The satellite and IoT world is watching closely as a group of new space startups are trying to innovate the industry by developing a new type of global IoT networks that promise to bring low cost IoT connectivity covering the entire world, using low power communication nodes. These so-called Low Power Global Area networks (LPGAN) are using smallsats in LEO orbits and state of the art software based technology in an attempt to disrupt the industry.

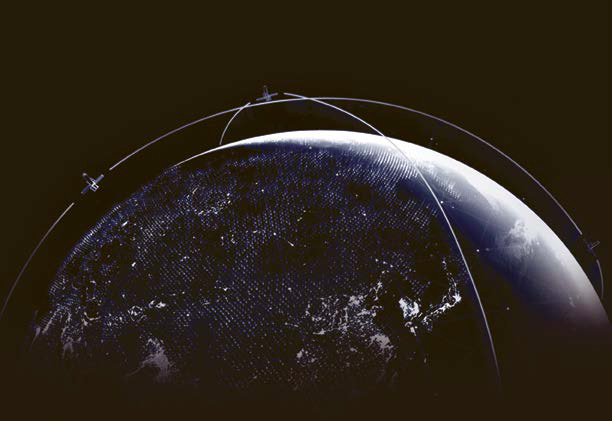

NanoAvionics GIoT constellation-as-a-service.

Image is courtesy of NanoAvionics, Corp.

Originally there where about 12 to 15 players in the LPGAN race to develop, launch and conquer the global IoT connectivity market — this number has already been reduced. Now, approximately a half a dozen firms (Hiber, Myriota, Kepler, SAS, Astrocast, Fleet, Swarm) have launched one or two LEO IoT satellites, mainly for on-orbit testing and as proof of concept satellites. Most of them have also started the first customer pilots as part of their system validations.

The next round in the race is on to launch a full satellite IoT constellation. Who will be able to offer the first commercial, global IoT service? The race is interesting to watch as round two comes with significant challenges.

Only a well-designed and manageable satellite IoT constellation with an appropriate global, ground station network is able to provide the IoT service level envisioned to fuel the global IoT take off in sectors such as agriculture, public infrastructure, environmental monitoring, the tracking of small vessels and other global asset tracking applications. However, it’s not technology alone that’s required — the necessary financing, commercial and regulatory arrangements also need to be in place as well to make this the breakthrough innovation the IoT world is awaiting.

Financing the Constellation Phase

One of the major challenges is the financing of the constellation. While all systems have been funded to get one or two POC satellites into orbit, the companies now have to finance the next generation of satellites.

Astrocast (8.3 million euros) and Fleet (6.67 million euros) recently finalized financing rounds for their constellation phase. Astrocast will use the investment (backers were not disclosed) to build and deploy a larger constellation of IoT satellites. The company is preparing to launch eight more satellites in 2020 and to place a constellation of 80 satellites into orbit by 2023 or 2024. To deliver the full constellation, an additional 45 million euros investment is required.

Fleet will use the investment to launch four 6U smallsats in mid to late 2020. For that, the company has attracted two major backers: Momenta Ventures, which is devoted to IoT companies, and Horizons Ventures, the investment branch of Hong Kong billionaire Ka-Shing

Additionally, all other players are busy getting the launch of their satellite configuration financed by trying to convince potential investors that their technology is mature, that they fulfill all regulatory requirements and that they are able to tap into lucrative (but yet to be proven) satellite IoT markets with their sales and marketing teams.

Constellation Design Challenges

The size of the fleet — is it flexible enough to allow the constellation to grow along with market demand? The size is a function of the service type, service level and geography needed to serve as LPGAN operator, and if a real-time service, a full fleet on-orbit, is required to start commercial operations. Ask Iridium and Globalstar, or more recently SAS, about that requirement. A huge upfront investment is needed and, once obtained, all should go well with the launch and deployment of the satellites.

