Matthieu Chartier, Director, and Théo Roulendes, Senior Consultant, both with Starburst France

In the 16th century, the explorer Sir Walter Raleigh was already pointing out the importance of being able to control and monitor the maritime domain: “Whosoever commands the sea commands the trade […] and consequently the world itself.”

The maritime domain is strategically important for governments and private actors: 90% of global trade is made in the oceans1. Piracy, migrations, various trafficking, and environmental concerns are rising issues that can destabilize entire regions. Thus, the necessity of understanding, navigating and controlling the oceans is more than ever a strategic matter. And that’s where space technology plays its part.

From the earliest navigation methods, such as latitude calculations by using stars and sun, to longitude positioning thanks to the lunar distance method, to modern artificial satellite constellations, space-originating innovation has always been there, enabling the maritime endeavors and discoveries of men.

From the earliest navigation methods, such as latitude calculations by using stars and sun, to longitude positioning thanks to the lunar distance method, to modern artificial satellite constellations, space-originating innovation has always been there, enabling the maritime endeavors and discoveries of men.

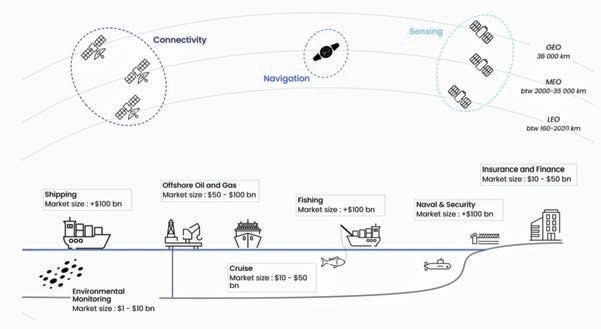

As technologies evolved, the reach of the space sector on the maritime world grew far beyond the mere use of the Global Positioning System (GPS), as public and private stakeholders learned how to make the most of sensing, connectivity, and navigation technologies.

In the context of an accessible and democratized space, we can expect these technologies to become increasingly ubiquitous in the future and exponentially more efficient when paired with data analysis Artificial Intelligence (AI). The range of space tech will continue to broaden, as satellites will diversify their activities. These innovations will continue to shape the maritime sector and impact all of the industries.

Here are the main space-related trends that inhabit the maritime world and how these technologies affect various identified end-users.

__________________________________________________

The Pervasive Influence of Space Technologies

Across the Maritime Sector

♦ The offshore energy industry involves the exploration and extraction of oil, natural gas, and renewable energy resources, like wind from ocean-based installations.

♦ The cruise industry provides passenger voyages on ships, combining transportation, lodging, entertainment, and dining on large, ocean-going vessels.

♦ The shipping industry encompasses the transport of goods and commodities across the world’s oceans using a variety of vessels, including container ships and tankers.

♦ The fishing industry captures and processes fish and other seafood from oceans and seas, utilizing vessels equipped for commercial fishing operations.

♦ Maritime environmental monitoring employs satellite and in-situ technologies to observe and manage oceanic conditions, pollution, and ecosystem health.

♦ The naval and security industry focuses on the protection and defense of maritime territories, involving naval forces, surveillance systems, and maritime law enforcement.

♦ Maritime insurance and finance provide risk management, insurance coverage, and financial services tailored to the needs of the shipping and marine industries.

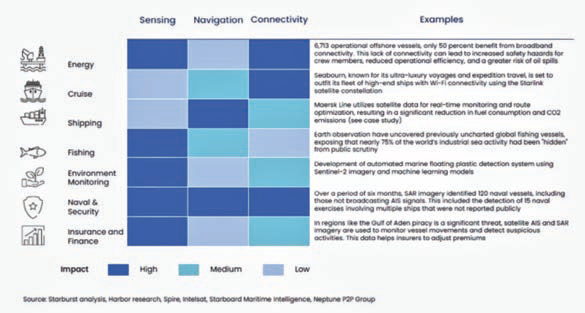

Space technologies have revolutionized the maritime industry by providing sophisticated sensing, navigation, and connectivity tools. These advancements enhance operational efficiency and improve safety and environmental monitoring.

