SpaceX, it might be justifiably argued, is already a glorious business. The company’s Falcon 9 rockets are now the backbone of the industry with blue-chip clients drawn from NASA and other government contracts as well as multiple demands for the firm’s own, Starlink broadband, global service.

____________________________________

Chris Forrester takes a deep

dive into SpaceX, and

anticipates a glorious future

for the rockets-to-broadband

company

____________________________________

Lifting the cover on SpaceX is a true challenge, given that the company releases zero information on their assorted ventures — being still privately held only makes that task even more difficult.

Investment bank Morgan Stanley summed up the information dilemma neatly by recently stating, “The majority of our clients (by survey and client discussions) believe SpaceX could ultimately command a higher valuation and significance than even Tesla.”

Given that Tesla already has a spectacular valuation (market capitalization as of May 13th of $539 billion), although Tesla’s share price can fluctuate significantly. Since early 2023, Tesla’s then $670 billion market cap has fallen 25%, caused by negative reports on squeezed profit margins.

Although SpaceX is currently well below the value of Tesla, it can still safely be measured at above $137 billion, which is the reported valuation on a recent 2023 funding round by the company.

The prospects for company owner Elon Musk mounting a public offering of shares in SpaceX, perhaps around 2025, are considerable. The profitability metrics are increasingly in place.

SpaceX is making profit on each and every commercial launch of their Falcon 9 rocket, and even greater margins on the launches of the Falcon Heavy vehicles as well as their Dragon module for NASA equipment and supply shuttles to the International Space Station (ISS).

However, in the past, SpaceX’s President and COO, Gwynne Shotwell, told CNBC that SpaceX is unlikely to go public until the company is flying on a regular basis to Mars. A May 2022 report from CitiBank’s Global Perspectives & Solutions suggested that colonizing Mars is not quite ready for tomorrow.

Musk wants his first cargo flight to Mars during the 2024-2025 timeframe and the first two-crewed Starship operational by 2026. Perhaps such might occur, but CitiBank suggests that the Mars project will not come into its own until 2040.

Shotwell, speaking at the FAA-organized Commercial Space Transportation conference in Washington, D.C., in February of 2023, told delegates that Starlink had recorded its first quarter of positive cash flow in 2022 and was on track to turn a profit this year.

As most readers know, SpaceX owns the Starlink satellite internet service provider that has launched thousands of their smallsats into orbit since January of 2020, providing internet connectivity to a fast-expanding portfolio of overseas markets. Starlink has also enabled the Ukraine to maintain internet access since the Russian invasion in February of 2022.

As of June 2022, SpaceX stated they had 400,000 Starlink subscribers and that increased to one million by December of last year. The company’s growth over the past year or so has been spectacular.

Indeed, new analysis by research company, Dataxis, states that at the end of 2022, SpaceX’s company had reached 1.07 million satellite broadband subscribers. Mid-May of this year saw SpaceX Tweet that Starlink had more than 1.5 million subscribers.

Starlink has barely taken three years to achieve this new and most impressive subscriber number which qualifies the business as the largest supplier of satellite-based broadband. Equally impressive, only five months were required to add around 500,000 new users (from December of 2022 to May of 2023).

The reality now is that Starlink is probably on course to being close to a three million subs number by the close of 2023. Starlink has, in recent months, ramped up their dish manufacturing capacity to more than 150,000 units per month. The firm has also widely expanded the markets the service can address.

The current Starlink fleet can support some 5 to 10 million subscribers, but such has been the demand that, in some parts of the world (especially certain U.S. States), access is limited.

Starlink’s 2nd Generation satellites that are currently being launched will remove some of these bottlenecks. A fleet of 2Gen Starlinks will support 20-30 million clients.

A major and well-established rival, EchoStar-owned Hughes Network System, has more than 1.3 million subs “in the Americas.” Viasat does not divulge subscriber numbers; however, at the last public declaration (in the Spring of 2021) they stated they had 590,000 subs.

