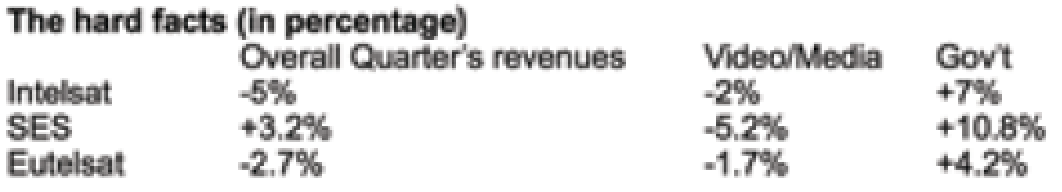

The end of October saw the industry’s ‘big three’ operators — Intelsat, SES and Eutelsat — unveil their latest quarterly results. They were not good. At best, the trio admitted that revenues would be flat, with each of them announcing falling Video/Media division revenues.

The only bright spot shared by all three were their ‘Governmental’ revenues, but it is fair to say those government increases are only recovering from the depressed ‘sequestration’ period which ended — more or less — a year ago.

However, and despite a few share price hiccups, optimism for their future trading during 2019 remains high from each of the three players and that optimism is hugely helped by the prospects of massive windfalls from the reassigning of C-band spectrum in the US.

“The Market-Based Approach will minimize the need for Commission

intervention and complex and lengthy oversight. Extensive FCC oversight

of a Transition Facilitator will prove unnecessary and likely delay

deployment of 5G service in the C-band Downlink,” said the CBA.

Indeed, the potential rewards that could flow into each of three (plus Telesat of Canada) are so meaningful that the market has already started building in significant extra values to the share prices of all of those operators involved. One equity analyst said that the market was looking at the C-band prospects with “blinkers on” in regard to the underlying trading prospects.

Intelsat, SES, Eutelsat and Telesat have formed the C-Band Alliance (CBA) and have agreed to expand their original offering of 100 to 200 MHz of their capacity to help push 5G’s speedy roll-out. October witnessed the CBA stress that a market-based approach represented the fastest way to repurpose C-band over the U.S., essential if a commercially sensible approach is needed to free up bandwidth for 5G telephony.

“The Market-Based Approach will minimize the need for Commission intervention and complex and lengthy oversight. Extensive FCC oversight of a Transition Facilitator will prove unnecessary and likely delay deployment of 5G service in the C-band Downlink,” said the CBA.

The phrase ‘market-based approach’ is another way of saying ‘let us sell our spectrum ourselves.’ The alternative is for the FCC to become involved themselves which, the CBA argues, would lead to “prescriptive mandates,” which would be unnecessary, long-winded and likely to involve an army of lawyers.

The CBA, in a truly impressive 152 page document, stated, “The Commission should reject alternative transition mechanisms, including overlay auctions and variations on the incentive auction, which are slower, less efficient, and pose implementation challenges that the Market-Based Approach avoids. These alternatives require far more heavy-handed government intervention and would likely be tied up in litigation for years to come.”

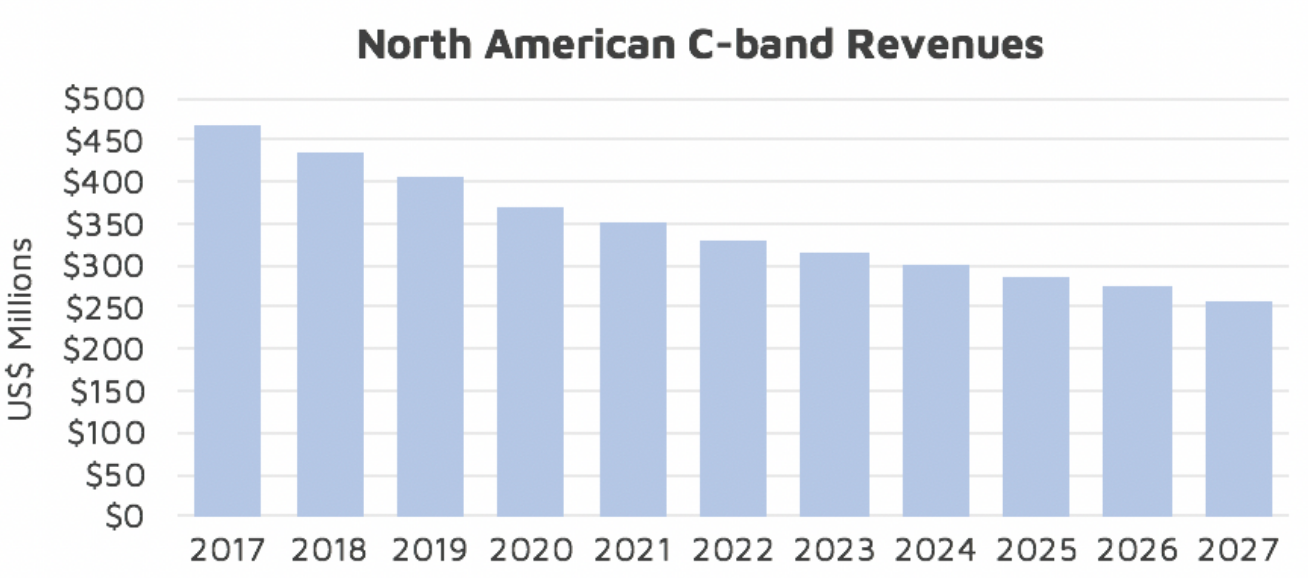

The above data chart is courtesy of NSR.

The CBA scheme has fresh support from chip-set giant Intel, the IT Innovation Foundation, the World Teleport Association and GCI Corp. The responses and comments from other interested parties were due to the FCC are due no later than November 27.

Intelsat’s CEO Stephen Spengler told analysts during the firm’s Q3 conference call that the CBA’s plan to free up C-band capacity for the USA’s speedy adoption of 5G would be limited to 200 MHz (made up of 180 MHz plus guard bands) and that this bandwidth was the highest slice of spectrum likely to be available in the short-to-medium term (see the chart in the adjacent column).

Spengler said that 200 MHz was the maximum available to be cleared in the target 18-36 month time-frame.

SES President and CEO Steve Collar had expressed the same view during his report to the market.

Intelsat says that neither they — or other members of the CBA — had done any work above the 200 MHz target and that freeing up additional spectrum would require a greater depth of technical development and, possibly, new satellites. As if to emphasize that point, anything above 200 MHz is not on the CBA’s agenda, at least not for now.

Spengler specifically referred to the C-band restructuring and said, “The Comment Phase of the U.S. Federal Communications Commission C-band proceeding ended [Oct 29] a major milestone as we continue to advance our proposal. The formation of the C-Band Alliance, announced [in October], demonstrates that the continental US C-band satellite operators are in full agreement on the technical and operational steps necessary to clear 200 MHz of spectrum over the course of the next 18 to 36 months. We will continue to advocate for our breakthrough, market-based approach that is the best path to protecting incumbents while repurposing spectrum that will accelerate 5G deployment and innovation in the U.S.”

Steve Collar of SES said much the same... “We continue to make strong progress with our C-band initiative in the US, aligning our proposal with the leading continental U.S. satellite services operators, founding the C-band Alliance (CBA) and hiring experienced U.S. executives to run the consortium. In comments to the FCC’s NPRM due [in October] the CBA will confirm on behalf of its members that up to 200 MHz of mid-band spectrum could be cleared to support 5G wireless deployment nationwide in the U.S. while protecting the important broadcast and other communities that we serve today. I am increasingly persuaded that our market-based proposal is the best way to facilitate a leading position for the US in 5G and is the only way to repurpose spectrum in a timeframe consistent with the stated goals of the FCC.”

The CBA’s submission to the FCC, naturally, was ultra-polite, although stated that the FCC should “avoid prescriptive mandates” and that “The Commission should reject alternative transition mechanisms, including overlay auctions and variations on the incentive auction, which are slower, less efficient, and pose implementation challenges that the Market-Based Approach avoids. These alternatives require far more heavy-handed government intervention and would likely be tied up in litigation for years to come.”

That warning — about the lawyers — is valid. Not only would legal arguments extend the project into the wild blue yonder, but such would also scupper the current valuations for satellite operators.

Intelsat said the company’s costs to restructure their U.S. C-band spectrum, complete with filters and site visits to more than 16,500 dish installations, will cost as much as $2 billion. Take the other operators into the equation and the overall costs will be significant. Add in the procurement of a few extra satellites to replace the ‘lost’ capacity and the overall bill starts looking quite expensive. SES estimates that there could be 30,000 C-band users in the U.S. — the American Cable Association, earlier in 2018, guesstimated that 90 percent of the organization’s member ‘receive only’ Earth stations were unregistered.

Intelsat confirmed that clearing 200 MHz will, indeed, require the procurement of multiple satellites — the exact number has not been confirmed, but there are now RFP’s that have been delivered to satellite manufacturers — in a discussion of the publicly mooted clearing cost figure of $1 to $2 billion, Intelsat management steered expectations toward “the higher end of that range.” The CBA will be watching closely how 5G standards evolve to ensure that the spectrum blocks and interference measures are optimally configured; management are pleased with the FCC’s (Notice of Proposed Rule Making) NPRM comments filed so far.

Spengler told analysts, “We have been very clear with our customers that we will make sure this is as painless and least disruptive as possible. We will provide compensation to them for the costs they incur to make sure this is not a financial burden to them.”

Sami Kassab, an equity analyst at investment bank Exane/BNPP, in a note to investors on Oct 30, said, “Importantly, the National Association of Broadcasters also uses supportive language, in our view, as it objects to frequency co-sharing. Overall, we consider these comments as supportive. We also note that only 16,500 C-band Earth stations have registered to the FCC. Our current clearing costs assumed satellites would need to install filters on 33,000 C-band earth stations. This suggests repacking costs could be lower than our $1.9 billion forecast and reach around 1.1 to 1.2 billion euros. This ,in turn, could add around 0.5 euros per SES share of C-band spectrum value.”

Giles Thorne, equity analyst at investment bank Jefferies, said, “In a tour-de-force 152-page submission, the CBA gives its most robust account to date. Tacked on to the well-aired merits of the CBA’s proposal (fastest clearing of band, protecting incumbent users, creation of de facto transition facilitator thus rendering FCC oversight unnecessary) was a statement that the proposal was ‘fully consistent’ with the law and the Commission’s statutory authority and would avoid ‘anti-competitive outcomes’. Elsewhere, we note that the CBA has now come out more forthrightly on a wider range of associated regulatory proposals (don’t over-burden the operators of the 16,500 C-band downlink Earth stations, rejection of point-to-multipoint co-existence in the downlink band).”

Thorne continued, “But for us, the most important comment appeared at the close - the CBA calls on the FCC to ‘reject alternative transition mechanisms’ such as overlay auctions or derivations of the successful 600 MHz incentive auction - this is the nexus of the C-band thesis as it is the transition mechanism where the FCC’s desire to protect competition, the Executive’s desire to raise funds, the MNO’s desire to secure value-accretive spectrum and the CBA’s desire to secure a windfall meet. The battle lines are drawn, the CBA must now hold its ground.”

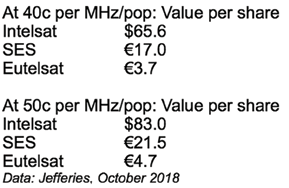

The FCC recognizes that the time for 5G investment is now. The prospects of maybe three million extra jobs is a tempting benefit. The additional benefits to the CBA members are obvious: a speedy freeing up of their 200 MHz as well as revenue valuations at anything between 40c-$1 per MHz pop would dramatically reduce Intelsat’s current $14 billion debt burden and more or less wipe out SES borrowings. Eutelsat and Telesat would each receive a useful bonus windfall for their spectrum.

Then there’s the real prospects down the line of a further 50 to 100 MHz which might be released and the impact from outside the USA to other countries where a readjustment of C-band might be beneficial.

A well-regarded industry name said that the re-allocation of satellite C-band frequencies for 5G could well be extended to other nations, according to analysis by J. Armand Musey of Summit Ridge Capital.

Musey explained the rationale in a highly detailed and compressive study in Summit Ridge’s 2018 Spectrum Handbook that was issued in October. Musey points out that global mobile data traffic, and thus spectrum demand, is growing at an explosive rate (63 percent up in 2016, and by a similar amount in 2017).

Video downloading represented 69 percent of consumer Internet traffic in 2017. More than 78 percent of the world’s mobile data traffic will be video by 2021, said Musey, leading to a crunch for operators. “Mobile is a big industry. Today, it supports over 4.7 million jobs and contributes around $475 billion annually to the U.S. economy. One study suggests that mobile carriers in the U.S. will spend $275 billion building 5G networks, creating three million new jobs and adding $500 billion to the economy. Thus, the mobile industry, by adding the new three million jobs that are projected to be created, will approach five percent of the total U.S. job market.

“Other countries, such as the European Commission through the CEPT (European Conference of Postal & Telecommunications Administrations), Australia, and Japan, are looking at reallocating the C-band as the ‘first primary band for 5G’. Methods of reallocating the spectrum from satellite to mobile use could include FCC-type auctions or an innovative alternative to allow satellite providers to voluntarily sell spectrum through a secondary market method using an independent third party ‘Transition Facilitator’ to manage the valuation of the satellite spectrum and the sale of licenses to mobile carriers.

Musey added, “The Transition Facilitator would be a cooperative entity with expert knowledge of satellite spectrum valuation and the satellite operators. It would be created by the relevant satellite operators to coordinate negotiations, clearing, and repacking the band. A Transition Facilitator would be more efficient and faster than an FCC auction and create a more coordinated market than satellite vendors selling on their own spectrum with the potential for holdouts creating gaps in the available spectrum. On the other hand, the satellite auction process could be directed by the FCC using an auction process similar to the Broadcast Incentive Auction process.”

In other words, this particular C-band-wagon might keep rolling for some time.

Senior Contributing Editor Chris Forrester is a well-known broadcast journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content and satellite broadcasting, the business of television as well as emerging applications and technologies. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996. He also files for Advanced-Television.com. In November of 1998, he was appointed an Associate (professor) of the prestigious Adham Center for Television Journalism, part of the American University in Cairo (AUC), in recognition of his extensive coverage of the Arab media market.