_________________________________

Space Technologies Impacting

the Maritime Industry

_________________________________

Sensing

Satellite-based sensing technologies are crucial for maritime surveillance and environmental monitoring. Satellites equipped with synthetic aperture radar (SAR) and optical sensors offer continuous and precise observation of the oceans. SAR can penetrate clouds and operate day and night, making it invaluable for real-time maritime monitoring.

Optical sensors deliver high-resolution imagery for coastal monitoring, helping to track illegal fishing activities and marine pollution. Moreover, the detection of Radio Frequency (RF) allows satellites to track suspicious vessel activity.

In addition, Earth Observation (EO) satellites are used by maritime actors for weather forecasting, to avoid storms, rough seas, and/or to optimize routing, by getting information on waves, wind, storms, currents, temperatures, and precipitations.

Navigation

Satellite navigation systems have revolutionized maritime navigation by providing accurate positioning data, essential for safe and efficient vessel operation.

The Global Positioning System (GPS), developed by the U.S. Department of Defense, and Galileo, operated by the European Union, offers precise location information that enables ships to navigate narrow channels, avoid hazards, and optimize routes. Enhanced GNSS (Global Navigation Satellite Systems) such as Beidou from China and GLONASS from Russia also contribute to this global navigation network.

Additionally, ships around the world use the Automatic Identification System (AIS), which is a short-range coastal tracking system that broadcasts information such as course, speed, and identification at regular intervals. Satellite AIS (S-AIS) is based on satellites detecting these signals and then sending that data back for processing.

Connectivity

Satellite connectivity provides essential communication links for ships at sea, enabling data exchange, internet access, and emergency communication.

This connectivity allows for real-time weather updates, critical for route planning and safety, and supports applications such as telemedicine, which can provide medical assistance to crew members during emergencies.

The Inmarsat Global Xpress network provides high-speed broadband for operational efficiency, crew welfare as well as passenger services on cruise ships.

Artificial intelligence (AI) is emerging as a major technological trend in the maritime industry, revolutionizing how data is processed and utilized. Space technologies are already pivotal, offering standalone applications with concrete benefits. However, to unlock new use cases and maximize value for end-users, space companies are integrating AI components to provide comprehensive

end-to-end solutions.

For instance, the surge in EO satellites has enabled extensive planetary monitoring and surveillance. The Copernicus satellites produce 1 petabyte of data every six months2.

Companies such as BlackSky use their Spectra platform to offer AI-powered analytics, allowing users to swiftly react to insights.

Similarly, HawkEye 360 is developing AI and Machine Language (ML) models to enhance data quality, providing detailed information about vessels to combat illegal activities efficiently3. In navigation, AI plays a critical role in optimizing routes and building autonomous vessels. By integrating AI with satellite weather forecasts, companies can determine the best routes for ships.

ALongRoute, for example, leverages AI to fuse data from AIS and GNSS sources, tracking and identifying objects, analyzing vessel behavior, and ensuring maritime safety and awareness4.

The three different technologies will have a differentiated impact on the seven identified

maritime industries.

All identified industries have been, are, and will continue to be impacted by space technologies at various levels. Depending on the specific industry, this impact manifests in different ways, including cost reduction, enhanced service offerings, improved performance, and compliance with environmental regulations.

______________

Case Study

______________

The Impact of Space Technologies on Shipping Industry Costs

Maritime shipping involves many steps between the initial warehouse and the client’s warehouse. This analysis focuses exclusively on the spatial impact of the shipping process.