Dataxis says that, although the figure remains modest globally (when measured against established telco operators), it shows that, in just a few months, the company achieved a third of what the entire satellite broadband industry had accumulated in its entire history, at a different scale.

“A noteworthy fact is that the company practically did not steal customers from other satellite companies, which indicates that it is targeting users with less specific needs, an aspect of the demand that usually constitutes the ceiling for this technological segment. The company offers competitive speeds, and during 2022, its price level fell sharply, making it a viable alternative to certain terrestrial technologies. Price adjustments were tailored to the competitive environment of each region.”

Dataxis estimates that, by 2027, the company could accumulate almost 31 million active subscriptions.

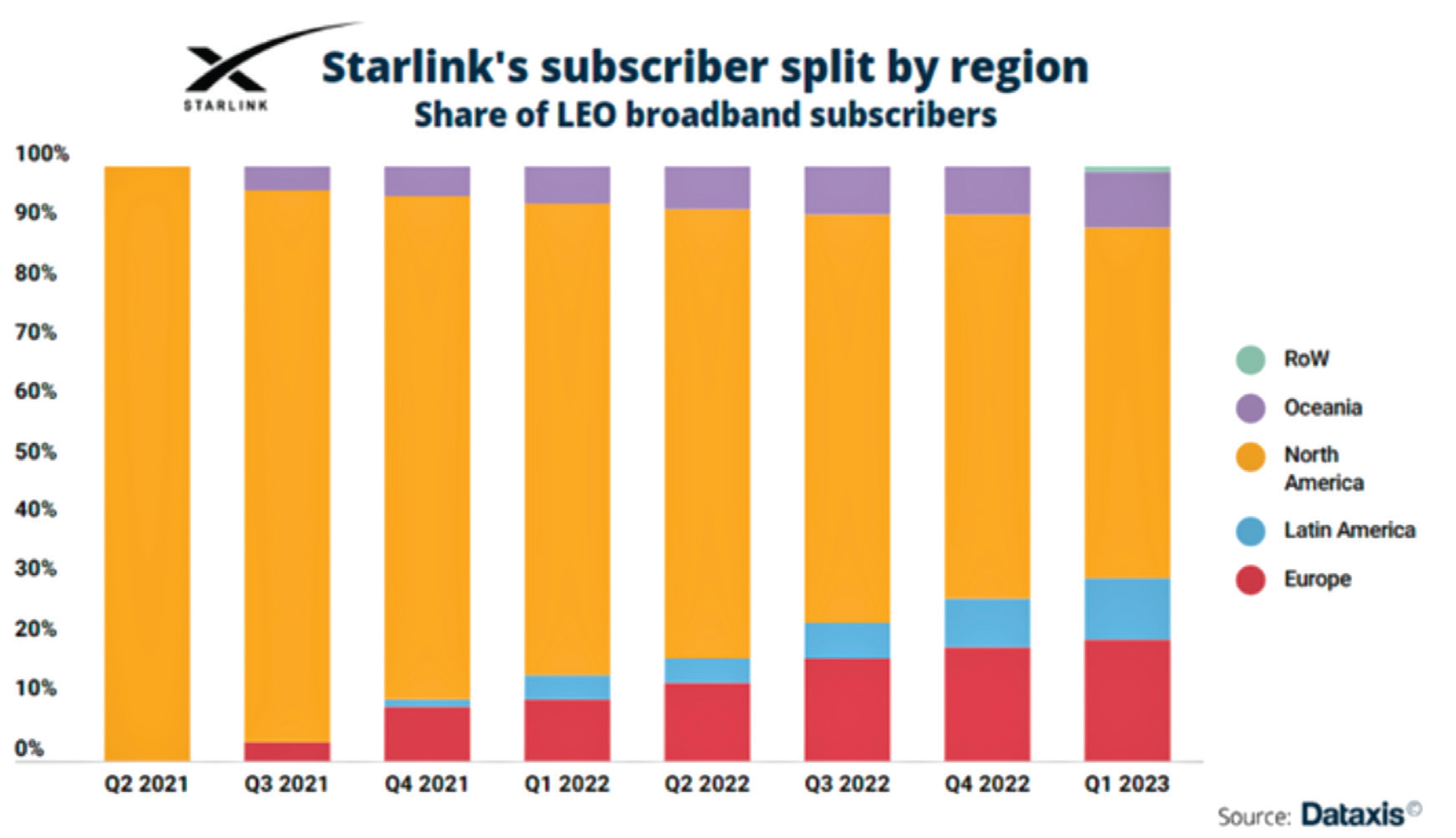

