The Bryce Space Start-Up Space series examines space investment in the 21st century and analyzes investment trends, focusing on investors in new companies that have acquired private financing.

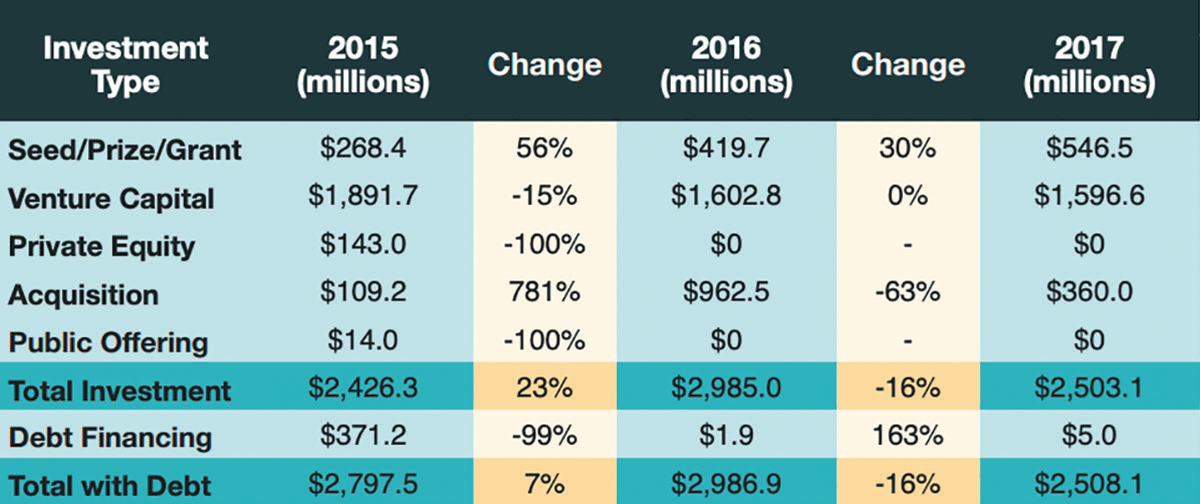

Table E-1. The magnitude of investments varies based on investment type and time period.

Table E-1. The magnitude of investments varies based on investment type and time period.

Space continues to attract attention from Silicon Valley and increasingly from investor communities worldwide. Space ventures appeal to investors because new, lower-cost systems are envisioned to follow the path terrestrial tech has profitably traveled: dropping system costs and massively increasing user bases for new products, especially new data and telecom products.

Some space start-ups are seeing large valuations, which are attractive to investors, although relatively few exits have occurred. While some maturing ventures are now generating revenue, the start-up space ecosystem has not yet definitively demonstrated business case success. This will be a critical topic in the next several years.

Start-Up Space reports on investment in start-up space ventures, defined as space companies that began as angel- and venture capital-backed start-ups. The report tracks seed, venture, and private equity investment in start-up space ventures as they grow and mature, over the period 2000 through 2017. The report includes debt financing for these companies where applicable to provide a complete picture of the capital available to them and also highlights start-up space venture merger and acquisition (M&A) and IPO activity.

Significant Investment in Start-up Space

Start-up space ventures have attracted over $18.4 billion of investment, including $6.3 billion in early and late stage venture capital, $2.3 billion in seed financing, and $4.5 billion in debt financing, since 2000. More than 180 angel- and venture-backed space companies have been founded and funded since 2000. Eighteen of these companies have been acquired, at a total value of $3.6 billion. Most investment activity has occurred recently, particularly since 2015, with investment between $2 and $3 billion in each of the last three years: $2.4 billion in 2015, $3 billion in 2016, and $2.5 billion in 2017 (excluding debt financing).

• In the early 2000s, an average of four funded space companies were started per year; today the figure is five times higher. (In the last six years, the number of funded new companies has averaged 19 per year.)

• This research has identified 555 investors in start-up space companies; not all investors are always disclosed, so the total number of investors is higher. Several high profile billionaires, including Jeff Bezos, Richard Branson and Elon Musk, are space investors; about 2 percent of Forbes’ 2017 World’s Billionaires have an affiliation with a space enterprise.

• Looking at investment only (excluding debt financing), three-quarters of investment in start-up space ventures since 2000 has been in the last six years, and nearly 60 percent in the last three. See Table E-1 on the preceding page.

