Editor’s note: In this feature, the author provides a brief review of SATCOM technology and the types of satellites on orbit today. She then presents the pertinent legislation and explains the space and ocean sourcing rule.

We thank Tax Notes International (www.taxanalysts.com/) for allowing us to repurpose this feature from their publication, which is copyrighted 2015 Tax Analysts and is reprinted with their permission.

New Technologies

O3b Networks (O3b) is the first communications satellite company to commercialize a non-geostationary, Medium Earth Orbit (MEO) satellite constellation, which began its commercial operations in September of 2014, the same month when the Indian Space and Research Organization successfully placed its first satellite into orbit around Mars1.

O3b was founded in 2007, backed by SES S.A. (the second largest satellite company), Google, and some banks, to develop a satellite constellation that would serve 3 billion people who live in parts of the world that are insufficiently connected by fiber optic cable and thus do not have access to the Internet through their cellphones2. The company’s name, O3b, stands for “other 3 billion.”

O3b launched its first set of four satellites to MEO in June 2013, but there were complications with a two of the four components, which were placed on standby3. O3b successfully launched eight more satellites to MEO in two more launches during 2014, which brought the number of its operational satellites in its satellite constellation to 104. 03b’s successful launches were in contrast to the back-to-back rocket launch explosions that involved private space companies—Orbital Sciences Corporation’s unmanned rocket, which was carrying cargo to the International Space Station, including 26 experimental satellite projects; followed by Virgin Galactic’s manned SpaceShipTwo rocket5. All three private space companies—O3b6, Orbital Science7, and Virgin Galactic8—are in a race that also includes Internet companies and various country space programs to develop reasonably priced communications satellite technologies to meet increased global market demand9.

Types of Communications Satellites

In simple terms, a communications satellite serves as a reflector in space. The satellite receives uplink signals sent from an antenna, gateway, or ground station located at one point on Earth and then processes the incoming signal by changing the frequency and amplifies it. The satellite then reflects these signals on a downlink to another antenna, gateway, or ground station located in another point on Earth. Communications satellites can be located in a variety of orbits including geostationary or bits and medium and Low Earth Orbits (LEO).

Geostationary

A geostationary satellite is stationed 22,236 miles above our planet’s equator, appearing to hover at a fixed orbital point, while it moves circularly at the same speed as Earth’s rotation, in 24-hour orbits. It relies on stationary antennas, since there is no need to track the satellite.

A classic geostationary communications satellite provides a broad single beam (C-band) to cover wide regions or even entire continents on Earth to facilitate intercontinental and global communications. Because of its significant distance from Earth, the signals to and from the geostationary satellite are delayed, making the C-band beams unsuitable for many applications. Therefore, a geostationary communications satellite acts in tandem with fiber optic cable, terrestrial infrastructures, to transmit data more quickly.

There are wireless satellite telephony network (STN) systems, which integrate geostationary satellite and terrestrial radio communication technologies into one system that may be approved for use in the United States by the Federal Communications Commission10.

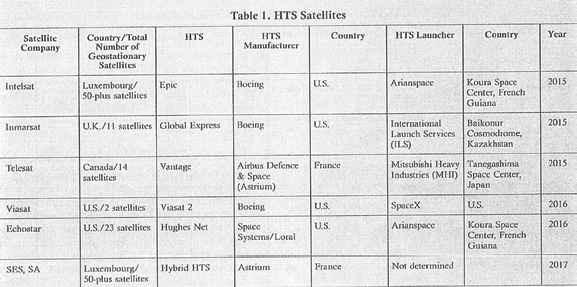

The new geostationary satellite technology being highly commercialized is the high-throughput satellite (HTS). HTS can provide more capacity per orbital slot, by handling much larger amounts of data, at higher speeds, through frequency reuse and use of multiple narrowly focused spot beams (Ka-band, Ku-band), as opposed to one wide beam, on areas of high demand and population density, cost efficiently11. Satellite manufacturers are developing new electric HTSs12, while the largest communications satellite companies are expanding their HTS network coverage area by entering into first-of-its-kind interconnection agreements (“HTS agreement”)13 and by launching HTS into Geostationary Synchronous Orbit (GEO) as detailed in Table 1.14 Currently, most of the communications satellites in space are located in GEO15.