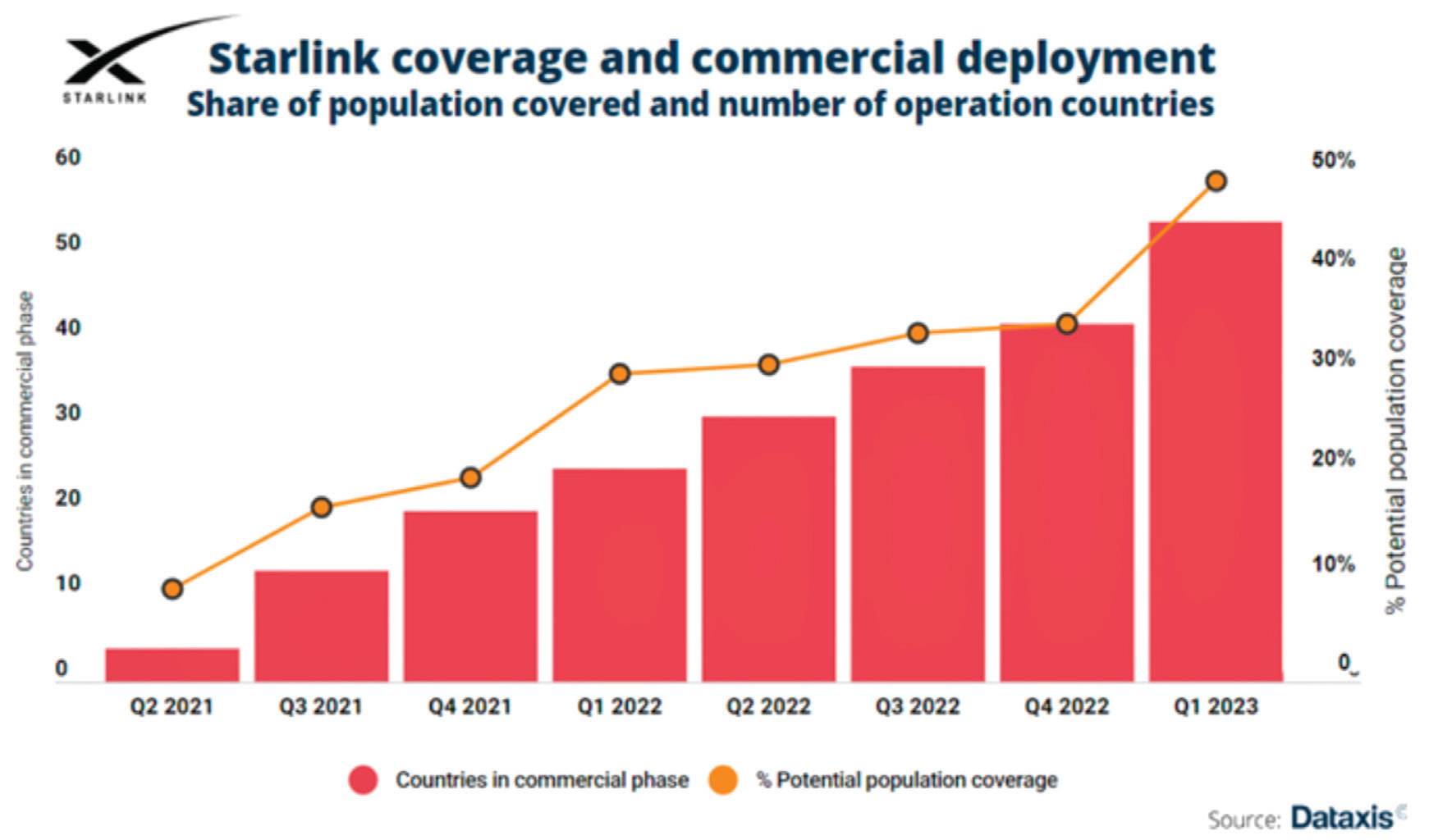

By 2022, the fleet expanded to 3,000 Low Earth Orbit (LEO) satellites, plus another 500 satellites that were not yet operational. In commercial terms, SpaceX’s Starlink already had a presence in more than 40 markets, giving the service potential coverage for more than 35% of the world’s population. North America, its area of origin, still accounted for 64% of all customers at the time. Europe was its second-most important market. However, half of its European accesses were in Ukraine and Poland, where the operator positioned itself as a communication alternative in the war.

In 2022, Oceania and Latin America had similar shares and, as a whole, represented around 17% of the subscribers.

The entry into Asia and Africa only began to take shape in Q1 2023. During that quarter, Starlink already had a commercial presence in more than 50 countries, the equivalent of 50% of the world’s population.

