Chris Forrester, Senior Columnist, SatNews Publishers

SES recently unveiled their half-year results and made the most of the firm’s new mantra: “Two companies: one mission,” now that it counts Intelsat as part of the company’s portfolio.

The results were helped by news from the U.S. Space Force, which is awarding contracts worth $4 billion to five companies: Astranis, Boeing, Northrop Grumman, Intelsat, and Viasat. The contract is to focus on anti-jam satellite communications. It is not yet known how much this contract will be worth to Intelsat/SES... but every dollar helps.

SES COO Adel Al-Saleh

There was also a positive comment from CEO Adel Al-Saleh on another C-band restructuring. Al-Saleh told analysts that SES expected the FCC “to move quite fast” in its move to secure more 5G spectrum. He said that freeing up 100 MHz was a possibility and that SES was prepared to provide the technical know-how to facilitate the move. Al-Saleh added that there was nobody better equipped than “us” to facilitate the Federal Communication Commission’s (FCC) requirements.

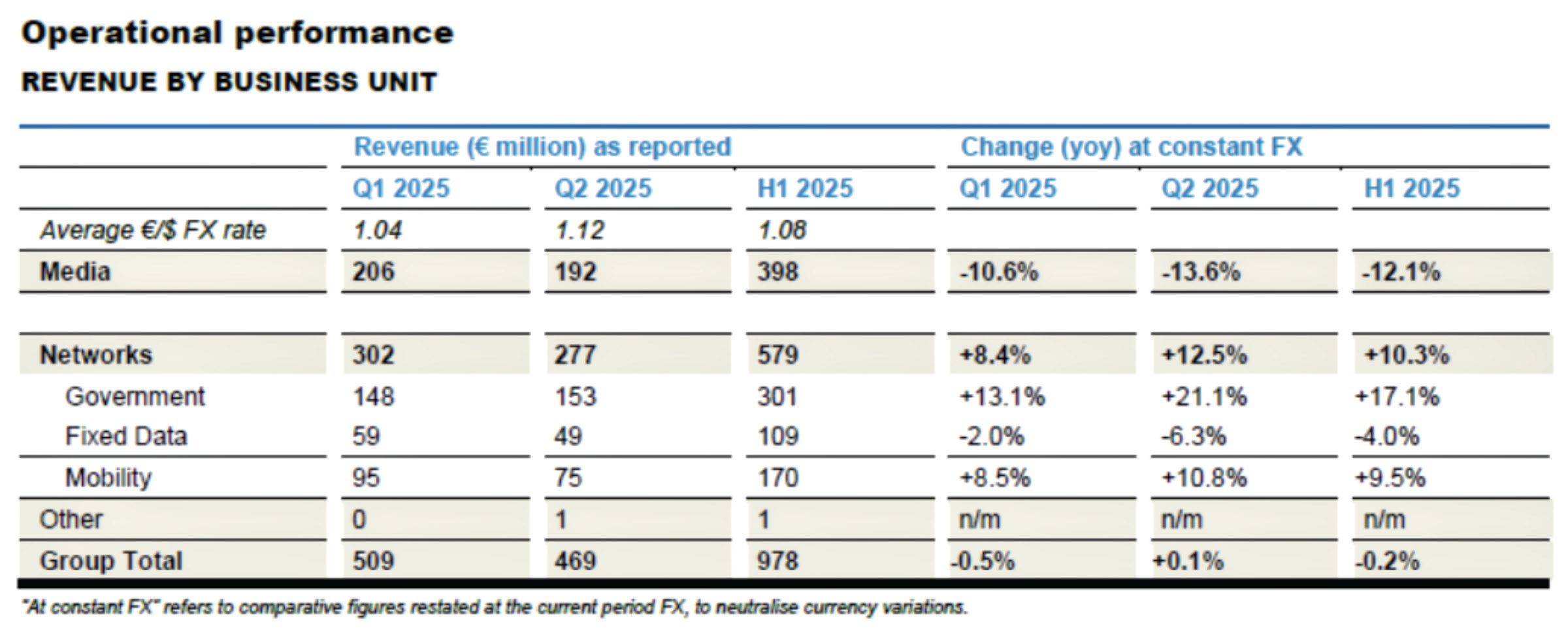

