Prior to co-founding ThinKom (www.thinkom. com), William (Bill) Milroy held the position of Senior Engineering Fellow within the Electromag- netic Systems Department of Raytheon’s Electronic Systems (ES) Segment. During his 20 year tenure at Raytheon (Hughes Aircraft), Mr. Milroy managed and lead the RF antenna design, development, and production of a wide range of antenna array implementations for radar and communication applications in both the commercial and military marketplaces including 1t-D and 2-D Electroni- cally-Scanned Arrays (ESA’s). These efforts have included the creation and invention of a number of innovative EM modeling and RF design improvements, including the invention of the Continuous Transverse Stub (CTS) Array and its variants. He left Raytheon in May of 2000 in order to co-found and incorporate ThinKom Solutions, where he currently holds the titles of Chairman and CTO. Located in Hawthorne, California, ThinKom Solutions is focused on the design and development of innovative antenna access solutions and products for the Broadband Wireless Communication market.

Photo is courtesy of Ryan Patterson

Photo is courtesy of Ryan Patterson

Mr. Milroy is a graduate of the University of California at Los Angeles, earning BSEE, MSEE, and Engineer (Ph.D. course, field, and examination requirements) degrees in 1979, 1981, and 1986, respectively and is a graduate of the Hughes (Raytheon) Corporate Program Manager De- velopment Course (PMDC) and Engineering of Systems Course (EOSC) curricula and the Executive Marketing Program at UCLA’s Anderson School of Business Management. He is the author or co-author of nine journal and symposia papers in the fields of Network Analysis, Circuits, Antennas, and Microwaves. He is the inventor or co-inventor of more than thirty-five awarded and pending patents in the fields of Electromagnetic Scattering, Materials, Microwave Devices, and Antennas. Mr. Milroy is a past Chair- man of the Los Angeles Chapter of the IEEE Antennas and Propagation Society (APS), a periodic Guest Lecturer at the UCLA Anderson School of Business Management, and a Technical Reviewer for both the Nation- al Science Foundation (NSF) and the IEEE APS Transactions Journal.

Mr. Milroy, why did you decide to become involved in SATCOM as a continuing, leadership, career path?

William W. Milroy

Bill Milroy

My first interest in antennas, came when I was in college. I took a course from a professor named Bob Elliott, who was well-known in the antenna industry. That really caught my attention through my undergraduate and graduate studies at UCLA, and was the beginning of my career, working on radar antenna subsystems for things like fighter planes.

In the late 1990s, while I was still at Raytheon, myself and the other two co-founders of ThinKom — Stuart Coppedge and Mike Burke — got together and we started to work on SATCOM applications for customers like General Motors and a little bit for government uses, as well.

Circa 2000 seemed like a great time to move into the SATCOM telecom equipment market. We were working on a proprietary GM project at the time for their new Cadillac line, which eventually turned out to be their Escalade.

The company wanted to put SATCOM terminals on those cars that could work with different systems including, at the time, Teledesic, a system of Ka-band LEO satellites financed by Bill Gates and Craig McCaw. It turns out, that was (about 20 years) ahead of its time.

I’ve been in the SATCOM industry now for 20 years. The first 10 years of that were relatively boring. It was GSO satellites in the Ku-band, maybe in the C-band. Ka-band GEO satellites were kind of an exciting a new thing.

In the early 2000s, the industry saw the various Ka-band LEO constellation attempts fail and wrote them off as a dead technology.

But the electronics are more sophisticated and lower cost now, both on the satellites and on the user terminals and consequently its now much easier to deliver the substantially higher data rates that consumers demand today. So, in the past five or so years LEOs started coming back. That has really made this a much more interesting career for me and a much more interesting industry to be in.

Along those same lines of increasing bandwidth and technology changing, certainly the inflight connectivity market has matured significantly over the past few years. What are some of the main challenges you see today in extending that connected experience more broadly to different travelers, different airline business models, different aircraft types?

Bill Milroy

To make this more than just a business traveler type of solution, boosting the low adoption rates that we’ve seen historically, Wi-Fi on board is going to have to be free to the customer. Of course, that doesn’t mean it’s free; It just means that the cost will be absorbed into the ticket. And to deliver that for passengers, the cost per gigabyte has to come down.

