For many decades, NASA and other government-based space organizations, have led, driven, nurtured, and helped to create, a robust and fertile ecosystem leading to the commercialization of space-based technologies.

Much of these activities were driven by security interests, as well as the desire to maintain competitive standing in technology. Through public-private partnerships, and massive budgetary outlays, these government organizations have established a foundation that has become a launchpad for innovation and the commercialization of Low Earth Orbit (LEO).

Facilitating increased innovation in LEO is the rapid expansion of small satellite (smallsat) technology and launch opportunities. Smallsats, and in particular, cubesats, have changed the game in LEO.

Large facilities and systems occupying LEO include the International Space Station (ISS), the A-Train constellation and the Joint Polar Satellite System (JPSS) satellites. These massive — physically and functionally — platforms took years to develop, and huge sums to launch and maintain. They are loaded with capabilities and sensors, and are built with redundancy designed for zero failure tolerance.

Government-based missions such as these tend to incorporate broad objectives to push the edge of technology, but because they serve many needs, they also include many compromises. The resulting general-purpose missions touch on many new markets and potential business applications that can benefit from the research outputs of these missions.

The results of these activities are coming to light with the rapid expansion of private LEO-based satellite constellations with carefully focused capabilities that create new commercial markets, or expand the capabilities of free public services. The new objective is to address the competitive and economic needs of specific industries. And the vehicle of choice for these business operators is the cubesat.

Why Cubesats and Why Now?

Cubesats are typically referenced in increments of 1U (10cm x 10cm x 10cm) and range from 1U to 24U. The capability to put cubesats into orbit has been around for some time, but in recent years, factors have converged to make commercial utilization more attractive. From 2000 through 2014, some 230 cubesats were launched. In 2017 alone, cubesat launches exceeded that amount.

While not inexpensive, the cost to build and launch a cubesat-based system can range from a few hundred-thousand dollars to a few million dollars — a small investment when compared with the multiple billions of dollars spent on government missions.

Currently, several innovative companies such as Orbital Micro Systems (OMS), as well as Spire, Planet and DigitalGlobe, have announced, or have launched, constellations of smallsats to provide high-resolution observations of the Earth. Key commercial markets for these services include insurance, food production, aviation and maritime transportation, and government.

Through normal competitive market forces, the costs associated with building and launching a cubesat have been reduced. Economies of scale, competitive pressures from bus providers, availability of dedicated, as well as piggy-back, rides to space, and advances in miniaturization, receiver sensitivity, computing capacity on-board and in dynamic cloud-based terrestrial systems, and continuous development of low-power, high-function electronics, all factor into the equation for growth.

Leveraging these capabilities and advantages, nimble and innovative companies are staking out territories for commercial ventures. Among the most active markets are different types of Earth observation (EO), including high-resolution imagery, maritime tracking, and weather data collection. While large government missions also provide some level of capability in each of these areas, with their multi-purpose objectives, the information and data does not always fulfill the needs of the marketplace.

Cubesat operators have the advantage of creating purpose-built single- or dual-function devices that can be placed in constellations to provide near-constant global observation. For example, DigitalGlobe touts a global revisit rate of approximately one day for high-resolution digital images; Orbital Micro Systems plans for high-resolution weather data observations with 15 minute global revisits; Planet provides images of the Earth’s landmass every day; and Spire offers highly accurate ship tracking throughout long ocean voyages.

Impacts of Weather Observation

One market with tremendous potential for economic success, as well as societal impact, is the expansion of weather data observation.

A seemingly unending stream of weather-related disasters have dominated the headlines in 2017, highlighting a consistently concerning global weather picture, and the need for better forecasting in every region. A key factor hindering the ability to understand and predict weather is limited by the low number of observation and sensing systems in LEO.