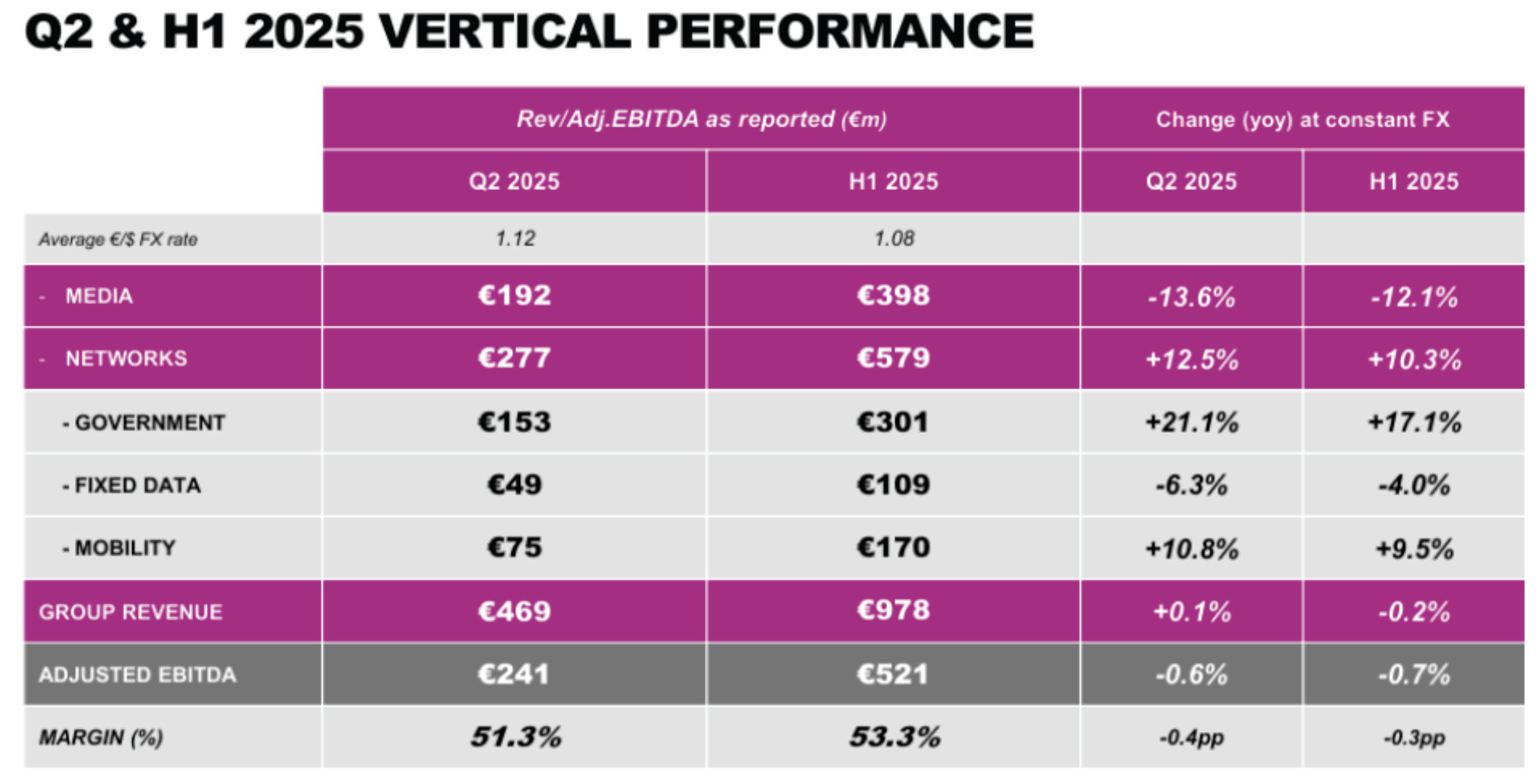

SES reported Q2 sales and core earnings above market expectations and confirmed its 2025 guidance on July 31st, buoyed by its strong backlog of government contracts and growing confidence that government business—already representing 17% of overall revenues—will continue to expand and was worth €301 million ($352 million) in H1. The firm’s Q2 government business grew 21% year-over-year (yoy). When Intelsat’s governmental revenues are included, SES expects revenue approaching $1 billion in future years.

As to the actual H1 results, its overall Revenue was €978 million (-0.2% yoy). Its growing Networks division grew +10.3 percent yoy supported by +17.1 percent yoy growth in Government and +9.5 percent yoy growth in Mobility. Media continued to decline and fell -12.1 percent yoy.

Media revenue of €398 million (40% of total revenue) fell on the back of lower earnings from mature markets, due to capacity optimization and the impact of Standard Definition (SD) channel switch offs as well as the full Q2 impact of the Brazilian customer bankruptcy. That