Piers Cunningham is the Vice President of Maritime Services for Speedcast International. Piers has more than 20 years of experience in the maritime communications sector with previous stints at SatComms Australia and Inmarsat. Based in Australia, he has worldwide responsibility for Speedcast’s Maritime Business Unit. He holds a Bachelor of Science with Honors from the Aldenham School in Hertfordshire, England.

How has Speedcast evolved as a company in the last few years?

Piers Cunningham

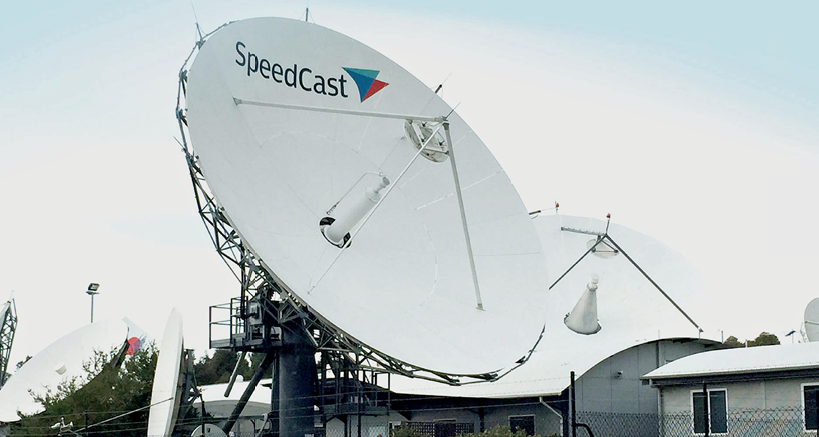

Speedcast was founded in September of 1999 and initially gained a foothold in the Asia Pacific (APAC) region.

As the company grew, it followed a course of aggressive acquisitions to enlarge its geographic coverage and market positioning. Speedcast launched a diversity of communications services over the course of the next 17 years including satellite, terrestrial and wireless solutions to customers in the maritime, energy, government, cruise, mining, media, telecommunications and enterprise industries among others.

Speedcast International Ltd (ASX: SDA) has evolved to be the world’s most trusted provider of highly reliable, fully managed, end-to-end remote communication and IT solutions. The company uses an extensive worldwide footprint of local support, infrastructure and coverage to design, integrate, secure and optimize networks tailored to customer needs.

With differentiated technology, an intense customer focus and a strong safety culture, Speedcast serves more than 2,000 customers in more than 140 countries via 39 teleports, including offshore rigs and cruise ships, 10,000+ maritime vessels and 4,500+ terrestrial sites

Tell us about Speedcast’s maritime business.

Piers Cunningham

Maritime is one of the larger businesses in Speedcast, contributing approximately one-third of the firm’s revenues. We have the most individual customers in this unit, providing services to more than 10,000 vessels.

We have multiple sub-verticals within the group as different vessels have different requirements. Speedcast would not provide the same type of technology to connect a tanker as we would a cruise ship, so we are careful to segment the market according to customer needs.

In terms of needs, for some, connectivity means a revenue stream, for others it’s an important safety net.

What was the background to Speedcast’s acquisition of Harris CapRock?

Piers Cunningham

Speedcast has pursued a long-term strategy of acquiring companies that complement Speedcast’s geographic and industrial strengths.

The company has completed more than 15 acquisitions over the last five years, successfully building market share and product capabilities into its portfolio. Over the course of 18 months, Speedcast had been searching for a larger, transformational deal that would quickly cement the company’s standing as an industry leader.

As part of this search, Speedcast had been monitoring the performance of Harris CapRock (HCC), given HCC’s strong asset and customer base and leading position in the energy and maritime verticals.

What are the implications of merging Harris CapRock’s maritime business into the Speedcast family?

Piers Cunningham

The acquisition built significant scale for Speedcast in terms of the number of vessels served.

The acquisition augmented specific areas of Speedcast’s maritime business that were growing or that the firm wished to additionally penetrate, such as the cruise industry

This deal altered the landscape of communications’ solutions provided to the maritime industry. Harris CapRock served a majority of the world’s oceanic cruise vessels, including the Carnival and Royal Caribbean fleets.

Speedcast was strong in commercial shipping, yachting, fishing

and ferries.

The joining of the two companies provides customers with more coverage, a greater local presence, increased flexibility, a broader array of product and services options as well as a clear pathway for them to upgrade their communications as they (or the market) require.

How will the company’s physical global networks evolve?

Piers Cunningham

There will be full interoperability between all of Speedcast’s networks.

Service providers these days continue to grapple with the need to seamlessly integrate different networks to present an optimum experience for the customer without that integrate causing a headache for them.

As assets become more mobile and HTS continues to gain market momentum, vessels might be traveling through a variety of beams as they traverse the globe. This can cause network disruption and drive up the costs of maintaining communications.

This means it is essential that solutions such as Speedcast One with the firm’s intelligent communications director (ICD) add the smarts to automatically switch beams or bands to hone in on the best connectivity via the highest performing network. While spot beams will provide low latency and high throughput, there will still be challenges for highly mobile vessels

In regard to value–added service transition, what is Speedcast doing to make it easier for customers to understand or control traffic behavior? How have industry operators changed their relationship with providers over the years?

Piers Cunningham

The move has been toward more integrated partnerships as opposed to just being a provider of link and air time.

In the maritime industry, there is a far more focused drive to outsource a company’s communications/IT. You cannot underestimate the expertise and organization needed to run a support operation. Finding skilled, certified personnel worldwide, stocking sufficient spares and running multiple Network Operations Centers (NOCs) is a true challenge. There is still significant value in the role of being a service provider.

Speedcast is expected, as a company, to provide support both commercially and operationally and the company continues to evolve as a service provider. A great deal more expertise is now required to ensure the viability of even more complex communication systems—this requires a far higher level of partnership then previously experienced.

What’s your vision of where the maritime market is going and how it’s evolving?

Piers Cunningham

There is, obviously, the movement toward smart shipping. The automation of tasks or the ability to remotely monitor affairs can ultimately reduce costs and improve safety.

This does take a significant investment, however, and I don’t expect things to really push further until the maritime shipping industry recovers.

In addition, I see the role of VSAT increasing in merchant shipping, fishing, workboats and yachts. Sailors and crew are starting to want improved connectivity on their vessels and prices will come down as the technology to supply these needs improves.

In the years ahead, I fully expect to see increased use of all of the devices that require Internet connectivity services aboard ships, as well as for those that are catered for ashore. The digital isolation era of vessels is now over.

Speedcast.com/