When Mobile Network Operators (MNOs) dream of expanding their network into untapped regions, a primary consideration is how to handle the exponential growth of data traffic. Deploying a high-capacity 4G network is inseparable from the challenge of handling massive quantities of data in a rapidly expanding network.

For MNOs to upgrade their existing network with additional cell towers with 4G backhaul capacity is a non-trivial effort; the required infrastructure investment is significant. Maximum network throughput speeds are more than ten times faster in a 4G network than a 3.5G network. This requires a huge boost in capacity. In addition, erecting high-performance cell towers in sufficient proximity to reach new areas, along with installing a backhaul infrastructure, takes time—sometimes more time than MNOs can afford.

Meanwhile, the passage of time works against the MNO’s dream. If an MNO cannot enter a new area and set up a 4G network quickly, a competitor will most assuredly do so and reach those potential customers first. This has weighty business implications: the loss of potential revenue, the difficulty of convincing a customer who has signed up with one mobile service carrier to switch carriers, and the ongoing cost of having to pay other carriers high roaming charges in areas where the MNO has no coverage. In this race, there is little consolation for second place—the subsequent carriers to enter a market are at a distinct disadvantage. By providing a connection within days rather than years, MNOs can leapfrog competitors relying on slower-to-deploy backhaul technologies.

To win this contest, rapid deployment is a must. Here, satellite backhauling has a huge advantage. Fiber and microwave backhauling solutions represent substantial CAPEX costs, are time-consuming and often not feasible when spanning long distances or difficult terrain. Satellite, on the other hand, bypasses many of the logistical obstacles to deployment. In a single hop, a satellite solution provides a connection to the core LTE network.

Several factors mitigate satellite backhaul’s CAPEX expense. One is the benefit of rapid deployment; the immediate collection of revenue from 4G service helps offset the cost. Another is reusability. As their networks grow, MNOs can relocate equipment purchased and deployed for satellite backhaul elsewhere as needed. Of course, an equally important consideration is ensuring a quality user experience, and here Gilat’s satellite backhaul solution shines through, meeting the 4G performance challenge with SkyEdge II-c Capricorn, a TDMA VSAT that reaches the record-breaking speed of 200Mbps. At this speed, this VSAT supports the full capability of 4G handheld devices, a feat that is unique in the satellite industry. An obstacle inherent in satellite communications is the inevitable delay that limits throughput and performance. Capricorn is unique in the industry in having overcome this barrier. Gilat’s patent-pending embedded acceleration techniques compensate for the delay, maintaining a user experience that is indistinguishable from terrestrial solutions.

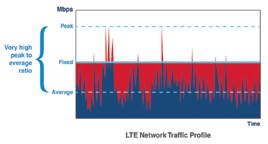

Another important point to consider is that new satellite technologies are lowering the cost of satellite connectivity. According to industry analysts, this trend is expected to continue well into the future. The main reason: High-Throughput Satellites (HTS) that offer significantly increased capacity, reducing bandwidth costs to as much as a twentieth of their previous rates. This breakthrough has helped position satellite communication as a cost-effective alternative for delivering broadband while reducing operating expenses. Another cost variable is the backhauling access scheme. When providing a satellite backhaul link, the question of bandwidth efficiency is crucial. The goal is to save money by using exactly the amount of bandwidth that meets the subscriber’s performance needs. For this reason, MNOs must determine which access scheme best fits the download as well as the upload direction: TDM/TDMA or TDM/SCPC.

When data traffic is bursty with a high peak to average ratio, as is the case in an LTE network, the traditional SCPC fixed-speed access scheme suffers from two main drawbacks, those being that SCPC does not meet peak traffic demand and SCPC wastes satellite bandwidth when demand is average. For these reasons, bandwidth sharing is a must in both the upload as well as the download directions. The TDM/TDMA access scheme is a must in LTE networks to reach maximum bandwidth efficiency and realize the full performance potential of handheld devices; other options are not economically viable.

The way forward for rapid 4G deployment is shifting. As solutions that may have seemed peripheral in previous years gain primacy, MNOs are re-evaluating their options. Not only is satellite backhauling a viable option—it is also an option backed by a clear-eyed business case.

www.gilat.com/SkyEdge-II-c-Capricorn