There’s a new space race — and access to space has never been easier. Affordable launch options, off-the-shelf satellites and comprehensive mission services all enable organizations to develop unique, revolutionary services and products without the need to be experts on the complexities of satellites and space architecture.

More people, businesses and organizations are participating in this once limited and exclusive industry. Highly creative ideas on how to leverage space technology are emerging on a constant basis with no end in sight. We have just scratched the surface of what is possible.

Much of this innovation is being fueled by satellites that are inherently scalable and flexible. Satellites are now built to support a wide range of performance metrics while preserving the cost and schedule benefits of production line manufacturing.

The industry is quickly adapting to this new approach by moving away from a project/mission focus to a product line focus with continuous manufacturing and on-going technology evolution. Investors are taking note and are placing big bets on the most promising applications.

Market Forces

With the commercialization of space comes new priorities and expectations. Satellite design decisions are more closely coupled to commercial business models than ever before. To keep pace with investors’ financial targets, space executives are laser focused on growth and profit. That doesn’t always mean the lowest cost satellite — it often means the satellite that can produce the most value, day-in and day-out, becomes the selected platform.

Businesses and investors need commercially, operational constellations. Like a military operational system, these constellations need to meet the expectations for up-time, system throughput, and data and service quality, but at a fraction of the cost.

It’s not enough anymore to just get “something” into space — the space infrastructure needs to produce product at the rate and quality built into the commercial business plans.

Scalability, Software Definition, Intelligent Manufacturing

These market forces can be addressed with scalable and software-defined bus product lines that are applicable across a wide range of applications and combined with intelligent manufacturing. Marrying these two elements will greatly reduce the cost and timeline for volume production.

Initially, the satellite buses need to be scalable to leverage common designs while providing high degree of relevance to application requirements. Commercial off-the-shelf satellites and components are just one part of the equation — they are only useful if they meet the needs of the specific applications. The next stage for the industry is to provide smallsat buses that can easily scale capabilities with interchangeable modules to create a variety of configurations.

A classic example is the difference between Earth Observation (EO) imaging satellites and communication satellites. EO satellites need a high degree of pointing stability, agility, and on-board data processing.

Communication satellites do not require such optical stability and agility but need significantly more power generation, greater storage capacity and larger payload envelopes. Product lines that are designed to include scalability can bridge that gap by tailoring power, agility, stability, thermal control, downlink data rates, propulsion, and other key performance metrics while keeping the same core satellite architecture, avionics, configurable software, and manufacturing process.

Secondly, the next generation of satellites also require a high degree of software flexibility that maintains a core and constantly evolving bus operations software, but that can be easily adapted to support the various, scalable configurations. Additionally, the software should be capable of supporting application specific on-orbit behavior or concepts of operations (CONOPs) as well as a variety of space-to-ground and space-to-space command and data interfaces.

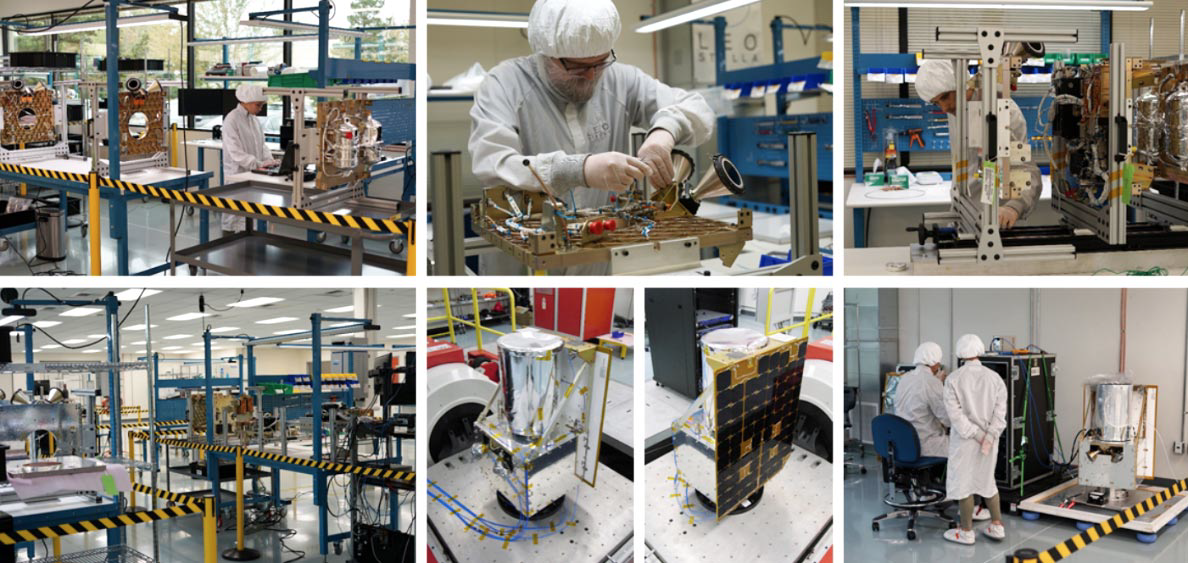

Third, the satellites need to be built as product lines with a common core architecture and a high degree of common components. To be successful in this, intelligent manufacturing will need IoT connected equipment, digital processes, statistical process optimization, inventory-rich manufacturing processes and supply chain integration to materials requirement planning (MRP). This will allow new product lines to be built at similar scale, with predictability and at the volume of other complex commodities typical in the non-space tactical and scientific industries.

The space industry is going to experience an increase in the emergence rate of innovative business models. The commercialization of space is still in its early days, but it has reached an important inflection point.

The cost of space has decreased significantly, a new approach for satellite product lines is taking hold, and manufacturing capabilities are significantly more sophisticated, positioning many businesses to succeed with their own creative uses of space infrastructure.

Investors are taking note of the industry’s potential and supplying significant funds. With these factors, the industry is poised to experience a wave of market acceleration.

The innovations and capabilities seen today are just the tip of this massive industry iceberg.

www.leostella.com

Author Brian Rider has spent his career developing high quality space systems for a variety of missions, including earth imaging, weather monitoring, astronomy, optical communications, and interplanetary exploration. Prior to joining LeoStella, Brian was the Director of Imaging at BlackSky and was part of the leadership of the satellite engineering group. Brian has a passion for space missions and believes strongly in the benefit of leveraging emerging technologies to create new capabilities in the space domain.