Non-Geostationary

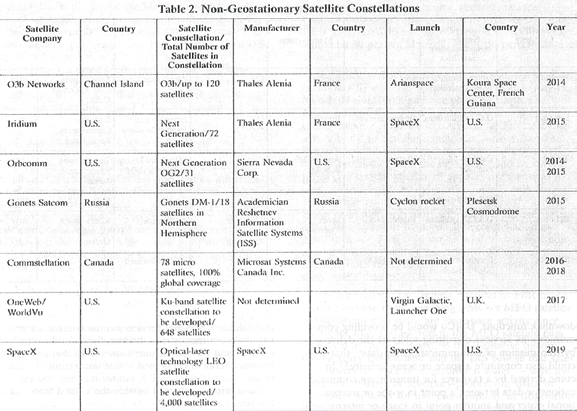

A non-geostationary satellite can be located at a MEO anywhere from 1,243 miles to 22,236 miles below a geosynchronous orbit, or it may be located at LEO anywhere from 99 miles to 1,243 miles below a geosynchronous orbit. A non geostationary satellite does not appear to hover at a fixed orbital slot but needs to be continuously tracked by moving ground antennas as it moves eastward in a circular motion around the world in anywhere from 1.5 to 23 hour orbits. Because of a non-geostationary satellite’s proximity to the Earth, the signals to and from the satellite can provide fiber-optic-cable-like performance at high speed, which supports video, Internet protocol virtual private network, Voice over Internet Protocol (VoIP), cloud computing, enterprise applications, and interactive gaming in remote locations throughout the world that are insufficiently populated and insufficiently fiber-optic cable connected16.

However, an MEO or LEO satellite constellation requires many more satellites, satellite launches, gateways, moving antennas, and ground stations to provide the same beam coverage of Earth that can be accomplished with only three geostationary satellites, making these satellite constellations more expensive to commercialize and to operate17. Other challenges concerning commercializing and operating MEO and LEO satellite constellations include:

• Space debris

• Interference issues with existing communications satellite infrastructure because of increased communication between moving antennas, base stations, and satellites

• Obtaining landing rights for gateways in various countries18

To alleviate the cost burdens relating to establishing and operating an MEO or LEO satellite constellation, several companies are developing technologies to reduce the moving antenna costs19 and satellite launch costs by making rockets reusable20. Such initiatives are encouraging companies to continue to develop commercial non-geostationary LEO satellite constellations to provide low-cost satellite communications services to the 3 billion people who live in parts of the world that are insufficiently fiber-optic-cable connected.

In-Earth-Atmosphere Satellite Initiatives

In addition to MEO and LEO satellite companies, there are also U.S. Internet companies that are developing communications satellite technologies to be used within Earth’s atmosphere. Google’s Project Loon aims to deliver Internet access to Earth’s remote areas through fleets of high-altitude balloons22, while Face book’s Connectivity Lab project aims to develop a solar powered drone to compete with both satellites and balloons to deliver Internet access cost efficiently23.

Market Demand and the Orbit Act

The technological innovation and growth in the $190 billion global communications satellite industry during the past 14 years was spurred by increased commercial demand for up-to-date information in a globalized economy24 as well as by the enactment in the United States of the Open-Market Reorganization for the Betterment of International Telecommunications Act (ORBIT Act)25.

The ORBIT Act encouraged competition in the global satellite services market by ending the monopoly position of the International Telecommunications Satellite Consortium (Intelsat) through privatization26.

Intelsat was a former intergovernmental consortium that was established in 1964 and promoted the development and commercialization of a global satellite system in cooperation with countries throughout the world based on a treaty agreement. Intelsat enjoyed privileges including immunity from competition laws and exemption from taxation27.

From 1964 up to its privatization in 2001, Intelsat operated the largest single fleet of commercial geostationary communications satellites that were a key part of the global communications network, which in 1969 al lowed 500 million people from around the world to watch on TV images of astronaut Neil Armstrong’s first steps on the moon.

Intelsat’s privatization in 2001 coincided with the Internal Revenue Service’s issuance of proposed regulations governing space or ocean and communications source rules, under Internal Revenue Code section 863(d) and (e)28. These proposed regulations were withdrawn and replaced on September 19, 2005, with new proposed regulations that were finalized on December 26, 200629 . The space and ocean source rule is used for sourcing income from the commercial activities of privatized space companies, which provide 40 percent of the global communications satellite services30.

The Space and Ocean Sourcing Rule

The space and ocean rule sources income based on the residence of the recipient earning the income and serves different functions for U.S. taxpayers as com pared with foreign taxpayers.

A U.S. taxpayer is subject to U.S. taxation on its worldwide income, making the ocean and source rule relevant to the taxpayer’s outbound transactions including subpart F31, withholding taxes, and foreign tax credits. Under the space and ocean rule, a U.S. person’s32 income from space or ocean activity is U.S. source unless the income, based on all the facts and circumstances, is attributable to functions performed, resources employed, or risks assumed in a foreign country or countries33.

A foreign taxpayer is subject to U.S. taxation on some U.S.-source income or income that is effectively connected with a U.S. trade or business34. A foreign person’s35 income from space or ocean activity is foreign source, unless:

• Space and ocean income derived by a CFC36 is U.S.-source income, except to the extent the in come, based on all the facts and circumstances, is attributable to functions performed, resources em ployed, or risks assumed in a foreign country

or countries

• Space and ocean income derived by foreign persons (other than CFCs) engaged in a U.S. trade or business is U.S.-source income to the extent that the income, based on all the facts and circumstances, is attributable to functions performed, resources employed, or risks assumed in the United States.37

Thus, the space and ocean rule defines the boundaries of U.S. taxation of a foreign taxpayer’s inbound transactions, allowing them to structure their operations to minimize their U.S. federal income tax liability.

