When Extensia was first invited to organize a summit focused on the African satellite sector, the company was unsure if this was the correct path to take.

Most of the talk in Africa, at the moment, is on fiber deployment, TV Whitespace, 3G/4G, LTE and so on. Why would an event be organized around a technology that many people see as the ‘old solution’ to Africa’s connectivity needs? Surely, in today’s advanced connectivity agenda, satellite is only used to reach the parts other technologies cannot reach.

Fiber cannot reach everywhere. Even now, 54 percent of the population of sub-Saharan Africa still live at least 25 km from the nearest fiber node. However, over the course of coordinating the agenda for this summit, all came to realize that the satellite sector has many tricks up it’s sleeve to ensure the technology remains as essential to supporting the future of Africa’s connectivity agenda as in the past.

SMART Cities, Connected Communities, Digital Governments and Millennium Development Goals are all key drivers for improved connectivity. Ironically, rural communities, humanitarian agencies, health workers, schools and remote workers are among those for whom improved connectivity would bring the greatest advantage—yet, these are the people who are not being reached.

The reality is there will never be a single solution to Africa’s connectivity needs. When fiber is lain, essential to any success is to ensure redundancy is in place to prevent extended service interruption, in case of fiber cuts or breakage. Satellite is a perfect solution.

While GSM mobile is, by far, the most prolific technology in Africa, true, uninterrupted mobility is disrupted by geographical black spots and restricted network coverage. In these instances, satellite can support terrestrial networks to fill gaps, provide reliable redundancy and backhaul and provide the only solution to providing affordable access solutions to sparsely populated areas.

The integration of technologies and the development of heterogeneous networks which incorporate the best solution for the best situation is essential in providing reliable, robust and affordable services.

Over the three days of the Future-Sat Summit, we heard from the leaders of the global satellite sector that connectivity needs can be resolved, not just with satellite, but at least by incorporating satellite elements to wider connectivity needs. Satellite is not the only nor the best solution to solve the puzzle of Africa’s connectivity agenda; however, satellite is the best solution in the correct environment.

A World Of Opportunity, A Region Of Change

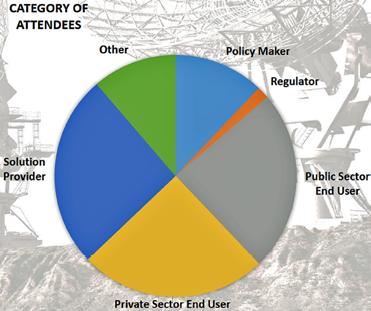

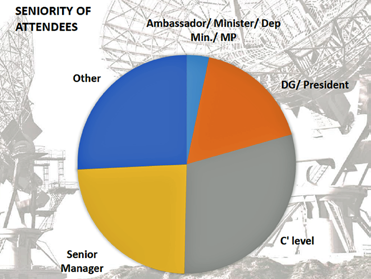

More than 270 delegates from 124 individual organizations across 28 countries (of which 17 were African nations) gathered in Addis Ababa for the inaugural Future-Sat conference. They engaged in three days of discussion and collaboration on Africa’s satellite industry, the impacts and future directions.

The countries represented included: Angola, Belgium, China, Egypt, Ethiopia, France, India, Italy, Israel, Kenya, Mauritius, Morocco, Mozambique, Namibia, Nigeria, Rwanda, Senegal, Singapore, Somalia, South Africa, Spain, Sudan, Tanzania, UAE, Uganda, UK, USA, Zambia

Insights from 70 speakers delivered 21 sessions that included two workshops and a Round Table session. Case studies were presented from across the region:

• iMlango school project in Kenya

• UNSAF project for schools in Tanzania

• National Library Project in South Africa

• Media Library Network of Angola

• AIESEC youth leadership (Ethiopia)

• CIF micro-finance network (Burkina Faso, Togo, Benin, Senegal, Mali)

Major emerging initiatives include OneWeb, with 648 LEO satellites slotted for full service in 2020.

Following are ten important takeaways and calls to action from the conference track of Future-Sat 2016; they will also be addressed in future editions of this conference. In addition, attendees expressed a desire for the next edition of the conference to address topics such as hybrid networks, Smart Africa, USOF, converged business models, deep-dive case studies of satellite in multiple sectors, licensing agreements, industry forecasts and market rules.