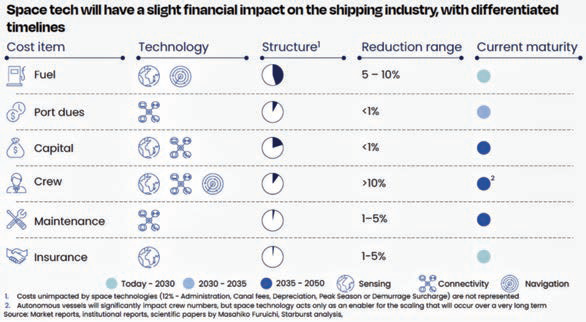

The Financial Impact of Space Technologies on The Cost Structure

The trio of satellite technologies sensing, navigation, and connectivity—when combined with enabling technologies such as AI and data analytics tools, will uniquely and significantly impact the cost structures of shipping companies.

Fuel Cost—Reduction through Route Optimization and Efficiency— 5-10%

Fuel Cost—Reduction through Route Optimization and Efficiency— 5-10%

Enhanced Navigation

Satellite-based systems like GPS and Galileo enable precise route planning and optimization, reducing unnecessary travel and fuel consumption.

Weather Forecasting

Satellites provide real-time weather data, allowing ships to avoid rough seas and minimize fuel use.

Fuel cost is the main cost item for shipping companies: for instance, Maersk consumed 9.8 million metric tons of fuel5 in 2023, for an average ton price of $616. That means that the firm spent roughly $6 billion just on fuel in 2023. Therefore, being able to reduce this consumption is of capital interest for shipping companies.

Port Dues and Various Charges—Indirect Benefits through Improved Operations— <1 %

Improved Traffic Management

Satellite data can streamline port traffic, minimizing delays and congestion.

Terminal Handling Charges (THC)

These are paid by the shipping companies for the handling and unloading of its containers by cranes on the port. Rates vary depending on ports and countries and can reach more than $250 per container6. Therefore, optimizing the monitoring and efficiency of these operations could help reduce these fees.

Crew Cost—Reduction through Automation and Remote Operations— >10 %.

Autonomous Systems

Satellite-supported autonomous navigation reduces the need for large crews.

Enhanced Communication

Improved satellite connectivity facilitates remote management, further reducing the need for onboard crewA reduction in direct crew costs, autonomous vessels would mitigate the risk of human errors, which are the cause of roughly 80 to 85% of all marine accidents7, which can be extremely costly. For instance, the Sanchi accident in 2018—which was estimated to have cost around $110 million by the Navy Information Operations Command (NIOC)—was caused by a violation of the maritime codes from Sanchi, who failed to respect the crossing rules8 and collided with freighter CF Crystal. This type of accident could be avoided with efficient autonomous vessel systems.

Capital Cost—Reduction of crew-related infrastructure— <1%.

Autonomous vessel technologies will allow ship constructors to save money on accommodation and all other crew-related infrastructure on board, or embark more cargo, therefore making it less costly for shipping companies. Capital cost for the most massive ships can represent a large part of the cost structure of shipping companies. For example, Hapag-Lloyd spent roughly $1 billion to acquire six, ultra-large container vessels, carrying a capacity of over 23,500 TEU (Twenty Foot Equivalent Unit), which means $167 million per ship9.

Maintenance Cost—Reduced Costs through Predictive Maintenance— 1-5%

Real-Time Monitoring

Satellite-enabled sensors detect issues early, allowing for preventative maintenance and reducing expensive breakdowns.

Even though predictive maintenance will not reduce significantly the maintenance cost of a ship, it can have a broader impact in avoiding incidents and disasters, as these new technologies will be much more effective than planned or reactive maintenance. Therefore, adopting predictive maintenance will allow companies to avoid unplanned costs and disasters. Indeed, according to Allianz, machinery failures have become the top shipping incident cause during the last decade. For instance, poor maintenance in 1999 caused the Erika to break in two, resulting in a cost of almost $200 million for the owner, as well as unprecedented damage to the environment. More recently, poor maintenance and compliance have been identified among the causes of the El Faro disaster in 2015, which resulted in the loss of 33 lives10.

Insurance Cost—Reduction through Parametric Insurance— 1-5%

Parametric Insurance

Satellites provide precise data on ship movements, weather conditions, and potential hazards. This data supports parametric insurance models, which use predefined parameters (such as wave height or wind speed) to trigger payouts.