Space and Ocean Activity

Under the space and ocean rule, space and ocean activity includes any activity conducted in space or Antarctica or under water other than that of the United States, its possessions, or a foreign country, to the extent recognized by the United States38. Such activity includes the manufacturing of property39, the performance of services40, the leasing of equipment41, the licensing of technology or other intangibles42, the underwriting of insurance risks on activities that produce space income43, sales of property in space44, communications activity in international waters45, and the lease of a research vessel46.

The following examples demonstrate the application of the space and ocean rule to the new communications satellite technologies of private space and Internet companies.

Geostationary Satellite HTS

A U.S. satellite company (USSCo) and a foreign satellite company (FSCo) enter into an agreement as follows: USSCo will lease its HTS satellite and sub-license its orbital slot in geosynchronous orbit to FSCo (note that an orbital slot is applicable in the context of a geostationary satellite, but not in the context of a non-geostationary satellite constellation). FSCo will operate the HTS satellite and gateways or ground stations in the United States because an HTS satellite uses smaller beams, which are connected to a gateway beam or station on the ground with different frequencies used for the forward and return channels.

Part of USSCo’s performance as lessor or sub-licensor in this transaction occurs in the United States, but the HTS satellite and the sub-licensed orbital slot are in space. USSCo’s income from leasing the HTS satellite and sub-licensing the orbital slot would be from space activity and foreign sourced to the extent the income, based on all the facts and circumstances, is attributable to functions performed, resources employed, or risks assumed in a foreign country or countries47.

FSCo’s income from commercializing the HTS satellite, orbital slot, and U.S. ground stations would be from space activity. Assuming FSCo is deemed engaged in a U.S. trade or business for operating the U.S. gateway or ground station, then FSCo’s space income would be U.S. source to the extent that the income, based on all the facts and circumstances, is attributable to functions performed, resources employed, or risks assumed within the United States48. FSCo may be engaged in a U.S. trade or business when conducting business through an independent or dependent agent49 or by being a partner in a partnership engaged in a U.S. trade or business50. There is no description in the IRC or Treasury regulations defining when a principal agent relationship exists; the U.S. tax analysis is made based on facts and circumstances that differ from the analysis for attributing profits to a permanent establishment under a tax treaty51. An FSCo engaged in a U.S. trade or business would be taxed at graduated rates on effectively connected U.S.-source income and some foreign-source income attributed to the U.S. office or fixed place of business that may be offset by deductions and tax credits only if FSCo has filed a U.S. tax return52.

Non-Geostationary Satellite Constellation

U.S. Internet Co. (USICo) is developing an MEO satellite constellation, which is operated by a foreign satellite company (FMCo) that is not a CFC. FMCo’s satellites are manufactured by a foreign space company (FSCo) and launched into space by a foreign launch company (FLCo). FMCo leases a transponder to USICo but does not provide uplink or downlink services in the United States or in a foreign country on behalf of USICo.

As a service provider, USICo offers a service to personal computer users accessing the Internet. This service permits a customer, C, to make a call, initiated by a modem, routed to a control center, for connection to the World Wide Web. USICo transmits the requested information over a transponder on FMCo’s MEO satellite constellation and performs the uplink and downlink functions in the United States and a foreign country. USICo would be providing communications services consisting solely of the delivery by transmission of communications or data that could also constitute a space or ocean activity53. The MEO satellite constellation operates 8,000 kilometers (4,970 miles) above Earth’s surface. Space is not a defined term under the code or the regulations or under the Outer Space Treaty, but international law defines the lower boundary of space as the lowest perigee attain able by an orbiting space vehicle at the Karman Line (100 km/62 miles from Earth’s surface). Accordingly, the communications activity over a transponder on MEO satellite constellation would be a space/ ocean communications activity54. If USICo does not derive international communications income, then services performed by USICo would be space activity to the extent the value of the service is attributable to functions performed, resources employed, and risks assumed in space55. However, if USICo derived international communications income, the international communications income rule would override the source rules for space or ocean activities, and USICo income would be 50 percent U.S. source and 50 percent foreign source56.

In FMCo’s MEO satellite constellation, the satellites constantly fly over Earth and do not appear to stay in an orbital slot. From any one place on Earth, the MEO satellite flies by such that a remote station requires tracking antennas to track the satellite as it flies across Earth so that the remote can perform ”make before-break” decisions and ensure that connectivity can be established with the next satellite to fly over before the current satellite disappears from view as it continues its flight around Earth.