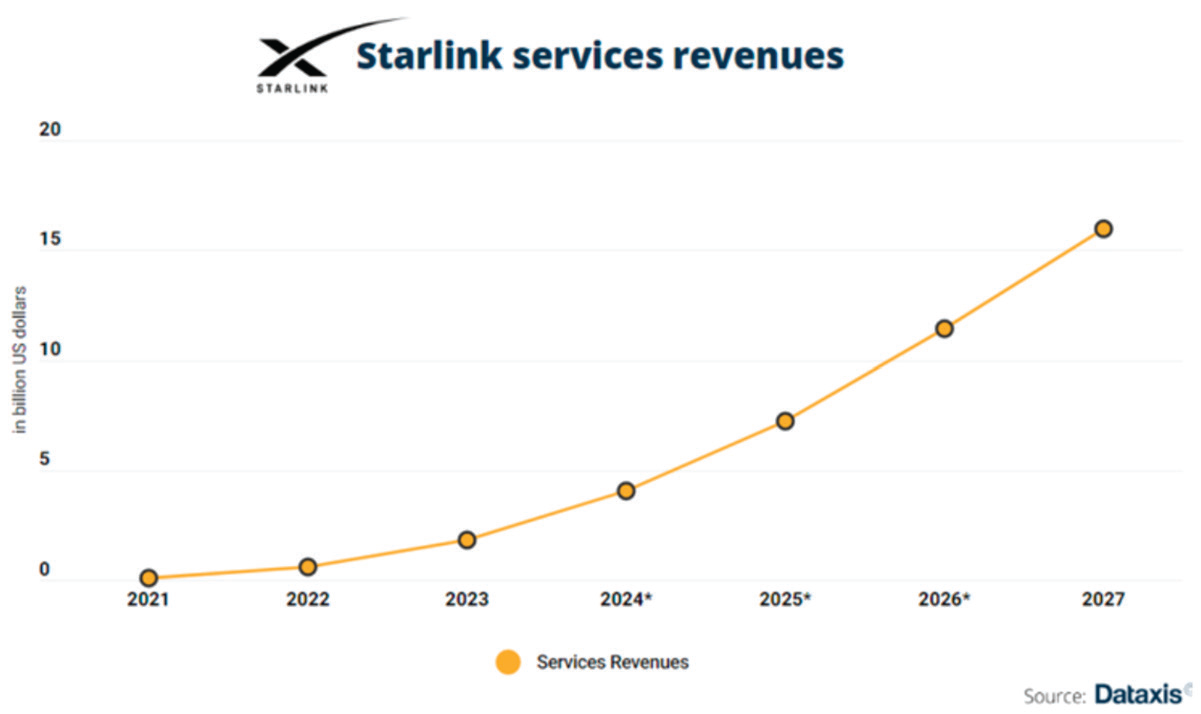

Dataxis estimates that in 2022, Starlink generated $607.3 million in service revenues. As the company gained customer volume, its average monthly revenue per subscriber (ARPU) evolved downward.

Although the total ARPU for Q4 2022 reached $95, this indicator did not share the same fate in all regions. North America is the only territory where the average revenue level has been rising.

In the other markets, Starlink adjusted its pricing aggressively to match the competitive environment and gain volume. Between Q4 2021 and Q4 2022, Oceania’s ARPU fell by 11%, while the decrease reached 41.5% in Europe and 52.3% in Latin America.

In Q2 2023, the company announced another drastic price reduction, but although ARPUs keep going down rapidly, Starlink’s service should remain far from becoming a mass market offer.

The LEO broadband access could become an attractive option to compete against old-fashioned terrestrial options in rural and suburban areas, as it did not only bring additional coverage but also more competitive download speeds. Starlink found markets in zones lacking efficient internet access, as well as in areas with alternative, but flawed, options to access broadband.

In 2027, Dataxis projects that Starlink could have 31 million customers and service revenues of $16 billion. Such a number of subscriptions would represent almost 1.5% of the total broadband access globally. Starlink has a vertically integrated business model and a direct reach to end-consumers.

This trajectory could be adjusted through alliances with strategic operators, as it seems to be the way forward in Africa and Asia, and the signing of agreements for subsidized social connectivity programs with governments.

Although the company does not yet have an equivalent competitor, satellite alternatives will begin to emerge in 2023 as they also try to capture parts of this market.

The greatest threat to Starlink comes from Jeff Bezos and his Amazon Kuiper project. Few doubt that Amazon’s marketing and direct-to-consumer muscle could be a highly competitive rival to Starlink.