• Three start-up space companies have attracted investment in excess of $1 billion: Jeff Bezos is estimated to have invested more than $1.5 billion in Blue Origin since 2000 (with some sources placing this total much higher); Google, Fidelity, and other investors have invested $1.7 billion in SpaceX since 2006; and SoftBank and other investors have invested $1.7 billion in OneWeb since 2015. SpaceX and OneWeb closed billion dollar deals in 2015 and 2016, respectively.

• Venture capital in start-up space companies since 2000 totals $6.3 billion, with more than 80 percent in the last three years.

• Nearly 40 percent of the value from acquisitions in space start-ups since 2000 has come from transactions in the last three years. Planet acquired Terra Bella for an undisclosed amount (2017), AAC Microtec acquired Clyde Space for $35 million (2017), EagleView Technologies acquired OmniEarth for an undisclosed amount (2017), and SES acquired O3b for $730 million (2016). Apple acquired Mapsense for $25 million (2015). In addition, Uber acquired deCarta in 2015, and Spaceflight Industries acquired OpenWhere in 2016, for undisclosed amounts.

Historic Number of Companies Reporting Investments

Investors provided $2.5 billion of financing to start-up space companies in 2017, about $500 million less than in 2016. This difference is primarily driven by the absence of a billion dollar deal such as those seen in 2015 and 2016 and by smaller value acquisitions in 2017 compared to 2016. See Table E-2.

• More start-up space companies reported investment in 2017 than in any other year, surpassing the 2016 total by one-third. The number of investors and deals increased compared to 2016, returning to the slightly higher levels seen in 2015.

• 164 investors put $2.5 billion into 73 start-up space ventures across 77 deals.

• The total number of start-up space companies reporting new funding in 2017 (73) broke the 2015 record (65) and increased by one-third over the 2016 total (55).

• While total investment decreased by $500 million, 2017 saw more investors and dramatically more venture deals (an increase of about 70 percent) compared to 2016. The number of investors increased from 136 to 164 and the number of venture deals increased from 26 to 44.

• The year 2017 did not see any billion dollar deals, although Saudi Arabia’s Public Investment Fund (PIF) announced that it plans to invest $1 billion in the Virgin Group — the investment was not reported to have closed in 2017. In addition, it was reported in December 2017 that SoftBank was considering providing an additional $500 million of investment to OneWeb.

• The number of investors (164) increased in 2017 compared to 2016 (136), returning to the 2015 level (166). Similarly, total deals increased from 64 to 77, returning to roughly the 2015 level of 81.

The Growing VC Interest in Space

Total venture investment, nearly $1.6 billion, was about the same in 2017 as 2016. Venture deals increased in frequency by nearly 70 percent (to 44) and 2017 saw nine late stage venture deals (the most of any year).

When excluding investments larger than $100 million, venture investment doubled from 2016 to 2017.

Of the 87 venture capital firms that invested in start-up space companies in 2017, 44 had previously reported investment in start-up space companies, while 43 appear to be new additions to the start-up space ecosystem.

• Three 2017 deals exceeded $100 million. The largest deal was SpaceX’s $450 million Series H round, the second largest was China-based ExPace Technology’s $182 million Series A, and the third was Mapbox’s $164 million Series C, led by SoftBank.

• Total venture capital invested was about the same from 2016 to 2017, roughly $1.6 billion. Excluding the very large, atypical $1.2 billion round of venture capital from SoftBank and other investors in OneWeb in 2016, 2017 saw about four times the venture investment of 2016.

• The average space venture deal in 2017 was $36.3 million, compared to $61.6 million in 2016.

• The number of venture capital firms investing in start-up space increased in 2017, from 75 to 87 firms. (The reported number of venture capital firms investing in 2016 has increased since our previous report, as more companies have announced transactions and as new data sets have become available.)

Table E-2. Third consecutive year of substantial investment in start-up space, with a slight drop from 2016.

Table E-2. Third consecutive year of substantial investment in start-up space, with a slight drop from 2016.