Many LPGAN players start with a smaller fleet that offers high latency store and forward messaging service levels, e.g., starting with messaging on a once per day basis then moving to once per hour and then once per 15 minutes. Growing the number of satellites to meet market demand is the mantra, which sounds good and customer oriented when you target the correct market segments and low latency applications. It is also quite a practical way to approach the financing issue.

Another design consideration is the lifetime of the satellites that comprise the constellation.

One of the advantages of smallsats in LEO — up to 650 km. — is that, due to their short lifetime, the latest technology is usually incorporated onboard the spacecraft, which is a solid argument in times where the law of Moore still applies.

On the other hand, time in orbit can be extended by orbiting at a higher altitude that provides a larger satellite footprint on Earth as well as increases the satellites orbit lifetime — and that lowers the cost per message sent.

Related to this is the service level for customers. LEO constellation satellites pass a ground node location several times a day; therefore, it is important to accomplish this pass in as regular a time interval as possible in order to guarantee a reliable service. For this to occur, a clever combination of avionics, propulsion and software is needed, even on the smallest satellites.

The last constellation design consideration is how to keep space “clean.” This means how to manage de-orbiting, or by raising altitude. This also includes collision avoidance in the ever more crowded orbits, especially now that a number of broadband LEO also wish to use 600 km. orbits with massive numbers of spacecrafts.

Already, Kepler has adjusted their constellation design to accommodate that concern. Plus, the smaller player satellite IoT actors can only hope that the big broadband LEOs take their responsibility seriously.

Manufacturing

Now that the LPGAN operators are entering the constellation phase of their operations, a hot topic is manufacturing. How can operators control and manage their supply chain and get everything delivered according to specs, within budget and on time? How to manage the manufacturing of a whole constellation, never mind just a single smallsat, and also to develop a reliable supply chain as well as build an upstream eco-system of supply partners to support, that is the challenge.

A number of smallsat operators such as Spire, Planet, Kepler and also Astrocast have already made the decision to vertically integrate and take the manufacturing of their satellites in house. Others remain undecided and are looking at smallsat integrators that are building “smallsat factories” in anticipation of the constellation phase.

Launching the Satellites

Launching the large number of satellites that are envisaged in the constellation development round of LPGAN players appears to be not only a challenge, but perhaps a true bottleneck.

Current launch capacity, such as from PSLV or SpaceX, is primarily aimed at large, old space satellites going to Sun Synchronous Polar Orbit — all that smallsat operators can hope for is that one of the launch brokers like ISL or Spaceflight manages to find some spare ride along space for them. Perhaps China comes to the rescue as that nation is investing heavily in launch capacity and capabilities.

Hopes for the moment are on the NewSpace launchers that are promising to provide more flexibility when it comes to delivering the satellite to the various, required constellation planes. However, it appears that a couple of more years will be needed before these launchers become available. Launch company Vector recently pulled out of that business and launch companies, such as RocketLab and Astra, are kept busy with old space.

The investments required to develop a reliable launcher are immense. There are a couple of hundred launcher start ups, so there is always hope for launch developments and other scenario’s are being developed. Perhaps a launch as an SSO ride share and then have a company, like D-orbit, pull the satellite in the proper plane?

An example is Astrocast that is planning to launch the first five, three U smallsats in the spring of 2020, then a second batch a few months later, both using India’s PSLV rocket. Another 10 are scheduled to launch at the end of the 2020 on an Arianespace Vega, the ride share provided by D-Orbit that will also incorporate dispensers to deliver the satellites into another plane.

Market Access and Landing Rights

Having the satellites launched, and not forgetting that the necessary ground segments must be ready as well, is but the first step to launch for this burgeoning market.

Do the operators have the necessary licenses to start offering their services ? The subject of having obtained a license to use the service frequencies on a global level with ITU is a separate subject for a future article.