Since FMCo does not provide uplink or downlink services in the United States or in foreign countries for USICo but only leases a transponder on its MEO satellite constellation located in space, FMCo’s income from leasing transponders to USICo would be space activity and foreign sourced, not subject to U.S. tax liability under the space and ocean rule57.

FSCo’s income from selling satellites to FMCo and FLCo’s income from launching FMCo’s MEO satellite constellations into space are also space activity since the rights, title, and interest in the MEO satellite pass to FMCo in space58. Based on the legislative history, the Treasury Department and the IRS believe that sales of property in space or international water -with the exception of sales of inventory property in space or international water for use, consumption, or disposition outside space, international water, and the United States should be considered space or ocean activity and that the source of income from such sales activity should be determined under section 863(d)59. Accordingly, FSCo’s and FLCo’s income from the space activity would be foreign-source income under the space and ocean rule60.

Balloons and Drones

U.S. Internet Co. (USICo) is developing in-Earth atmosphere balloons and drones to serve as communication satellites. As a service provider, USICo offers a service to personal computer users accessing the Internet. This service permits a customer, C, to make a call, initiated by a modem, routed to a control center, for connection to the World Wide Web. USICo transmits the requested information over a balloon or drone communication satellite and performs the uplink and downlink functions. USICo would be providing communication services consisting solely of the delivery by transmission of communications or data61 that could also constitute a space or ocean activity62. Income derived by a taxpayer for transmitting communications or data between a point in space or international water and another point in space or international water would be income from a space/ocean communications activity63. Since the balloon and drone communications satellites would operate within Earth’s atmosphere, below the Karman Line, the balloon and drone communications activity would not meet the definition of space/ocean communications activity.

Accordingly, any communications income relating to balloons and drones could be determined under the international communications source rules, which states that a U.S. person’s international communications income is sourced as 50 percent U.S. income and 50 percent foreign income from the transmission of communications or data from the United States to any foreign country (or U.S. possession) or from any foreign country (or U.S. possession) to the United State64.

To the extent that USICo’s personal service income constitutes international communications income, this would override the personal service income source rules that source personal services performed inside the territorial limits of the United States as U.S.-source income, and personal services performed outside the United States as foreign-source income 65.

Reusable Rockets

A U.S. space company (USSCo) manufactures unmanned launch rockets, launches satellites into space from a launch facility located in the United States, and also attempts to land rockets on a barge the size of a football field located 200 miles off the U.S. coast in the Atlantic Ocean in an attempt to make rockets reusable, which reduces launch costs.

USSCo unmanned rocket production income would be sourced as follows:

• When production occurs only in space or in inter national water, income attributable to production activity is space or ocean income that is sourced under the space and ocean rule.66

• When property is produced both in space or in international water and in other areas, gross in come must be allocated to production occurring in space or in international water and other production to the extent the income, based on all the facts and circumstances, is attributable to functions performed, resources employed, or risks assumed under the space and

ocean rule67. (See the “How To Apportion” section of this article for apportionment.)

The regulations empower the commissioner of the IRS to separate parts of a single transaction into separate transactions or combine separate transactions as parts of a single transaction68 so that the space and ocean activity is broadly defined69 without disadvantaging a taxpayer70. Accordingly, when services occur both in space or in international water and constitute parts of a single transaction such as USSCo’ s reusable rocket launch activity (the rocket launch activity taking place in space and the rocket landing on an experimental barge placed 200 miles away from the U.S. coast in international waters) 71, the transaction will be characterized as a space or ocean activity in its entirety and sourced under the space and ocean rule72.

How To Apportion

When a taxpayer allocates gross income based on all the facts and circumstances73, the taxpayer must allocate or apportion expenses, losses, and other deductions to the class of gross income, which includes the total income so allocated in each case74. A taxpayer then applies the allocation or apportionment rules to properly allocate or apportion expenses, losses, and other deductions to gross income from U.S. sources and non-U.S. sources75. The taxpayer must prepare and maintain documentation regarding the allocation of gross income and allocation and apportionment of expenses, losses, and other deductions, the methods used, and the circumstances justifying use of those methods at the time its return is filed and must make this documentation available to the IRS within 30 days upon request76.

Conclusion

In our globalized economy, private global communications satellite companies and Internet companies are constantly developing new ways to bring communications services to people who live in parts of the world who cannot access the Internet through their cell phones. These companies do not have immunity from competition laws and are not exempt from worldwide taxation; therefore they should carefully consider the impact of international tax laws, tax treaties, and com petition laws on their international tax planning initiatives, as they set out to commercialize their new technologies to bring communications services to parts of the world where their services are most needed77.

Footnotes

1The Federal Communications Commission has authorized 03b to operate a number of Earth stations in the United States to communicate with the 03b system . See Federal Communications Commission DA-14-637; “India successfully sends ‘MOM’ to Mars,” USA Today, Sept. 24, 2014; Madison Park, “India’s spacecraft reaches Mars orbit . . . and history,” CNN, Sept. 24, 2014.