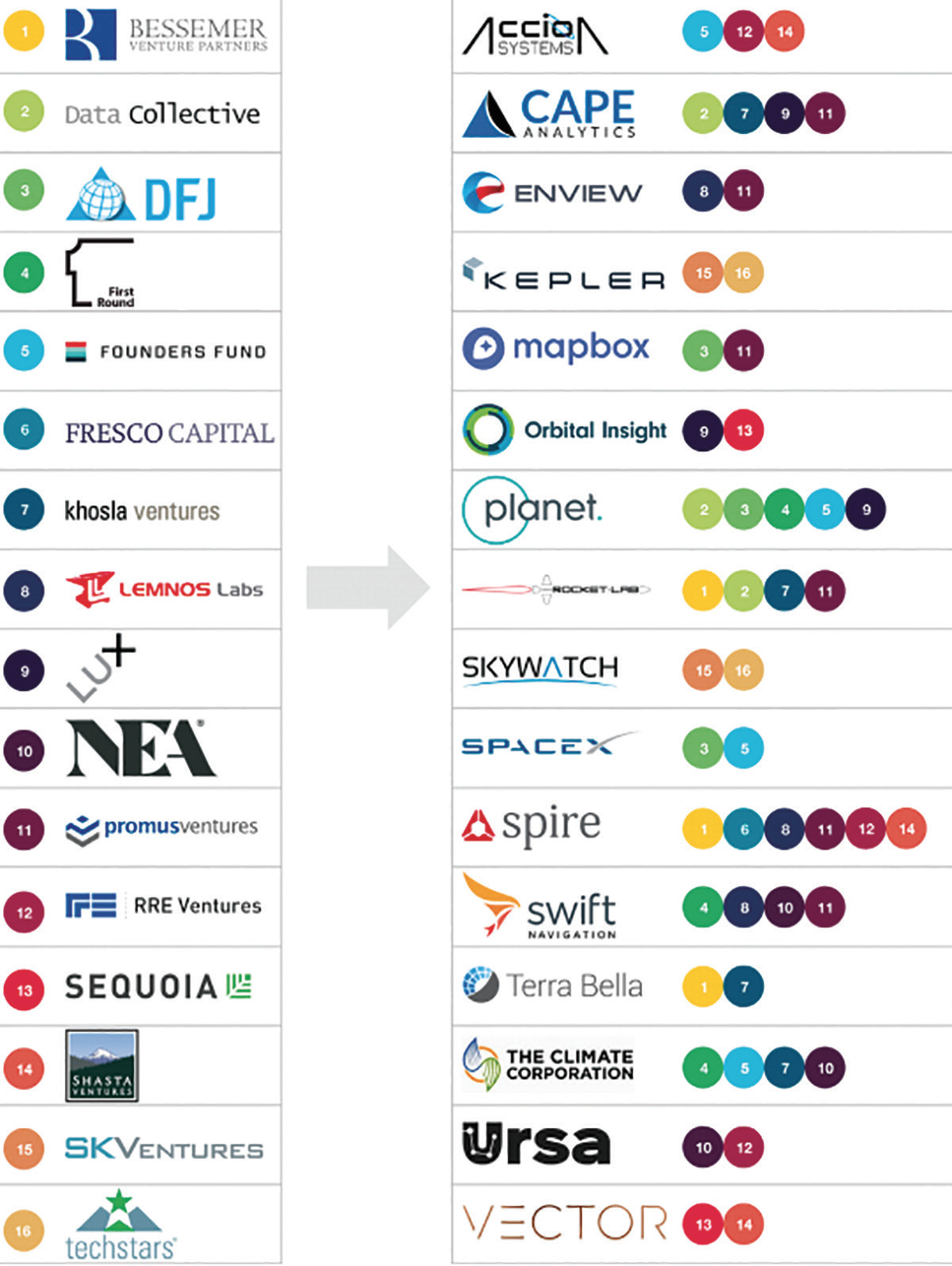

• More than 250 venture capital (VC) firms have invested in space start-ups. Sixteen VCs have repeatedly invested in common with others, with each of the following space start-ups reporting investment from at least two of these investors: Accion Systems, Cape Analytics, Enview, Kepler Communications, Mapbox, Orbital Insight, Planet, Rocket Lab, SkyWatch, SpaceX, Spire, Swift Navigation, Terra Bella, The Climate Corporation, Ursa Space Systems, and Vector. See Figure E-1. In addition, 19 VCs have invested in at least three different start-up space companies, and 15 VCs have participated in at least five start-up space deals.