A big part of that is getting more efficient antennas. That’s something we do at ThinKom. Our forte is to squeeze a lot more out of the satellite pipe, two to five times as much out of the same pipe as our competitors — that’s really important. We also look a lot at the types of aircraft that are well-connected today. And especially at those which are not connected.

The untapped potential for commercial aircraft remains huge around the world and across all types of aircraft. For the wide-bodies and narrow-bodies we think there are some pretty good solutions flying already, including a couple of our own. As the market demands better connectivity on regional jets, however, the available options are somewhat less compelling today, in terms of cost and size.

ThinKom Ka1717 antenna installed on an airliner.

Expanding into the regional jets means the terminal needs to be smaller and has to use less power. It must be more reliable and more adaptable to different types of airframes. It is also even more important to keep the costs of the solution low for the regional jets, as fewer seats means fewer user sessions to amortize the installation costs. We believe the new ThinAir® Ka1717 addresses those challenges head-on.

What are some of the key technological advances that make this new form factor possible?

Bill Milroy

Making the antenna smaller, with less drag is somewhat obvious. We shrank the fuselage footprint for the new Ka1717 solution to account for the smaller fuselage diameter. We also developed a new approach to mounting the antennas and radome on board, with just six bolts required.

The smaller antenna platters are significantly lower in weight, making them better suited to these planes. And we kept it a low-profile design, so it is still a very low-drag solution.

Less well-known is that regional jets also have a lot less space available inside the plane. So we’ve not only shrunk the external footprint, but also addressed internal factors.

We integrated the KANDU antenna controller unit, which is traditionally a separate Line Replaceable Unit in the plane, into the external antenna hardware. That preserves in-cabin space and removes about 15 pounds from the kit. It means one less hole in the fuselage for cabling. And the integration reduces costs for the kit overall.

Again, thinking about the reduced space above the ceiling panels or in the electronics bay, we also transitioned the Ku/Ka-band Radio Frequency Unit (KRFU) to the exterior, as well. It now sits on the external mounting plate rather than inside the aircraft. Just like with the integration of the KANDU, this further reduces weight and cabling. The shorter cable also helps to reduce power loss, which leads to lower power consumption by the system overall. Ultimately these changes all contribute to what we believe is a more powerful, lower cost solution for the market.

A little earlier there was a discussion about Teledesic and the resurgence of the LEO market. There are also MEOs and HEOs, a broad suite of NGSO constellations launching. That really changes the supply side of the market. How do you see in flight connectivity (IFC), responding and shifting as those constellations come into service?

Bill Milroy

It is great to see this resurgence of the technology that we originally targeted some 20 years ago, especially now that it seems it is finally going to succeed. But it also presents a tricky challenge. I think most people will agree that not all of the vying constellations and orbits will survive, but few people agree on exactly which ones will ultimately be successful.

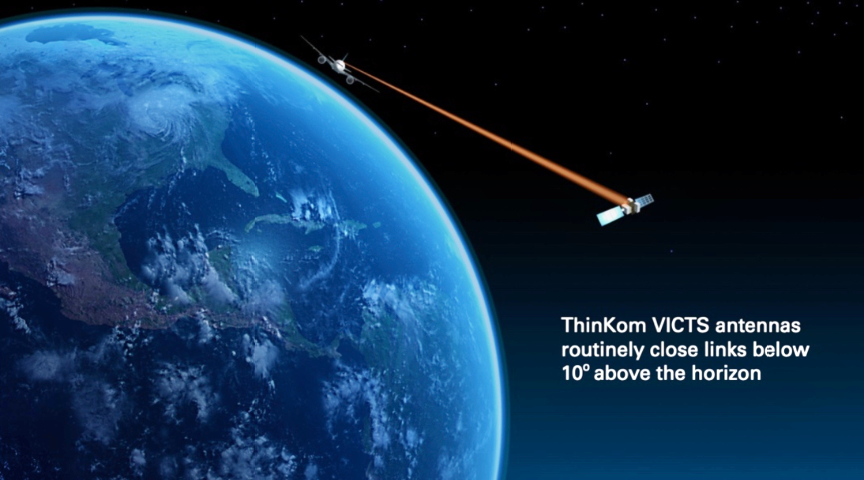

With this in mind, we advocate having a truly agnostic system that that can work on any LEO constellation, but also can work on MEOs and GEOs. “From every Orbit to Every Seat” is our motto. And we really walked the talk on that in terms of demonstrations of our hardware.