OneWeb is another LEO system that will move forward through alliances with major players, albeit focused very much on telco-based, wholesale relationships. OneWeb is not seen as of this writing as a direct-to- consumer offering.

O3B, SES’s MEO fleet, is already populating its fleet with its mPOWER satellites. SES/mPOWER will be another threat, although, again, not in the direct-to-consumer market. In addition, GEO systems will gain competitiveness with HTS units such as Eutelsat Konnect in Europe or the future Viasat 3 global, three-satellite system in the Americas, Europe, Africa and the Asia- Pacific (APAC) regions.

Unknown, as of this writing, is also Europe’s IRIS2 proposed LEO/MEO/GEO system that is expected to have a consumer based, broadband offering.

These alternate offers also have the potential to bring a surgical approach to the market, with more capacity for small surfaces — elements that can also make them serious contestants in the race for widespread, efficient and affordable broadband satellite access.

Either way, the commercial head-start that Starlink enjoys in the company’s ‘first-to-market’ offering is going to be a tough act to beat. Viasat and Hughes will also expand, but few expect Starlink to be too worried by their efforts.

The SpaceX portfolio

• Starlink for Consumers

• Starlink for Maritime

• Starlink for Aircraft

• Starlink for Business

• Starlink Starshield military

• Falcon

• Falcon Heavy

• NASA shuttles

• Starship

Author Chris Forrester is a well-known broadcasting journalist, industry consultant and Senior Columnist for SatNews Publishers. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996. He also files for Advanced-Television.com. In November of 1998, Chris was appointed an Associate (professor) of the prestigious Adham Center for Television Journalism, part of the American University in Cairo (AUC), in recognition of his extensive coverage of the Arab media market.