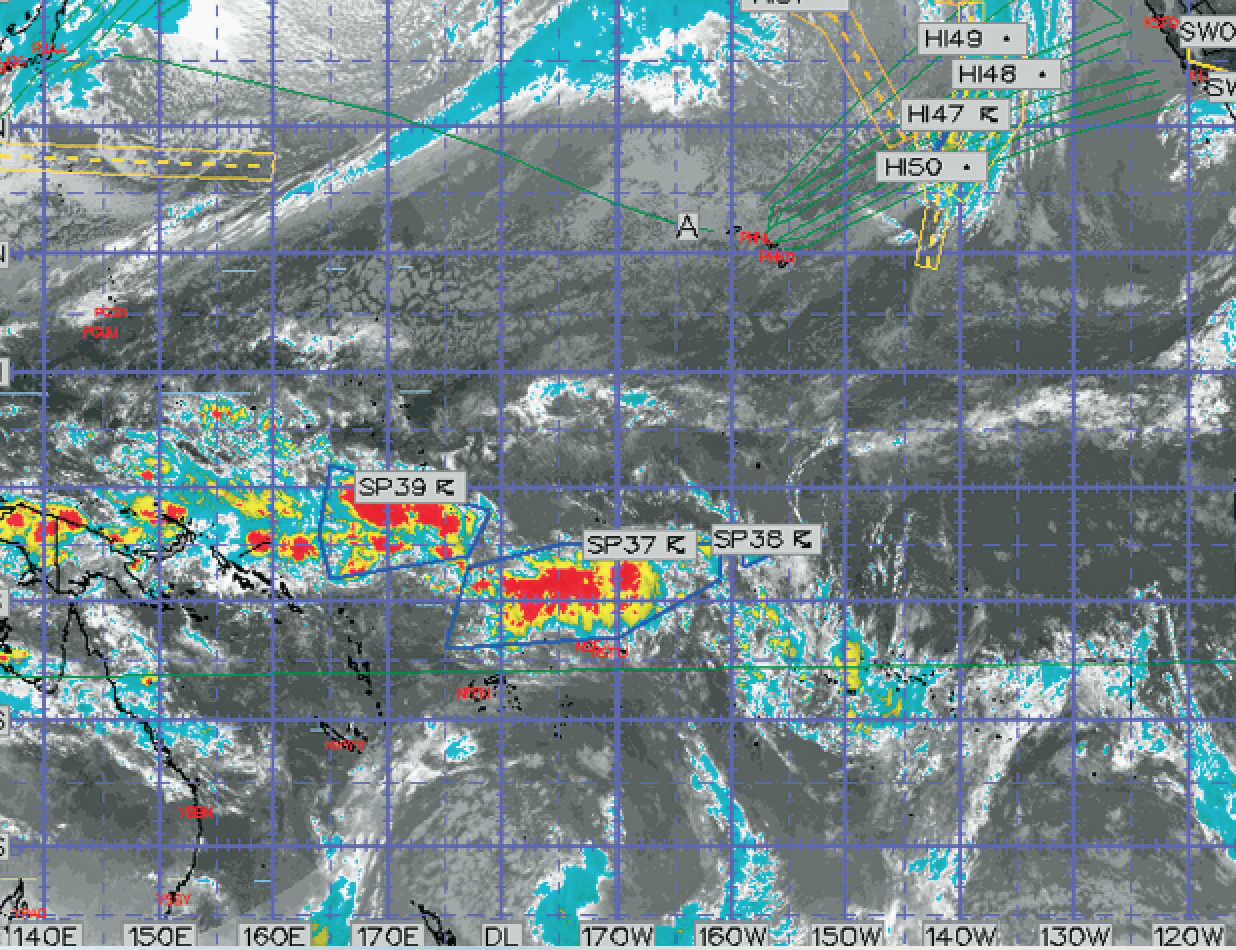

In some regions, such as North America and Europe, and parts of Asia, there is substantial investment in space systems, resulting in adequate weather observation density — on the order of three- to six-hour revisits.

Unfortunately, outside these zones, observation intervals are much longer, and in some cases non-existent. Weather data is as important in other world regions, but the resources aren’t available on a global basis, and unfortunately, many areas of the globe, including less developed regions, receive little satellite weather coverage.

It can be said that the government satellites, such as GOES and JPSS, already provide the required data and EO necessary. However, while these highly effective systems do provide adequate data, the small number of available samples from just a few satellites leave substantial holes in what is actually going on.

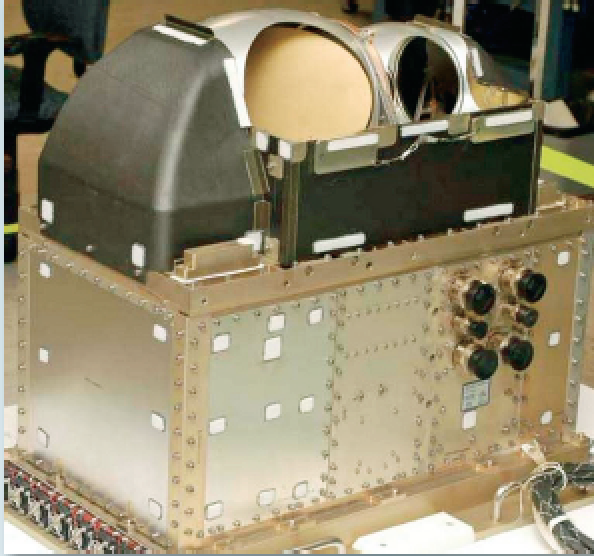

Advanced Technology Microwave Sounder on JPSS. Cost: $140 million, 70x40x60 cm, 75 kg. 130 W power.