Enhanced Security

Improved tracking and monitoring of ships via satellites reduces the risk of piracy and accidents, which can lower insurance premiums.

Indeed, marine insurance premiums amounted to $35.8 billion globally in 202311, reducing the induced costs can become a priority for shipping firms.

Therefore, the rise and improvement of new space technologies will directly impact the cost structure of firms, with possible reductions in fuel consumption, as well as potential savings on crew-related expenses. But the space sector will also have a broader impact on shipping companies, by improving social and environmental footprint or competitiveness.

The Non-Tangible Impacts of Space Technologies

Sustainability

EO and navigation satellites, along with data analysis tools such as AI/ML, can provide vessels with key insights in real time on weather, waves, traffic, or safety. Thus, the ships can constantly adapt their route and speed to stick to the optimal scenario, where it faces less complications, or follow the most direct route and use less fuel.

Not only does this contribute to important cost-cutting and improved reliability, but also to a lighter carbon footprint, as fewer resources will be used, and less greenhouse gas will be emitted. As the shipping industry still accounts for roughly 3% of global greenhouse gas emissions12 and as legislation and clients’ expectations are constantly evolving, requiring ESG policies and transparency, such technology will become essential for shipping companies to comply with the new regulations and retain their clients.

Crew Wellbeing

Satellite constellations provide users with internet access, which is paramount for the wellbeing of the crew, who can thus keep in touch with their loved ones on shore. Communication with home was the number one priority for crew members according to the Seafit 2023 crew survey13. A happier crew member will be more productive, focused, and less subject to errors, which in the end ends up in lower costs for the company. Thus, connectivity will become more and more of a prerequisite for a vessel operator, as it will be one of the most important factors to attract and retain new talents and maintain a good productivity level. As shown with the Safer Seas Act passed in 2022, crew welfare and security have become a prominent issue, and connectivity has its part to play, as it can provide devices such as sensors or intrusion detection systems.

Tracking and Quality of Service (QoS)

EO satellites, as well as navigation tools, can ensure a precise tracking of a ship and its containers. Customers can receive accurate and updated information about their orders, which builds trust between them and the company. In case of hazardous events, the company can swiftly react and still provide the customers with acceptable service. This ability to track becomes even more important if the goods are valuable or have a strategic relevance. For instance, Barcelona-based company Sateliot announced at the end of 2023 a collaboration14 with t42, an expert in providing IoT devices for tracking containers aiming to boost the use of satellite-based IoT(satIoT) in the high seas. This will allow shipping companies to track humidity, tilt, acceleration, impact, temperature, etc, and to be constantly aware of their cargo.

__________________________

Key Takeaways for

the Shipping Industry

__________________________

Conclusion—Do maritime stakeholders need a space strategy?

As the maritime industry navigates through an era of rapid technological advancement, the question arises: Do maritime stakeholders need a space strategy? We believe Maritime players can build a case for change following a four steps approach:

Assess

Start with a holistic approach, evaluating the overall impact of space technologies on the various activities within the organization. This comprehensive assessment should consider how satellite communication, Earth observation, navigation systems and other related space technologies can enhance efficiency, safety, and sustainability across maritime operations.

Prioritize

Identify the use cases where space technologies offer the most significant impact and value. By focusing on areas such as improved navigation, enhanced weather forecasting, and advanced surveillance, companies can pinpoint opportunities where the integration of space capabilities can drive the most substantial benefits.

Build

Develop a robust business case and a compelling case for change. This involves identifying potential partners who can support the implementation of space technologies and crafting a strategic roadmap that outlines the steps towards integration. Consider the financial, operational, and strategic implications to ensure a well-rounded plan.

Deploy

Implement the identified solutions and foster synergies with space technologies. This operational deployment should be meticulously planned and executed, ensuring that the new technologies are seamlessly integrated into existing systems and processes. Continuous monitoring and adaptation will be key to maximizing the benefits and achieving long-term success.

In conclusion, as the boundaries between maritime and space technologies continue to blur, it is imperative for maritime stakeholders to consider adopting a space strategy. By assessing, prioritizing, building, and deploying, organizations can harness the transformative potential of space technologies to drive innovation, efficiency, and competitive advantage in the maritime sector.

References

1 “Our economy relies on ship containers. This is what happens when they’re stuck in the mud.”, World Economic Forum, 2021, www.weforum.org/agenda/2021/10/global-shortagof-shipping-containers/

2 “Copernicus, un bon exemple de data en open source », https://la-rem.eu/2017/07/copernicus-exemple-de-big-data-open-source/

3 How AI and ML Are Supercharging Earth Observation, Via Satellite, 2023,

interactive.satellitetoday.com/via/november-2023/how-ai-and-ml-are-supercharging-earth-observation/

4 “Sensors and AI Techniques for Situational Awareness in Autonomous Ships: A Review”, IEEE, 2022, ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=9207841

5 “Annual Report 2023”, Maersk, 2024, ml-eu.globenewswire.com/Resource/Download/51b09aae-ecd3-4553-bbc9-e400896c6efe

6 “Terminal Handling Charges (THC): Best Guide”, Xchange, 2023,

www.container-xchange.com/blog/terminal-handling-charges/#who_pays_terminal_handling_charges

7 The Role of the Human Factor in Marine Accidents, MDPI, 2021,

www.mdpi.com/2077-1312/9/3/261#B6-jmse-09-00261

8 Sanchi: The world’s worst oil tanker disaster in decades”, Safety4Sea, 2019,

safety4sea.com/cm-sanchi-the-worlds-worst-oil-tanker-disaster-in-decades/

9 “Hapag-Lloyd Places $1 Billion Order for Ultra Large Ships with DSME”, The Maritime Executive, 2020,

maritime-executive.com/article/hapag-lloyd-places-1-billion-order-for-ultra-large-ships-with-dsme

10 “Learn from the past: Erika oil spill, Europe’s environmental disaster”, Safety4Sea, 2018, safety4sea.com/cm-learn-from-the-past-erika-oil-spill-europes-environmental-disaster/

“Coast Guard Releases Final Report on El Faro Tragedy”, The Maritime Executive, 2017,

maritime-executive.com/features/coast-guard-releases-final-report-on-el-faro-tragedy

11 IUMI’s 2023 analysis of the global marine insurance market”, 2023, file:///C:/Users/SB%20USER%2031/Downloads/IUMI_Stats_Report__654b5d3410cb9%20(1).pdf

12 “Reducing emissions from the shipping sector”, European Commission, 2024,

climate.ec.europa.eu/eu-action/transport/reducing-emissions-shipping-sector_en

13 “SEAFiT Crew Survey Report 2023”, seafit.safety4sea.com/wp-content/uploads/media/SEAFiT-Crew-Survey-Report-2023/26/

14 “Sateliot and t42 lead the way with Satellite-based 5G IoT Maritime Tracking Solution”, IoTforAll, 2023,

www.iotforall.com/press-releases/sateliot-and-t42-partner-satellite-based-5g-iot-maritime-tracking

About Starburst

Founded in 2012, Starburst is a leading global Aerospace and Defense (A&D) startup accelerator and strategic advisory practice. Combining three complementary activities – startup accelerators, strategy consulting, and venture investments—the company helps A&D stakeholders innovate, navigate, and invest in the dynamic ecosystem.

Starburst connects startups with corporates, investors and government, while providing strategic growth and investment consulting services for all. The firm’s leading Flagship Accelerator program helps startups scale their business in aviation, space, and defense, as well as enabling technologies, with access to one of the largest groups of corporate representatives, government stakeholders, and private investors in the world to help startups win their first contracts. Starburst has grown into a global team of 60 dedicated team members across 8 offices with a portfolio of 150+ startups, 20 accelerator programs, and one active venture fund, Starburst Ventures.

Article authored by Starburst, 2024, © All Rights Reserved.

Permission given to SatMagazine to republish this feature.