The global space industry is transforming at an accelerated pace with the entry of new solutions across the space industry value chain. Historically, the space industry had been dominated by government agencies and incumbent players.

However, in the last decade, the industry has witnessed multiple new innovations and low-cost solutions from the new commercial players, revising the conventional philosophies of the space systems, missions, and services. This has resulted in the expansion of space industry value chain making the industry increasingly competitive.

The rapid growth of the small-satellite market itself is largely responsible multiple developments in the small satellite (smallsat) segment resulting in new market segments

Major new developments leading the changes in the conventional philosophies:

• Evolution of small-satellites from a technology demonstrator platform to an operational platform.

• Vertical landing re-usable launch vehicle for affordable access to space.

• Introduction of dedicated launch services for on-demand small satellite launches.

• Increased usage of commercial off-the-shelf components on the operational platform enabling low-cost mission and frequent technology upgrades.

• Introduction of Serial production for satellite manufacturing.

• Use of low-earth-orbit based large constellation of satellites for real-time imagery and global connectivity solutions.

• Increased usage of High-throughput satellites offering flexible connectivity solution at prices competitive to the terrestrial networks.

• All electric satellites letting more power for the payload and increased mission life.

• SAR imagery for commercial applications using small satellite platform.

• wSpaceport business models facilitating commercial players’ developments and businesses.

What’s driving space industry transformations?

Downstream Demand

Downstream digital transformation, increased usage of IoT systems, system upgrades by large enterprises, globalization of small and medium enterprises and remote location connectivity are driving the evolution of satellite-based services.

New Investments

Rising investments from private firms, financial institutions, government and tech giants, supporting new entrants and university spin-offs, are reshaping the future of satellite industry. In 2017, $3.9 billion was invested by 120 private firms globally in the space industry.

Government policies

New policies and regulations reducing the barriers to entry are enabling a competitive ecosystem in the space ecosystem. Countries are developing and revising their broadband plans to include space based solutions, in order to bridge the digital divide of their population. Developing countries, like India, are revisiting their space policies to leverage new and evolving technologies like artificial intelligence and machine-to-machine connectivity.

Technological advancements

New developments in satellite platforms, propulsion systems, satellite systems, launch vehicles, connectivity networks and architecture are driving the evolution of space industry.

Frost & Sullivan Space Industry insights

More than 20 smallsat operators — with the constellation sizes 20 to 4,425 — will offer affordable downstream services, both complementary and competitive to the existing services by existing incumbent players in the next three to five years. This will result in lowering of the global satellite-based service prices and enable new customer groups to incorporate satellite-based services for their business intelligence and operations.

Frost and Sullivan forecasts the launch demand of 11,631 smallsats in the period 2018 to 2030. The lifespan of these satellites varies from two to five years. This will generate high launch demand for new installations and replacement missions.

High volume smallsat launch demand with shorter lead time is imposing the need for an increase in the launch capacity for small satellites. The existing rideshare capacity is insufficient for meeting the launch demand of all the small satellites. Multiple existing and new players are accordingly developing their systems and infrastructure in order to capitalize on the upcoming launch services demand by offering dedicated launch services to the small satellite operators. The dedicated launch services will achieve the market share of >50% for small satellite launches by 2022.

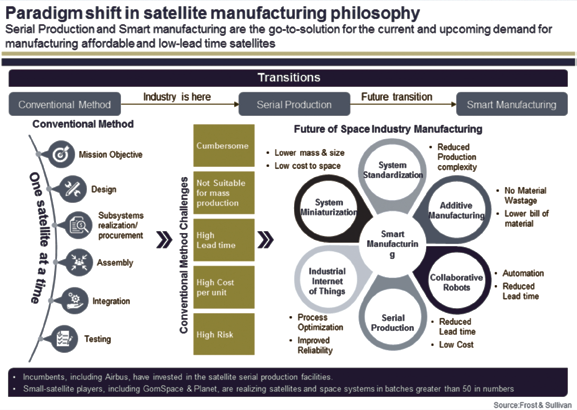

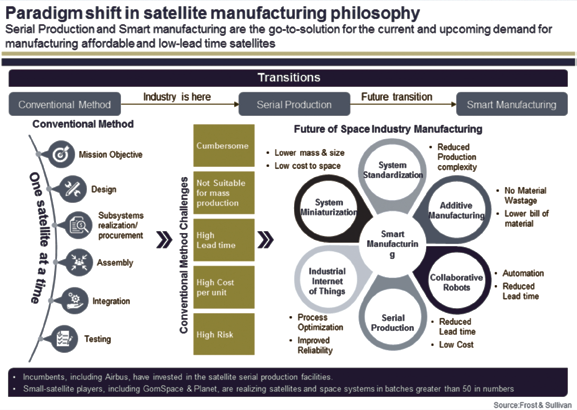

Companies with standardized, advanced, and integrated solutions, accommodating satellite constellation requirements, will lead the small satellite manufacturing market. Small satellite operators manufacturing their satellites poses business sustainability risk on 90 percent of the small satellite-manufacturing companies. Hence, the space ecosystem will witness the increased level of industry consolidation in the next 5 years. Image below gives the perspective of how the manufacturing philosophy in the space industry is evolving right now.

Big is getting bigger and small is getting smaller. The space industry is growing on either end of the spectrum simultaneously while competitively coexisting to deliver new capabilities to meet evolving requirements. High Throughput Satellites are carrying more capacity than previous generation satellites and small-satellites are getting more efficient with the use of miniaturized and advanced subsystems. In the next 5 years, the industry will evolve to conventional geostationary satellites primarily used for broadcasting services, HTS satellites for high data rate broadband in the urban location and small satellites connecting remote and higher latitude or polar locations.

Top Predictions for 2019

• Satellite Manufacturing

High volume demand from commercial small satellite operators. Incumbents, manufacturing large satellites, will target this increasing demand through acquisition and partnerships.

• Launch Services

Smallsat launch service providers will partner with spaceport operators to fill the existing on-demand and dedicated services gaps.

• SATCOM Market

Partnerships and alliances to achieve service penetration to new geographies and applications including connected cars, IoT/M2M and high-speed remote connectivity.

• EO Market

Increase in the number of value added services to different industry sectors for monitoring and business intelligence utilizing faster image-refresh rates satellite capabilities

• Ground Infrastructure

New opportunities for the ground station service providers from mega-constellations. Increased investment for the development of low-cost downstream hardware. New standards for networks integration.

• Industry Value Chain

Extended value chain with reduced entry barriers through private and government funding. Vertical and horizontal integration to penetrate larger market through product portfolio expansion.

Frost & Sullivan Space Program

Frost & Sullivan has evolved its space research program with the objective of enabling both existing suppliers and new entrants to assess the current market dynamics. This includes current and future constellations, launch services and downstream services. Frost & Sullivan provides perspectives on current market sizes, future potential, the evolving supplier ecosystem and the current and long-term threats and opportunities.

The company has developed an exhaustive and structured database of more than 500 companies across the value chain, including incumbent players and new entrants, tracking their historic events, current activities, and future plans. Frost & Sullivan uses the bottom-up approach using the frequently updated database to arrive at the precise and unique space industry insights.

Industry coverage includes component manufacturer, subsystem manufacturer, satellite manufacturer, satellite operators, launch service providers, ground station operators, ground infrastructure suppliers, downstream service providers, government agencies and end users.