-roll-out.html

13Network externalities, usually referred to as “network effects” are demand-side economies of scale where the value of a networked product or service exponentially increases with the number of users and network contributors.

14https://www.kratosdefense.com/products/space/networks/network-devices/spectralnet

15In a Network Functions Virtualization architecture, a virtualized network function, or VNF, is responsible for handling specific compute functions that run in one or more virtual machines on top of commodity networked hardware.

16https://www.ses.com/press-release/ses-pioneers-cloud-based-network-automation-and-service-orchestration

17A.I.: Artificial Intelligence

18Block chain is a term associated with digital currency but with potential for change in the communications industry. The very nature of blockchain — secure, distributed information made accessible through private keys — provides a solution to the common speed/security problems facing communications.

19http://www.intelsat.com/news/blog/service-beyond-the-next-frontier/

20https://aws.amazon.com/ground-station/

21An application programming interface (API) refers to an interface or communication protocol defined to simplify the implementation, integration and maintenance of software running on different environments.

22In computing, a plug-in (or plugin) is a software component that adds a specific feature to an existing computer program. When a program supports plug-ins, it enables customization.

23Mobile-satellite service (MSS) a radio communication service between mobile earth stations and one or more space stations, often making use of L and S frequency bands.

24Total cost of ownership (TCO) is an estimate of all the direct and indirect costs involved in acquiring and operating a product or system over its lifetime.

25Source: SES paper “Redefining network services with O3b mPOWER”

26Emerging Space is defined by NSR as any space company founded after 2000’s which has an entrepreneurial approach to interaction with and use of space.