A critical element for the commercial roll out of the satIoT services are the landing rights required in the different countries. It is the landing rights that provide access to customers and markets in a country — unfortunately, there is no quick fix, invention or software solution for that necessity. It requires individual arrangements between the operators and all individual countries around the globe, and that is a costly and time consuming exercise.

Marketing the Constellation —Filling the Network

Having a satellite constellation on-orbit and the ground-stations operating as well as the landing rights secured, well, that is only the start. How to sell the IoT connectivity services and fill the network with traffic and data is the ultimate challenge. To do this, and rather than be just connectivity or capacity providers, as is the case in the traditional SATCOM industry, news satIoT operators will have to become service providers who are able to handle data streams from a myriad of new, low cost data points directly into the customers’ back office to fuel their corporate applications.

The customer organization and company of the future is data-centric where everything evolves around the data fusion of varying data-streams analyzed by Artificial Intelligence (AI) to provide better performance indicators for business processes or environmental trends and to make better and more reliable forecasts.

The question is what distribution policy will enable the new LPGAN operator to become integrated into this data stream. Is this a model where there is direct contact between the LPGAN operator and the end customers? For some large corporate or government customers, what will work. However, how will the myriad of (new) SME’s develop products and services that are based on this new global network of data-points?

It is far from certain that the traditional satellite communications value chain, with its global distribution network of service providers and system integrators, will be able to handle this new data-centric market — terrestrial IoT system integrators? Perhaps...

The fact is that, with the satellite constellation up and the payback clock ticking, operators need to fill their networks quickly, a challenge in the IoT market as the value chains still need to crystallize. Not to forget, of course, that service levels in the beginning, with a limited number of satellites deployed, are in the new and largely unexplored big latency domain.

Conclusion

In the race toward low cost, low power, global satellite IoT connectivity, a number of players have now proven their concepts of satellite networks with on-orbit satellites. They are now entering the next round, that being the launch of constellations wherein the challenges for the LPGAN operators are formidable.

First of all, the technical challenge to get the network up and running is quite imposing. A great deal of focus is on the satellite portion of their missions, building and launching the satellites. However, in parallel, the ground segment must be built to include small, low power, user nodes and a LEO ground station infrastructure that includes a sophisticated network operations center.

The CAPEX needed for that is significant and obtaining the financing to cement such into place is art in itself. Not only is the space business inherently risky, but it is also difficult to describe the future IoT market and its revenue potential to investors, as this has such a wide impact (“everything is affected”) and is still under development.

Getting (regulatory) market access and the management of a successful commercial service roll out that addresses the correct verticals in order to fill up the satIoT network is crucial, as well, as can be realized from the Iridium experience.

Should satIoT operators focus on a limited number of high end verticals or, rather, have a broad segmentation approach? How can they build up a successful eco system and develop a healthy eco-system in this market ? One thing is certain — it has to happen fast as the investors will be looking for returns.

Will this second round be too much to handle for some players? With real innovations, the proof of the pudding is by proving their solutions in the market. The potential impact of low cost, low power IoT connectivity on the IoT market and on society is gigantic. There will not be many sectors that will not feel its impact due to the enormous increase in data-points that LPGANs will bring to customers.

The data-streams coming from tens of millions of sensors across the globe directly to company or government dashboards will change the way the world is looked at, allowing for better forecasting and trend analysis and improving the insights into world and company processes.

A good idea would be to give the new players some slack.

www.linkedin.com/in/

m2sat.com

Hub Urlings was one of the pioneers of Satellite M2M as the Product Manager of Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made the service useful for numerous applications — from sending messages, to truck fleet management, to pipeline monitoring and returning data from all types of sensors.

At that time, satellite was the only type of network that was able to offer global coverage for what we would now call IoT services. Now, 25 years later, Hub is again involved in the development of a new generation of cubesat-based satIOT services. To meet the complexity of the satIoT value chain, he developed the M2sat-IoT lab as a co-creation platform for global satIoT applications.