1. Technology Evolution

New waves of technologies are redefining how governments and industry can partner to deliver services. Tech sectors are evolving rapidly in parallel, as well as converging and colliding with other sectors. This makes satellite ‘defensive’ in some areas of disruption (e.g., spectrum allocation for mobile), as well as an industry leader in others (e.g., disaster response solutions, geographical mapping, deep space communications).

Understanding that ICTs (Information and Communication Technolgies) offer complementary capabilities is important and governments need to adapt their plans to ecosystem-thinking. There will always be multiple connectivity options for affordability and access.

2. Impacts

ICTs have improved business and education in Africa and, through transparency, can help tackle corruption. There needs to be more education on the role of satellite in connecting the unconnected, e.g., RascomStar in DRC.

Satellite helps cover areas that are hard-to-access via terrestrial methods, such as remote deserts and mountainous regions. In humanitarian emergencies, communications provide information, connection and life.

Satellite emergency communications transform the delivery of crucial aid and save more lives, such as during the Ebola crisis. The UN Crisis Connectivity Charter has been established by nine satellite companies and there are clear points of contact for each satellite operator (see www.ETCluster.org). Signatories now include GVF, SES, IntelSat, ArabSat, HispaSat, Thuraya, YahSat, Eutelsat and Inmarsat.

Analytics helps first responders understand, monitor and improve logistics during disaster responses. The satellite sector is ahead of any other private sector in achieving a formal charter with the UN and NGOs for disasters.

3. Spectrum protection

Mobile operator spectrum is important but should not be allotted at the cost of vital satellite services. The GVF and SSI initiatives are protecting the interests of the satellite sector and end-users in this regard (see www.satellitespectrum- initiative.com).

There are numerous real cases of interference from deployment of wireless systems in C-band. The relationship between satellite and terrestrial wireless should be collaborative, not antagonistic.

4. Security & Resilience

The ‘new Africa’ is witnessing rapid mobile growth. However, cybercrime is rising faster here than anywhere else in the world. Companies and countries need to draw up their telecom threat map and devise appropriate response strategies.

Categories of cybersecurity preparedness include legal, tech, organization, capacity building, and cooperation. Capacity building in security includes IT security, digital forensics, university courses, and industry-academic cooperation.

Satellites provide cyber-resilience and data connectivity backup to millions of users. Unfortunately, satellites have also become a battleground as countries jam each other’s signals.

5. Business models

There is an important need to find ‘triple-win’ success in wireless communications: for the operator, government and communities. More crosscutting cooperation is needed within the satellite sector and with others externally—in example, Airbus has become the first industrial partner of the African Space Program Summit.

All available technologies need to be roped in to offer complementary services, but more creativity is needed in business models and value exchanges. Policymakers, regulators and the industry need to be aware of the entire ecosystem of communications and collaborate on new frameworks; the old methods of industry activity are

not working.

6. Customer Needs

Industry and government need to focus on what the B2C and B2B customers want from their communication services. These service parameters include availability (any time), accessibility (any place/device), and affordability (price).

There are still huge digital gaps in Africa. Over 340 million people in Sub-Saharan Africa need to travel 50 kilometres to access the Internet.

Satellite can help bridge this gap and offer relevant services and efficiencies to farmers via IoT, such as automated reporting to reduce costs, reduced field travel costs and improved safety.

7. Academic Research & Capacity Building

More satellite data needs to be shared with academics and NGOs to come up with case studies and stories of satellite use, e.g., during disasters. Policies from different regimes need to be harmonized; this calls for better collaboration between government, industry and academia.

Courses need to be developed to train the next generation of Africa’s engineers and policy makers in this converged digital world. Local research and curriculum will help identify needs, aspirations and solutions unique to Africa’s context.

Africa has a huge youth dividend; government and industry should help youth unlock a better future. The next generation of youth leaders should be world citizens, self-aware, empowering others, and solution oriented.

Youth are looking for such opportunities via experiential learning, volunteering experiences, professional internships, and study tours/exchanges.

8. Enterprise Computing

The SMAC stack (social, mobile, analytics and cloud) is transforming enterprise computing and business services delivery. The corporate and government CTO needs to include satellite as a resilience strategy.