2Deepu Krishnan, “Why Satellite Communication Matters : India is seen to have a significant market potential for consumer broadband over satellite, as a large share of population still re main beyond the reach of the terrestrial broadband network,” Businessworld.in, Nov. 3, 2014.

3Alex Knapp, “03b Networks Launches Its First High Speed Internet Satellites,” Forbes, June 26, 2013; Chris Bergin and William Graham, “Soyuz ST-B launches with four 03b satellites,” Spaceflight.com, June 25, 2013; Peter B. de Selding, “Two 03b Satellites Taken Out of Service as a Precaution,” Space News, Sept. 11, 2014.

4De Selding, “Soyuz Rocket Launches Second Batch of 03b Satellites from French Guiana,” Space News, July 10, 2014; Graham, “Arianespace Soyuz ST-B successfully launches four 03b satellites,” NasaSpaceFlight.com, Dec. 18, 2014.

5Mike Wall, “Private Orbital Sciences Rocket Explodes During Launch, NASA Cargo Lost,” Space.com, Oct. 28, 2014; Irene Klotz, “Orbital Sciences’ unmanned rocket explodes on liftoff in Virginia : NASA,” Reuters, Oct. 28, 2014; Miriam Kramer, “Orbital Sciences to Stop Using Suspect Russian Rocket Engine After Explosion,” Space.com, Nov. 5, 2014; Joel Achenbach, Drew Harwell, and Mark Berman, “Virgin Galactic’s SpaceShipTwo crashes after ‘anomaly’ during test, killing one,” The Washington Post, Oct. l, 2014.

6Stephen Clark, “03b Networks plans satellite fleet expansion,” Spaceflight Now, Dec. 29, 2014.

70rbital pioneered the use of smaller, more affordable space craft used for geosynchronous-Earth orbit (GEO) communications and created the first global communications network to em ploy a constellation of ORBCOMM LEO satellite-based communications network. See https:/ /www.orbital.com/ SatelliteSpaceSystems/CommunicationsimagingSatellites/.

8Rob Coppinger, “Virgin Galactic Unveils LauncherOne Rocket for Private Satellite Launches,” Space.com, July 11, 2012; Alan Boyle, “SpaceX, Google and Virgin Revive Buzz Over Satellite Internet,” NBCNews.com, Jan. 21, 2015.

9James Clay Moltz, “It’s On: Asia’s New Space Race, While NASA and the European Space Agency gets most of the world’s attention, China, Japan and India are racing for the heavens,” The Daily Beast , Jan. 17, 2015; David Martosko, “911 emergency call system could soon be routed through Russian satellites, giving Putin’s government the power to snoop and interfere with first responders,” Dailymail.com, Jan. 22 2015; Damien Sharkov, “Russia Successfully Tests Alternative to U.S.-Funded GPS Technology,” Newsweek, Jan. 21, 2015; Sammy Said, “Top 10 Countries with Space Presence,” Therichest.com, July 12, 2013; Top Space Agencies (Space Research Organization) in the World, available at http:/ /www.lifengadget.com/ lifengadget/ top space-agencies-world/.

10SkyTerra, formerly Mobile Satellite Ventures, was a Reston , Virginia, company that developed telecommunications systems that integrated satellite and terrestrial radio communication technologies into one system. In March 2010 the company was acquired by Harbinger Capital Partners and became part of a new company called LightSquared. Lightsquared placed its first geo stationary satellite, SkyTerra-1, in orbit on November 14, 2010, and is seeking FCC approval to provide a wholesale, nationwide, wireless broadband network integrated with satellite coverage. LightSquared intends to combine its existing geostationary satellite communications services with a ground-based 4G-LTE net work that transmits on the same radio band as its satellites. The L-band is next to the primary GPS frequency and may cause interference with the GPS system. See http:/ /space.skyrocket.de/doc_sat/hs-702.htm; Nick Brown, “LightSquared creditors to vote on latest bankruptcy exit plan,” Reuters, Jan. 20, 2015.

11William N. Ostrove, “Civil and military demand for broad band communications drives the satellite market ,” Aviation Week & Space Technology, Jan. 9, 2014; Caleb Henry, “UK Space Agency Allocates More Than $315 Million for European Space Programs,” Satellite Today, Dec. 16, 2014.

12Henry, “Mitsubishi Electric Anticipating Five to Seven Satellite Orders in 2015,” Satellite Today, Jan. 14, 2015.

13Henry, “ViaSat, Eutelsat Ink HTS Partnership Deal,” Satellite Today, July 1, 2014; Mike Freeman, “Eutelsat’s HTS, KA-SAT, built by Airbus Defence and Space is the world’s most powerful satellite, with a total capacity of more than 35 times the traditional Ku-band satellites,” San Diego Union-Tribune, May 16, 2013.