Brazilian client has now been replaced by a new broadcaster, so there’s hope that revenues out of Brazil will recover. In H1 2025, the Media division secured more than €175 million of renewals and new business.

SES reported €690 million overall of new business and contract renewals signed in H1 2025—with a total gross contract backlog of €4.2 billion.

SES says it is continuing to engage with insurers regarding the $472 million insurance claim relating to O3b mPOWER satellites 1-4. SES has finalized settlements with a small number of insurers, resulting in initial settlement payments of c.$58 million collected, with further settlements expected to follow.

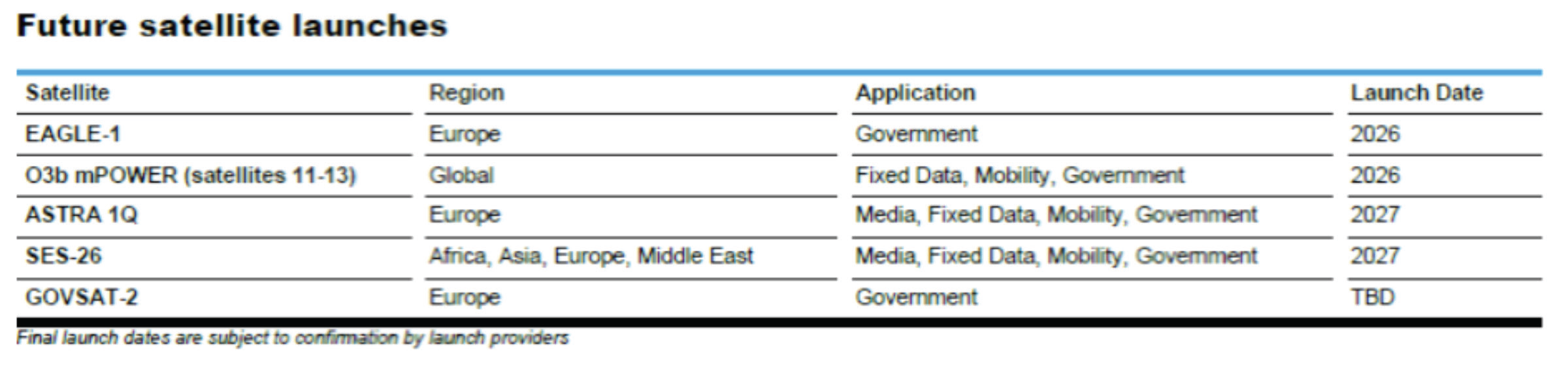

There were questions from analysts regarding O3b, with Al-Salah stressing that the new O3b mPOWER satellites (and two were launched in July) represented a tripling of the fleets satellite capacity when the full complement of 13 craft are in place. As the fleet is completed (and there are three more craft to be launched next year) then the original four O3b satellites would perform ‘back up’ roles.