Unicorns and a Few Exits

Investors focus on valuations and exits. SpaceX is an undisputed space unicorn (a private company with a valuation of $1 billion or more); after a $450 million Series H, SpaceX’s valuation was reported at $21.5 billion.

Several other start-up space companies, including OneWeb, Planet, and Rocket Lab, have been reported by some sources to be unicorns, and two, Mapbox and Kymeta, may be on the path.

While unicorn valuations are increasing in number, some financial analysts caution that many unicorns (across sectors, not specifically in space) have exaggerated valuations. Three acquisitions in 2017 totaled about $360 million, including Planet’s estimated $300+ million acquisition of Terra Bella, EagleView Technologies’ acquisition of OmniEarth, and AAC Microtec’s $35 million acquisition of Clyde Space.

Figure E-1. Common investments among the most space-focused VCs.

Figure E-1. Common investments among the most space-focused VCs.

• In February 2017, Planet acquired Terra Bella for an undisclosed amount, estimated at $300+ million. Google acquired the predecessor to Terra Bella, Skybox Imaging, in 2014 for $478 million. This possible loss for Google does not appear to have chilled the investment.

• Founded in 2005, Clyde Space previously reported $1.6 million of funding from investors, including Nevis Capital and Coralinn. In 2017, the company was acquired by a Sweden-based space technology company, AAC Microtec for $35 million.

• OmniEarth, a Virginia-based space start-up founded in 2014, was acquired by EagleView Technologies for an undisclosed amount in April 2017. The company had previously reported about $5 million of financing from angel investors.

Non-U.S. Activity in a U.S. Dominated Sector

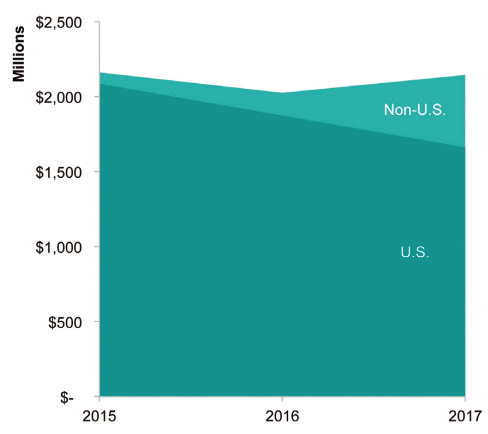

U.S. space start-ups continue to dominate start-up space, with about 75 percent of all investment (and 90 percent of seed and angel investment) from U.S. investors since 2015. Roughly 60 percent of investors and companies reporting investment in the last three years are U.S.-based.

• Total investment in non-U.S. space start-ups dropped in 2017, compared to 2015 and 2016, driven by a decline in private equity, debt financing, and acquisition transactions in U.K.-based start-up space firm, O3b. However, non-U.S. seed and venture investments, the number of non-U.S. firms reporting investment, and the number of non-U.S. investors reached highs in 2017.

• Total investment in non-U.S. space start-ups in 2017 was about $500 million, a drop from previous years.

• Seed and venture investment in non-U.S. space start-ups rose from $153 million in 2016 to $480 million in 2017. The 2017 non-U.S. total was greater than the three previous years, combined. See Figure E-2 on the following page.

Figure E-2. Seed and venture capital investment in non-U.S.

space start-ups increased from 2016 to 2017.

• Seventy-six investors in 2017 were based outside the United States. Non-U.S. investors went from about one-third in 2016 to slightly less than half of all investors in 2017. Most new non-U.S. investors were corporations. Thirty-two non-U.S. corporations provided funding to space start-ups in 2017, with 20 of these corporations headquartered in Japan. (2017 saw a quintupling in the number of Japan-based investors.)

• Thirty start-up space companies based outside the U.S. received funding in 2017. The largest investment in a non-U.S. space start-up was a $182 million Series A in ExPace Technology, a China-based launch start-up. (There have been three others under $10 million, with the most recent in 2014.) Other notable 2017 investments in non-U.S. space start-ups included a $90.2 million Series A in ispace (Japan), a $53.9 million unattributed venture round in Arralis (Ireland), a $27 million Series B in Satellogic (Argentina), and a $25 million Series C in ASTROSCALE (Singapore).

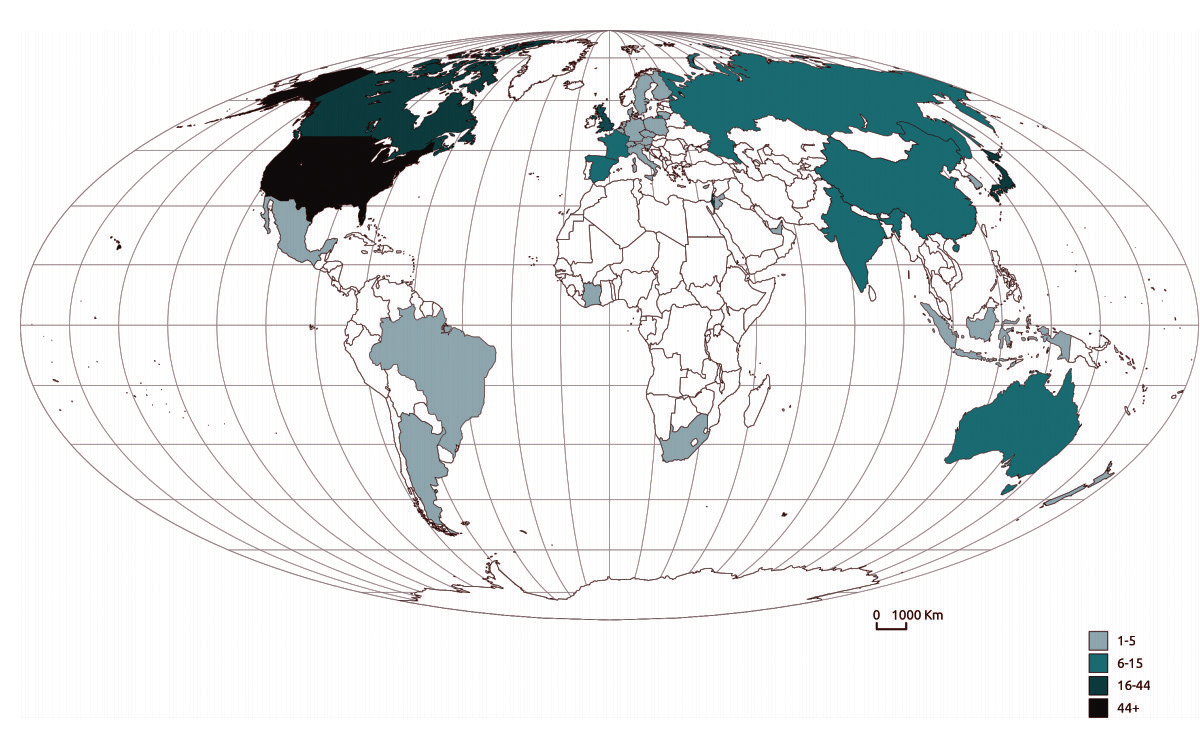

• Looking at all investors since 2000, investors in space companies are primarily headquartered in the United States (321), representing about 60 percent of the total; California is home to nearly half of these investors. Non-U.S. investors are based in 36 countries. See Figure E-3. Thirteen non-U.S. space start-ups are headquartered in the U.K., comprising 20 percent of all non-U.S. space start-ups. Canada has the second most start-up space companies (8), followed by Australia (5), Israel (4), Japan (4), and Spain (4).

Tracking Future Performance

After a 10x increase in venture capital and seed investment in space start-ups from 2014 to 2015, investment has remained relatively steady from 2015 to 2017, totaling between $2.5 and $3.0 billion annually. The year 2018 has the potential to outpace 2017 investment, as there are several pending megadeals, including investments in OneWeb, Planet, and the Virgin Group. The next few years have the potential to transform the start-up space ecosystem, and investors will be closely tracking the revenue dynamics and operational performance of maturing start-up space firms. We are now in a proving period as many services and products that attracted investment are deploying or planning deployment shortly and investors are seeking indications they will realize returns.