14Henry, “Inmarsat’s Second Global Xpress Satellite Prepped for Launch,” Via Satellite, Jan. 13, 2015; de Selding, “Boeing To Build Intelsat 35e High-throughput Satellite,” Space News, July 11, 2014; “SES Contracts Airbus Defence And Space To Manufacture Ses-12 Satellite For Launch In Q4 2017,” SES.com, June 17, 2014, available at http://www.ses.com/ 4233325/ news/2014/l 9799323#sthash.sWbPegZK.dpuf; Misuzu Onuki, “MHI Land s Breakthrough Contract to Launch Telstar 12 Vantage Satellite,” Spacenews.com, Sept. 26, 2013.

15See http:/ /www.satsig.net/sslist.htm; http:/ /www.Jyngsat. com/index.html.

16In its April 1998 study, the FCC predicted that “[i]n the future, new voice, data and video services authorized by the Commission will be available to consumers via low Earth orbiting, non-geostationary satellite systems.” See https://www.faa.gov Iabout/office_org/headquarters_offices/ast/ media/ leo-d.pdf.

17Many LEO satellite constellations were a commercial fail ure: Iridium in 1999, ORBCOMM in 2000, and Globalstar in 2002 filed for bankruptcy while Skybridge and Teledesic suspended operations; Graeme Philipson, “Battle of the low earth orbit satellites,” iTWire, Jan. 21, 2015.

18See http://www.itu.int/dms_pubrec/itu-r/rec/s/R-REC-S.1527-0-2001016-I!!PDF-E.pdf.

19Henry, “Kymeta Plans Mass Production, September Demonstration with 03b,” Satellite Today, June 11, 2014; Carol Pat ton, “Innovations in Satellite Antennas Attracting New Markets & Opportunities,” Via Satellite, Oct. 31, 2014.

20Melody Petersen, “SpaceX launches rocket, but attempt to land booster falls short,” LA Times, Jan. 10, 2015; Kenneth Chang, “SpaceX Founder Releases Photos of Rocket’s Crash Landing, It came down with a crash and a flash,” The New York Times, Jan. 16, 2015; Rolfe Winkler and Andy Pasztor, “Elon Musk ‘s Next Mission: Internet Satellites SpaceX, Tesla Founder Explores Venture to Make Lighter, Cheaper Satellites,” The Wall Street Journal, Nov. 7, 2014; Philip Shishkin, “U.S.-Russia Space Alliance Hits Snags Washington’s Sanctions Against Moscow, Growing Tensions Hamper Symbiotic Partnership,” The Wall Street Journal, Dec. 2, 2014; Wall, “SpaceX Dragon Capsule De livers Fresh Supplies to Space Station,” Space.com, Jan. 12, 2015; Aaron Mehta, “SpaceX, US Air Force Settle Lawsuit,” DefenseNews.com, Jan. 23, 2015; Mehta, “SpaceX Enters Satellite Business,” DefenseNews.com, Jan. 23, 2015; Jon Talton, “Elon Musk drops space plans into Seattle’s lap,” Seattle Times, Jan. 23, 2015.

21The Iridium system -a $3.37 billion, 66-satellite LEO constellation became commercially active on November 1, 1998. See https:/ /www.faa.govI about/ office_org/headquarters_offices/ ast/media/ leo-d.pdf; “Top 5 Companies to Watch,” Space News, Nov. 17, 2014; Jonathan Amos, “CommStellation: Swarm of net satellites planned,” BBC.co.uk, Jan. 20, 2011; de Selding, “WorldVu Seeks Builder for Smallsat Constellation, Wants to Co own Production Facility,’’ Space News, Nov. 11, 2014; Mark Kesler, “Tesla CEO Musk Teams with Former Google Exec to Manufacture Groundbreaking Satellite Fleet,” Modernreaders.com, Nov. 8, 2014; Catherine Shu, “SpaceX will Announce Micro Satellites For Low Cost Internet Within Three Months “ TechCrunch.com, Nov. 11, 2014; Ashlee Vance, “Revealed:, Elon Musk’s Plan to Build a Space Internet,” Bloomberg, Jan. 16, 2015 ; Winkler, Evelyn Rusli, and Pasztor, “Google Nears $1 Bil lion Investment in SpaceX,” The Wall Street Journal, Jan. 19, 2015; Tim Ferguson, “Virgin, Qualcomm fund new OneWeb satellite-based network,” Mobileworldlive.com, Jan. 16, 2015; Dana Hull, Brian Womack, and Serena Saitta, “SpaceX Sells 10% Stake to Google, Fidelity for $1 Billion,” Bloomberg, Jan. 20, 2015; Mike Dano, “Google teams with SpaceX for possible optical-laser powered wireless Internet service,” FierceWirelessTech.coll), Jan. 21, 2015; de Selding, “Falcon 9 Successfully Launches Six Orbcomm Satellites,” Space News, July 14, 2014; “Rocket delivers three Gonets Communications Satellites to Orbit,” SpaceflightlOl , Sept. 11, 2013; “Briz-KM booster with 3 satellites separates from Rokot launch vehicle,” ITAR-TASS Russian News Agency, July 3, 2014.