More and more enterprises will move to cloud. There are 50 different cloud regulations in countries around the world—enterprises operating on a pan-African basis need to master this growing complexity to serve their own communication needs.

9. Metrics

A mix of quantitative and qualitative metrics are needed for Return On Investment (ROI) calculation and forecasting: banking metrics (improved money access, higher revenues, FDI), education metrics (increased literacy, higher incomes), broadcasting metrics (advertising revenues, social cohesion, more channels) and humanitarian metrics (faster/better response to re-build damaged communities, control of refugee crisis, social development).

RoI should focus along the entire value chain and contact network: users, operators, distributors, and government.

Satellite investments are huge, hence, some RoI measures may take some time to ferment but do deliver significant value to investors and stakeholders. It is estimated that a 10 percent increase in broadband penetration correlates to 1.38 percent increase in GDP.

Social capital metrics are also important. These would include stories and multi-media capture of ICT4D in action, such as telemedicine and cataract detection.

10. National Agendas

Case studies were presented at this Summit of national ICT initiatives such as EthERNet (Ethiopia Education and Research Network) and Entoto Observatory. Such initiatives need to be interlinked and scaled up, e.g., EthERNet is peering with SudREN, KENET, and SolmaliREN.

The Ethiopian Space Science Society is promoting space science/tech in Ethiopia and east Africa. Space science can help Ethiopia in land resource monitoring, precision agriculture, watershed management, regional planning and development.

The Road Ahead

Africa is poised to reap satellite benefits, thanks to the continent’s vastness, resources and sector strengths. Africa has 45 percent mobile penetration and that will reach 54 percent by 2020; satellite will help mobile operators reach this goal.

An estimated 89 percent of African households are still not connected to Internet; low-cost site economics is key to connecting them. Digital service development is taking place in the total satellite industry value chain.

For example, Climate Corporation used satellite data for agricultural projections; the firm was purchased by Monsanto for a billion dollars. However, it is no longer true that content and application development only takes place elsewhere outside Africa; there is a lot of regional content creation as well.

Emerging trends include HTS (High Throughput Satellites), and fiber-like capacity with O3B. Terrestrial fiber bridges the digital divide between West and Africa, but not between urban and rural Africa—satellite will play a major role here.

Governments need to master the new telco ecosystem, which is quite different from everything before. As per ITU (International Telecommunication Union) recommendations, African governments need to ensure transparent and predictable regulatory regimes, safeguard development, manage scarce resources, and clearly define targets.

Emerging policy best practices are blanket licensing for VSATs, frequency co-ordination and harmonized standards. Governments should adopt and adapt best practices, but not blindly copy experiences from other countries.

National agendas and plans can provide targets and stimulus for the industry, such as broadband penetration and the impacts on various sectors.

Satellites seem to be at the fine line between science and science fiction, especially as the first major technology to help create real-time global consciousness. Satellite is big business—satellite data is big business as well.

In sum, the satellite industry has tremendous opportunity ahead in redefining and revitalizing itself in the emerging 21st century communications landscape.

There were a number of Future-Sat AFRICA presentations, such as the one offered by GVF... here is a list of presentations available for download.

Future Sat Africa - AFRINIC Overview

Future Sat Africa - Gondwana - Affordable Mobility

Future Sat Africa - GVF - Return on Investment

Future Sat Africa - The Egyptian Satellite Company

Future Sat Africa - The Role of Satellite in Connecting the Unconnected

Future Sat Africa - Ethio Telecom

Future Sat Africa - SES Effective Policy and Regulation for Satellite

Future Sat Africa - Skyvision Maximizing Return on Investment

Future Sat Africa - Thuraya Affordable Mobility

Future Sat African - Space Applications for Sustainable Development of Africa

Future Sat Africa - OneWeb overview

Future Sat Africa - NuRAW Wireless Business Case for 2G in Rural Africa

Future Sat Africa - Satellite Licensing and Regulatory Expertise

Future Sat Africa - Satellite Network Reliability

Future Sat Africa - Effective Policy and Regulations for Satellite

Future Sat Africa - Crisis Connectivity Charter

Future Sat Africa - Emergency Telecommunications Cluster