FY 2025 financial outlook well on track, reiterating stable Revenue and broadly stable Adjusted EBITDA yoy.

Al-Saleh added that the (Q2) information was the last when SES would report as a stand-alone business. Effective with Q3, it would be the financials from both SES and Intelsat, and as a combined company. He added that neither SES nor Intelsat’s financial teams were quite ready to talk about Intelsat’s financial performance to date, but that they remained “very comfortable” with Intelsat’s progress and numbers.

The company confirmed that its next (interim) shareholder dividend would be paid in October at the current rate of 25 Euro-cents per share with a final payment made in April 2026 at the same rate.

SES repeated its recent promises regarding shareholder dividends, stating, “As SES meets its net leverage target (Adjusted Net Debt to Adjusted EBITDA) of below 3 times within 12-18 months after closing the Intelsat transaction, the company intends to increase the annual base dividend and at least a majority of future exceptional cashflows of the combined company will be prioritized for shareholder returns.”

SES’s expected capital expenditure relating to the European mega-constellation IRIS2 of up to

€1.8 billion will start ramping up, mostly from 2027, and will translate into an average annual spend of around €400 million over 2027-2030 (subject to a rendezvous point at the end of 2025 to validate the project cost, technical requirements, and delivery timetable, whereby any party can exit in the event of excess expected cost, not meeting technical requirements, and/or delays to the in-service date).

Al-Saleh said, “H1 2025 delivered solid operational and financial performance. Through continued strategic execution and solid commercial momentum, we have stabilized Revenue and Adjusted EBITDA and are firmly on track to meet our reiterated FY25 financial outlook.

“Our solid H1 2025 performance is underpinned by the strong growth in the Networks business, now c.60% of revenues. We continue to see commercial traction across Government and Mobility. This underscores our strong positioning in high-value segments, driven by our differentiated and scalable multi-orbit offering. In the first half, we secured €690 million in new business and renewals, reinforcing our future growth trajectory. We have a robust pipeline of Government opportunities supported by increased defence spending in Europe, including the development of a second satellite for GovSat jointly with the Luxembourg government, as well as strong momentum with the U.S. Government, including the selection of SES Space & Defense to provide a hybrid space-based architecture to the U.S. Department of Defense through a secure integrated multi-orbit network (SIMON). In aero, we are seeing increased traction with Open Orbits—including partners’ wins with Thai Airways, Turkish Airline, and Uzbekistan Airways. Our Media business continues to deliver in-line with expectations, underpinning SES’s stable and cash-generative foundation.”

Al-Saleh said that government business (up 17% in H1) was its most attractive [segment] and was stable. But there remained a shortage of satellite capacity, and this benefited SES and that—in particular—some of its government clients were paying premium rates for unique projects to ensure access to space.

He also stressed that the days of Geostationary (GEO) satellites was far from over. He said GEO was still in considerable demand.

SES was well positioned, with its GEO and MEO fleets as well as the company’s commercial relationships with LEO operators and is able to provide a full service for clients.

Intelsat has an agreement in place with Eutelsat’s OneWeb, while SES has a commercial relationship with Starlink (SES Cruise mPowered + Starlink). Key to the demand for GEO access was the fact that Europe is committing to increasing defence-related spending to 5 percent of GDP.

“This is very important in terms of space activity, and we do not see this ending over the next few years. The recent order for GovSat 2 is a key indicator of that growing demand,” said David Wajsgras, formerly president at Intelsat, who was recently appointed to the Board of HawkEye 360.

SES Highlights

► Providing in-flight communications to 30 airlines and 3000 aircraft

► Serving 5 out of the 6 major cruise lines

► Delivering more than 9,500 channels

► Almost 2 billion viewers to its broadcast channels

► Serves 8 out of the world’s top 10 mobile operators

► Support more than 60 government organizations

► Active in more than 130 countries

Author Chris Forrester is the Senior Columnist and Contributor for SatNews Publishers and is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications.