The small satellite sector continues to enjoy increasing popularity as operators turn to smaller form-factors to achieve less expensive and more responsive access to space.

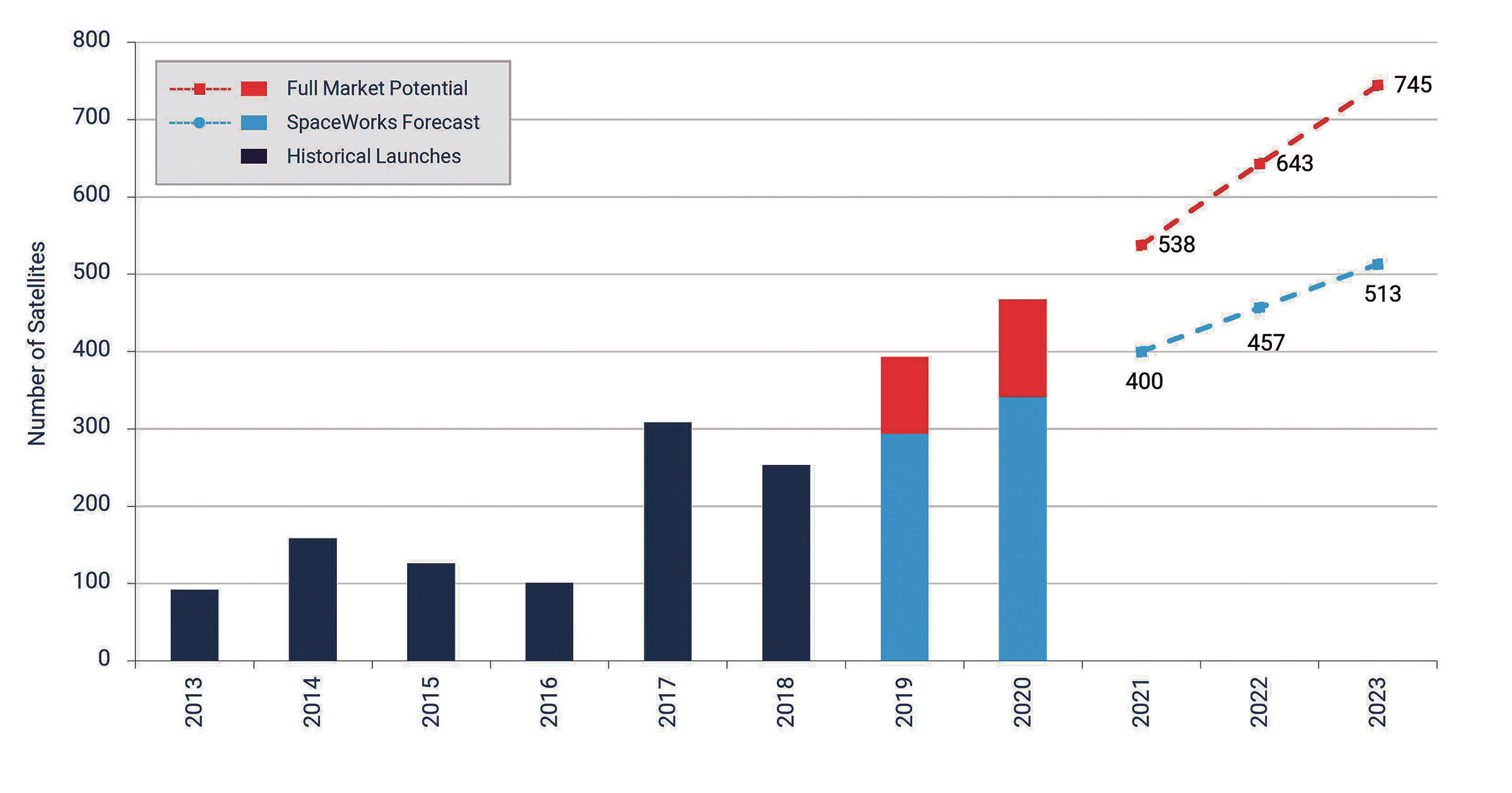

Based on the most recent insights from industry consulting firm SpaceWorks, the smallsat market is expected to continue its current growth trajectory in the near-term, fueled by maturing market segments and new satellite applications. SpaceWorks 9th Annual Nano/Microsatellite Market Forecast, released earlier this year, predicts as many as 2,800 spacecraft between 1 to 50 kg. will launch over the next five years.

As expected, the industry corrected after a record launch year in 2017, sending 20 percent less nano/microsatellites to orbit in 2018; however, future potential for the sector remains high. A flurry of launches in Q4 of 2018 helped sustain overall market performance and brought with them a number of industry success stories: Rocket Lab’s Electron saw its first (and second) commercial launches, the long-awaited Spaceflight SSO-A finally took flight and Russia’s Soyuz showed the launch vehicle has no intention of giving up its share of smallsat launches without a fight.

2018 was also an evolutionary year for the satellite Internet-of-Things (IoT) market, with seven different commercial operators launching their first satellite last year — five of the seven even registering more than one satellite.

Growth in this segment is already surpassing what was seen in the early days of the Earth Observation/Remote Sensing segment and promises to be a major driver of overall sector expansion in the future.

Increasing global demand in down-stream data analytics and communications applications are driving much of the segment’s growth, but competition from large LEO broadband constellations will require these operators to differentiate their offerings in order to stay relevant in the long-term.

In spite of meteoric growth over the past decade, some segments appear to be starting to push the boundaries of the nanosatellite form-factor.

Interestingly, microsatellites (10 to 50 kg.) defied the overall market decline in 2018, seeing a 25 percent increase in satellites launched. This trend is poised to continue as civil and military operators begin embracing the use of smallsats to meet key scientific and national security objectives.

With customer demand pushing the market toward more capable payloads, growth in the microsatellite segment is expected to reach double digits as more operators adopt larger smallsat form factors.

Even with operators looking toward larger form-factors to accommodate more demanding payloads, nano/microsatellites are demonstrating enhanced capabilities that make them particularly attractive for certain applications.

Of particular note is the rapid progress of commercial satellite IoT ventures, mostly restricted to the nano/microsatellite segment. These satellites, intended for communications and IoT applications, are expected to account for as much as 25 percent of the satellites launched over the next five years and, going forward, are anticipated to play a critical role in the growth of the overall nano/microsatellite segment.