Picking, for instance, our ThinAir Ka2517, it has already been flight- tested on O3b MEO. It’s been on all the different GEOs, with Inmarsat, Thales, Hughes, and SES. We’re approved for HEO satellites with Inmarsat. So we’re pretty confident that our products will work on any and all of these constellations as they come online.

Side view of a ThinKom Ka171 antenna.

The electronically steered antenna (ESAs) are getting smaller and more capable while reducing their power draw. But we think those ESAs — due to fundamental cost, power, and size constraints — are likely going to be practical to deliver acceptable performance only on LEO, and not GEO, constellations.

It’s simply not realistic to make ESA’s large enough to close links on GEO at an efficient rate, at least not with the performance levels required for in-flight implementations.

It is scary right now for an airline to put a proprietary system on board that only works on one constellation. If an airline chooses that path, they’ve limited capabilities in both dimensions, LEO-only and also likely locked in to just one particular LEO constellation. That seems awfully dangerous with those constellations just really getting started in their in their rollout. Clearly the commercial aviation market is going to see some benefits from the new technology the new constellations coming on board. Do you see these new antenna technologies spreading into other sectors as well?

Bill Milroy

We’ve flown our larger Ka2517 on a Gulfstream III jet, so it is certainly possible. But with the smaller Ka1717, we think that reduced footprint and weight really open up the business jet market. It has the spectral efficiency of a 20-inch parabolic dish, with a much, much smaller footprint and profile.

For planes with the tail pod option, that’s only a 12-inch dish, so this beats that as a solution. And for the planes without the tail pod, it is an even bigger opportunity where previously the market didn’t have any available high-speed SATCOM solution.

There are also a wide variety of government applications as well. Special mission aircraft can be fitted with a lot of intelligence, surveillance, and reconnaissance (ISR) gear. Getting that ISR data off the plane quickly and efficiently can be a real challenge. Those planes range in size from a King Air 350 up to the larger Challenger 6000, and everything in between.

We’re not just an IFC antenna company. The same reasons our hardware can be so effective on planes can be extended to payload antennas on satellites and to gateway systems on the ground as well.

Unlike a parabolic dish, our solutions mount directly on the satellite payload, so we don’t take up extra space or block other antennas. There’s no deployment process once on-orbit, so reliability improves from the outset.

ESAs are also a popular option for satellites, but just like on planes, they suffer from similar power consumption, heat, size, and efficiency issues. In space, it is even harder to dissipate that heat.

Satellite operators need as much power as possible for their primary mission objectives, limiting what’s available for running communications back to Earth. With a limited supply generated from the solar panels on board, we think satellite owners appreciate our lower power draw, yet with a higher performance factor. On the ground station side of things, people do not like the large parabolic dishes. But it has never been practical to create a multi- beam, phased array and replace the dish. Cost, size, power, and the other typical concerns have always been in the way.

We are certainly not the first people to talk about replacing the giant dishes with multi-beam phased arrays; however, we well may be the first to make it practical.

Going back to your career path again, as you think back over the many years you’ve been doing this and your past experience, what project or mission brings a smile in your face. What are that one or two special things that you’ve accomplished that make you super proud?

Bill Milroy

I think, although it sounds it sounds more parochial to say, we’re still pretty excited about when we first started working with Gogo. That program really changed what was possible to deliver to an aircraft.

We were really the first team to enable a streaming experience on Ku- band satellites via a high efficiency phased array antenna system. That was a game changer. Now, six years later and owned by Intelsat, 2Ku is still acknowledged as being the most efficient, most capable system currently available.

As a founder of a small company, it amazes me how bright all the folks here at ThinKom and across the industry are — it is really exciting, being pretty far along in my career, to get a chance to mentor and work with people who are early in their career and hear all their new ideas and their excitement in the industry. That puts a smile on my face every day, as well.

The ThinkAir Ka1717 PDF datasheet is available for download at this direct link…

www.thinkom.com