For headline-grabbing storms such as Hurricane Irma in 2017, the three- and six-hour interval weather data updates fed the hurricane track models, but short-term shifts in direction led to a missed landfall estimate — sparing Miami, and striking a less-prepared Tampa. Had a storm of this magnitude existed in a different part of the world, the models would have been even less accurate.

In general, more frequent data improves model accuracy and performance, providing ample warnings to communities at risk, and hopefully mitigating human and economic catastrophes. Just considering the case of extreme weather events, there is a strong business-case for high-revisit weather observation services.

Looking beyond extreme weather events, the daily nowcasting and forecasting of LEO-based weather observations has a direct impact on agriculture, extending to food supplies and markets.

For example, nine of the ten largest rice producers in the world are in Asia. A staple food, and a large economic component for many of these countries, ensuring high yields and avoiding weather-related crop losses are important issues. Governments have actually toppled as a result of price spikes in rice. However, this region, has limited access to reliable weather data from space-based systems.

Lacking sufficient weather data, forecasting of weather patterns and events in Asia is difficult. The result is farming advances seen in other world regions have not been implemented. Many decisions are based on historical, custom and day-to-day weather observations.

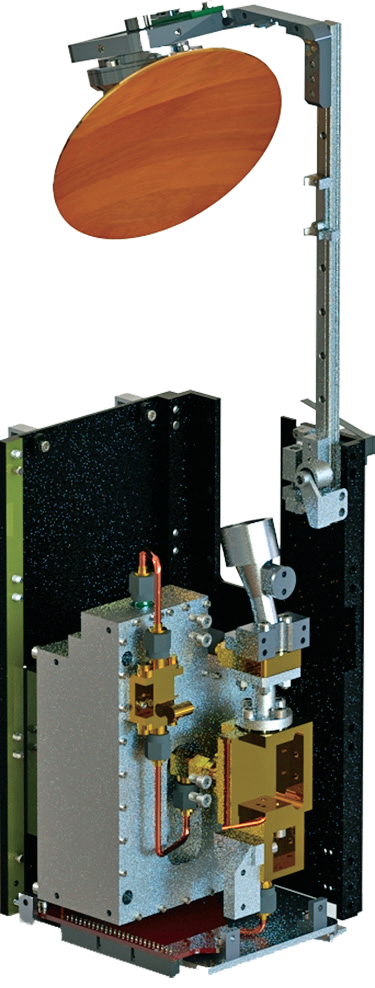

OMS MiniRad cubesat radiometer. Cost: $100k, 10x10x15 cm, 2 kg., 5 W power.

Plantings are staggered to spread risk from bad weather washing out a new crop, harvests are sometimes lost when not completed prior to storms, and unexpected droughts or floods cause catastrophic losses. While weather cannot be controlled or managed, most farmers would agree that better forecasting and understanding of impending weather conditions, such as wind speeds, precipitation density, and temperature variations, would be a substantial improvement over the current practices used for farming.

The ability to cover the globe with state-of-the art weather observation technology, at a fraction of the cost of large government satellites, will have a dramatic effect on agriculture in currently neglected and economically disadvantaged regions. Cubesat technology not only enables this, but conducted in concert with commercial entities offering stronger and more affordable solutions, will enable these regions to benefit. There are equally compelling business cases in other vertical markets, as well — for every opportunity, there is a quickly expanding number of payload companies looking to compete.

Government’s Continuing Role in LEO

Just as governments continue to lead other important sectors of science, such as medicine and public health, it is important to consider the development of LEO in a similar model.

In medicine, governments fund and encourage the research and development of new cures and treatments. However, when it comes to commercialization, they assume a regulatory role and let the marketplace take over.

For LEO, there is a similar inflection point. Government focus should continue to invest and support cutting edge technologies, national security, research and developments that will pay greatest returns for society, while ceding the commercialization to entrepreneurs and innovators in the private sector.

The convergence of multiple factors is defining an inflection point that makes the transition of LEO use from the domain of governments and science to an active and highly competitive landscape for commercial development and innovation.

Innovation will be driven through the greater access to LEO via cubesats and a healthy competitive playing field.

With this framework, all citizens will derive the most value from new technology and investment and markets will get much-needed solutions to address very specific business and market requirements.

www.orbitalmicro.com

William Hosack serves as chief executive officer for Orbital Micro Systems. His extensive aerospace background includes, twenty-eight years of supply, production, and senior management experience, executive management consulting, expertise in strategic business development in Asia, and as a compliance expert for export and ITAR in Southeast Asia. William studied Aeronautical and Space Management Operations at Embry-Riddle Aeronautical University. He is also an IFR Certified private pilot.