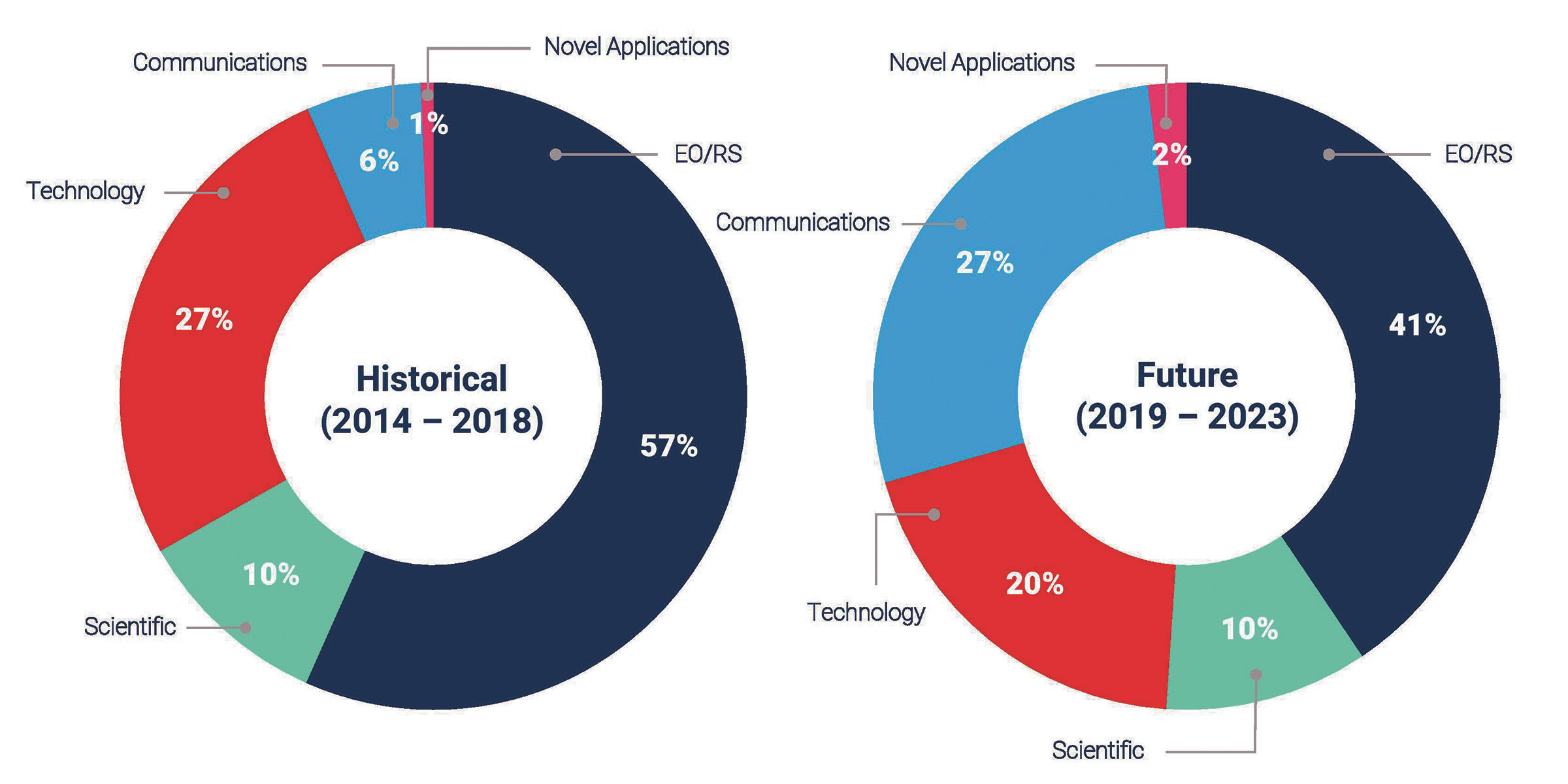

In contrast, Earth Observation (EO) and Remote Sensing operators, historically the dominant players within the sector, are expected to decrease their market share by more than 15 percent during the same time period.

Sub-segments, such as low-resolution optical imagery, are starting to reach saturation and EO and Remote Sensing operators are turning toward new applications — such as GPS Occultation, ADS-B, live-video and others — to help diversify their revenue streams.

Nano/Microsatellite Application Trends

Overall demand within the nano/microsatellite segment remains strong and SpaceWorks’ analysts are predicting 294 spacecraft to launch in 2019.

Compared to last year’s forecast, projections for 2019 have been revised to reflect changes in both application and operator trends.

Though still dominated primarily by commercial operators, the nano/microsatellite segment is seeing broader interest from government entities, including for expensive interplanetary science missions (e.g., NASA JPL’s MarCO mission).

In 2018, more satellites launched beyond LEO than in the last five years combined. Enhanced capabilities, new technologies and greater component reliability are all driving the increase in interplanetary CubeSat missions, and this trend is expected to continue, with as many as 35 nano/microsatellites expected to launch beyond LEO by 2023.

It appears, at least for the time being, that government demand in the smallsat sector is restricted primarily to the civil operators segment.

Despite vocal declarations, military operators have been slow to adopt these smallsat form-factors, and their interest seems little more than one of curiosity at this point.

Limitations in CubeSat payload capabilities are likely driving military operators to concentrate their attention on microsatellites in the 50 to 300 kg. range, rather than the 1 to 50 kg. range.

As technology modularization and miniaturization continues, this trend may change rapidly — smallsat manufacturers who are ready to capitalize on military opportunities once they arise are likely to be generously rewarded.

2019 Nano/Microsatellite Forecast

Increased launch consistency for small satellites, as well as new applications, are enabling future growth across the nano/microsatellite sector.

Several operators launched their first satellites in 2018 and many others began the initial roll-out of their larger constellations, creating confidence in SpaceWorks’ analysts and industry investors for near-term growth.

Overall, increasing market maturity is expected to unlock new opportunities for market growth in the small satellite sector.

Across all parts of the smallsat value chain, companies are beginning to demonstrate improved reliability, consistency, and sustainability.

Down-stream market applications, such as data analytics, are the critical benefactors of this changing industry landscape, and their success will dictate the future potential of the upstream market.

For more research, analysis, and commentary regarding the small satellite and commercial space markets, please visit

www.spaceworks.aero/insights.

Caleb Williams is the Lead Economic Analyst at SpaceWorks Enterprises where he oversees delivery of business strategy and economic analysis engagements for private sector clients. His primary focuses include market demand modeling, market strategy, and business case development for commercial space ventures. He received degrees in Economic Consulting and Marketing from the Kelley School of Business at Indiana University. He may be contacted at caleb.williams@spaceworks.aero

Stephanie DelPozzo is an Economic Analyst at SpaceWorks Enterprises where she specializes in market research, competitive intelligence, and policy analysis for the emerging small satellite industry. She received degrees in Political Science and Economics from Florida State University.