22Alistair Barr, “Google Says Drones, Balloons Could Use New Spectrum for Internet Access,” The Wall Street Journal, Jan. 20, 2015; de Selding, “Google-backed Global Broadband Venture Secures Spectrum for Satellite Network,” Space News, May 30, 2014.

23Christopher Mims, “The Internet’s Future Lies Up in the Skies,” Dow Jones Business News, Dec. 14, 2014.

24 “Intelsat Privatization Faces Competitive Global Market,” SpaceDaily.com, Oct. 6, 1998; International Technology Re search Institute World Technology (WTEC) Division Global Satellite Communications Technology and Systems, Dec. 1998, available at http:/ /www.wtec.org/loyola/pdf/satcom2.pdf.

25P.L. 106-180, Open-Market Reorganization for the Betterment of International Telecommunications Act, Mar. 17, 2000, available at http: I /www.gpo.gov I fdsys/pkg/PLAW-106publl 80/ pdf/PLAW-106publ180.pdf.

26Intelsat Privatization and the Implementation of the ORBIT Act,” GA0-04-891, Sept. 13, 2004 (publicly released Sept. 28, 2004), available at http://www.gao.gov/assets/250/244064.pdf; Joseph E. Stiglitz, Marius Schwartz, and Eric D. Wolff, “To wards Competition in International Satellite Services: Rethinking the Role of Intelsat, “ Council of Economic Advisers, Draft July 1995; “The Reform of International Satellite Organisations,” OECD Policy Roundtables, 1995.

27Under IRC section 883(b) Intelsat’s geostationary satellite commercial activities were exempt from U.S. federal income and communications taxation concerning activities authorized by Intelsat agreements. Intelsat was also exempt from customs duties on imports of communications satellite equipment. Also, Intelsat and its property, income, operations, and other transactions were exempt from all taxes imposed by the District of Columbia -where it had its headquarters except for those not used for, or related to, the purposes of Intelsat. More over, the wages and salaries of Intelsat employees who were not U.S. nationals or permanent residents were exempt from federal and District income taxes. United States Government Ac countability Office, Report to Congressional Requesters, “Tax Policy: Historical Tax Treatment of Intelsat and Current Tax Rules for Satellite Corporations,” Sept. 2004, available at http:/ /www.gao.govIassets/250/244060.pdf.

28REG- 106030-98, 66 Fed. Reg. 3902 (Jan. 17, 2001).

29REG- 106030-98, 70 Fed. Reg. 54859 (Sept. 19, 2005).

30Roger Rusch, “The Big Satellite Shakeout,” Space News, Nov. 10, 2014; Frost & Sullivan, “Space Mega Trends and Beyond,” available at http:/ /www.slideshare.net/FrostandSullivan/space-mega-trends-key-trends-and-implications-to-2030-and beyond; http:I/www.sia.org/annual-state-of-the-satellite-industry reports/2014-sia-state-of-satellite-industry-report/; http:II www.sia.org/wp-content/uploads/2014/09/SSIR-September-2014-Update.pdf; http:/ /en.wikipedia.org/wiki/List_of_commu:nication_satellite_companies.

31Before its repeal for tax years of CFCs beginning after December 31, 2004, IRC section 954(f) treated IRC section 863(d) space and ocean income as foreign base company shipping in come for subpart F purposes, which was not eligible for deferral. Section 415(a)(2) , P.L. 108-357, Oct. 22, 2004.

32A U.S. person is a U.S. citizen, resident alien individual , domestic corporation, domestic partnership (applied at the partner level Treas. reg. section 1.863-8(e)), or trust or estate that is not a foreign trust or estate; IRC section 770l(a)(30).

33IRC section 863(d)(l); Treas. reg. section J.863-8(b)(l).

34IRC sections 87l(a)(l), 881, 882, and 864(c)(4).

35A foreign person is a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, or foreign estate. IRC section 7701(a)(31).

36Defined under IRC section 957.

37IRC section 863(d)(l)(B), Treas. reg. section 1.863-8(b)(2)(i), (ii), and (iii).

38IRC section 863(d)(2). The United States considered only the areas within the boundaries of its states and territorial waters as U.S.-source and within its primary taxing jurisdiction . Staff of Joint Comm. on Tax’n, General Explanation of the Tax Reform Act of 1986, P.L. 99-512; 99th Congress; H.R. 3838, Pt. 13; JCS-10-87 (“Bluebook”). Consequently, the high seas and space would have been treated as foreign-source income. Under the IRC or the Treasury regulations thereunder, the U.S. sea boundaries are 12 miles from the coast, but the space boundaries are not defined. The Outer Space Treaty also does not define space, while international law defines the lower boundary of space as the lowest perigee attainable by an orbiting space vehicle but does not specify an altitude, which presumably is the Karman Line (100 km/62 miles from the Earth’s surface) since the Federation Aeronautique Internationale (FAI), which is an international standard-setting and record-keeping body for aeronautics and astronautics, uses the Karman Line to determine space boundaries as follows:

• Aeronautics: for FAI purposes, aerial activity, including all air sports, within 100 kilometers (62 miles) of the Earth’s surface; and,

• Astronautics: for FAI purposes, activity more than 100 kilometers above the Earth’ s surface.

39Treas. reg. section 1.863-8(d)(l)(i)(D); Treas. reg. section l .863-8(d)(2)(i).

40Treas. reg. section 1.863-8(d)(l)(i)(A).

41Treas. reg. section 1.863-8(d)(l)(i)(B).

42Treas. reg. section l .863-8(d)(l)(i)(C).

43Treas. reg. sections 1.863-8(d)(l)(i)(F) and (ii)(F).

44Treas. reg. sections 1.863-8(d)(l)(i)(G) and (ii)(G).

45Treas. reg. section 1.863-8(d)(l)(i)(E).

46S. Rept. No. 99-313 (P.L. 99-514), p. 341, 359.

47Treas. reg. section l.863-8(b)(2)(ii); Treas. reg. section 1.863-8(£), Ex. 1, 7.

48Treas. reg. section l.863-8(b)(2)(iii); Treas. reg. section 1.863-8(£), Ex. 13.

49Treas. reg. section 1.863-8(£), Ex. 14.

50IRC section 875(1); Treas. reg. section 1.875-1; United States v. Balanovski, 131 F. Supp. 898 (SDNY 1955), ajf d in part, 236 F.2d 298 (2d Cir. 1956), cert. denied, 352 U.S. 968 (1956); Vitale v. Commissioner, (l 979) 72 TC. 386.

51 Rev. Ru!. 70-424, 1970-2 C.B. 150; Hanfield v. Commissioner, (1955) 23 TC. 633; Inverworld Inc et al., (1996) TC. Memo. 1996-301, RIA T.C. Memo. 96301, 71 CCH T.C.M. 3231; Legal Advice Issued by Associate Chief Counsel 2009-2010 , Oct. 2, 2009; JRC section 894(a)(l).

52IRC section 874(a).

53Treas. reg. sections 1.863-8(b)(5), (d)(J)(i), and (ii)(E).

54Treas. reg. section 1.863-8(d)( l)(ii)(E).

55Treas. reg. section l.863-8(f), Ex. 2.

56IRC section 863(d)(2)(B)(ii).

57Treas. reg. sections l.863-8(b)(3)(i), (2)(i), and (2)(iii).

58Treas. reg. section J.861-7(c).

59Prearnble to the Final Regulations, 2007- 1 C.B. 479.

60Treas. reg. section 1.863-8(f), Ex. 11.

61Treas. reg. section l.863-9(h)(l)(i).

62Treas. reg. sections l.863-8(b)(5), (d)(l)(i), and (d)(ii)(E) .

63Treas. reg. section l.863-9(h)(3)(v); Treas. reg. section l.863- 8(b)(5) and -9(e). The source of space and ocean income that constitutes communications income as defined under Treas. reg. section l.863-9(h)(2) (other than income from a space/ocean communications activity rather than under 863(d) and Treas. reg. section l.863-8(b)).

64IRC section 863(e).

65IRC section 861(a)(3); IRC section 862(a)(3); Treas. reg. section 1.862-l(a)(l)(iii). 66Treas. reg. section l.863-8(b)(3)(ii)(B).

67Treas. reg. section l .863-8(b)(3)(ii)(C).

68Treas. reg. section l.863-8(d)(l)(i) and (ii).

69See Senate Report, supra note 46, at 357.

70Preamble to the Final Regulations, TD. 9305, 2007- J C.B. 479.

71 Under the IRC section or the Treasury regulations thereunder, the U.S. sea boundary is 12 miles from the coast; LTR 9610015; LTR 9012023; Rev. Rul. 75-483, 1975-2 C.B. 286; Rev. Rul. 77-75, 1977-1 C.B. 344.

72Treas. reg. sections l.863-8(d)(2)(ii)(A) and (B).

73Treas. reg. section l .863-8(b)(l), Treas. reg. section l.863- 8(b)(2), Treas. reg . section l.863-8(b)(3)(ii)(C), or Treas. reg. section 1.863-8(b)(4).

74Treas. reg. section 1.861-8 through temp. Treas. reg. section J .861-14T.

75Treas. reg. section l.863-8(c).

76Treas. reg. section l.863-8(g).

77Simon Bowers, “Amazon EU Sari paid too little tax, EU competition regulator says,” The Guardian, Jan. 16, 2015.