To read the complete Bryce Space report, please access this direct link:

brycetech.com/download.php?f=downloads/Bryce_Start_Up_Space_2018.pdf

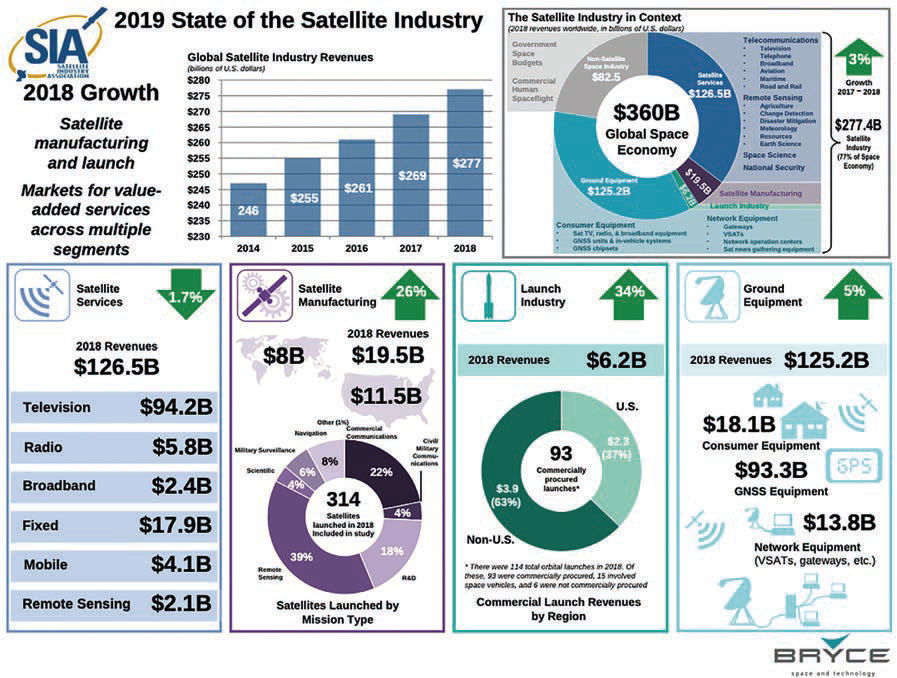

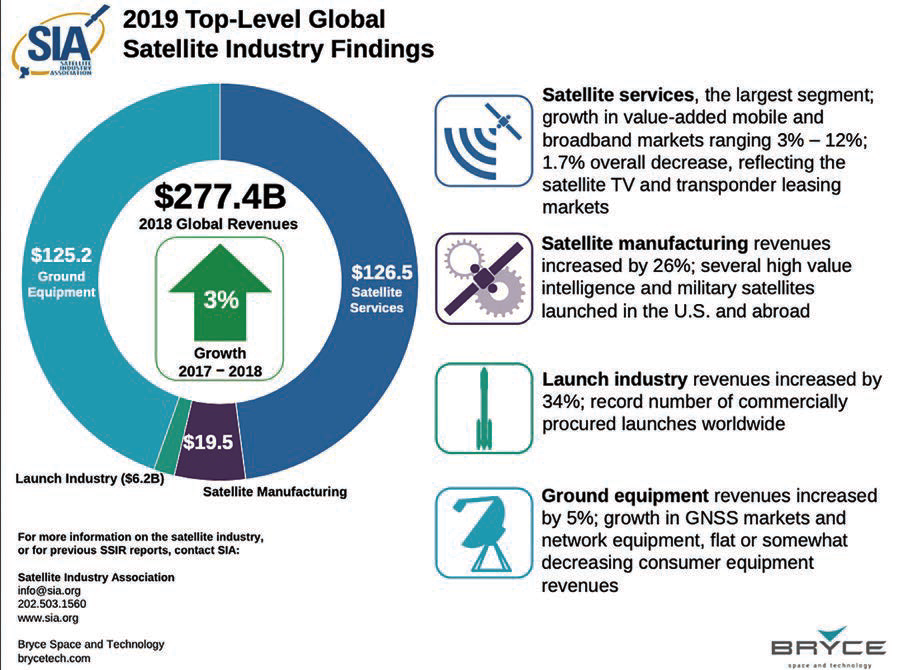

All of the above figures, charts and images are courtesy of Bryce Space. The charts below are courtesy of the Satellite Industry Association (www.sia.org)

Figure E-3. Investors in start-up space ventures are headquartered

in the U.S. and 36 other countries.